WESCO (WCC) Q2 Earnings & Sales Beat Estimates, Rise Y/Y

WESCO International, Inc. WCC reported second-quarter 2022 adjusted earnings of $4.19 per share, reflecting year-over-year growth of 59%. Also, the bottom line surpassed the Zacks Consensus Estimate by 7.9%.

The company reported quarterly net sales of $5.48 billion, up 19% year over year. Also, the figure beat the Zacks Consensus Estimate of $5.36 billion.

Top-line growth was driven by strong momentum across all three business units of the company.

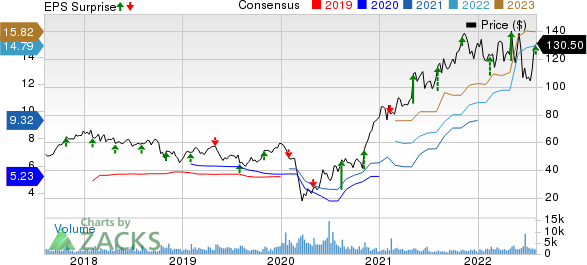

WESCO International, Inc. Price, Consensus and EPS Surprise

WESCO International, Inc. price-consensus-eps-surprise-chart | WESCO International, Inc. Quote

Top-Line Details

The company operates under three business units — Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS), and Utility & Broadband Solutions (UBS).

EES (41.8% of net sales): Sales in the segment were $2.3 billion for the second quarter, up 21.2% from the year-ago period. This was driven by a solid momentum across the company’s construction, original equipment manufacturer and industrial businesses. Benefits from the Anixter merger were other positives.

CSS (31.8% of net sales): Sales in the segment were $1.6 billion for the reported quarter, which rose 9.6% from the year-ago period. This was attributed to the well-performing security solutions and network infrastructure businesses.

UBS (26.4% of net sales): Sales in the segment were $1.6 billion for the reported quarter, up 28% from the year-ago period. This was driven by expanding integrated supply business, solid connectivity demand and benefits from investments in grid modernization.

Operating Details

The gross margin was 21.7% for the reported quarter, which expanded 70 basis points (bps) from the year-ago period.

Selling, general and administrative expenses were $772.9 million, up 10.5% from the year-ago quarter’s reading. As a percentage of net sales, the figure contracted 110 bps year over year to 14.1%.

WESCO’s adjusted operating margin was 7.1%, which expanded 140 bps from the prior-year quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2022, cash and cash equivalents were $236.8 million, up from $201.5 million as of Mar 31, 2022.

Long-term debt was $5.04 billion at the second-quarter end compared with $4.8 billion in the prior quarter.

WESCO used $132.6 million of cash in operations in the second quarter compared with $171.9 million in the previous quarter.

For the second quarter, WESCO reported a negative free cash flow of $128.6 million.

Guidance

For 2022, management raised its guidance for sales growth from 12-15% to 16-18%. The Zacks Consensus Estimate for 2022 sales is pegged at $20.9 billion.

The company also raised the guidance for adjusted EBITDA margin from 7.3-7.6% to 7.8-8%.

WESCO hiked its guidance for adjusted EPS from $14.00-$15.00 to $15.60-$16.40, indicating 55-65% growth from the year-ago reported figure. The Zacks Consensus Estimate for earnings is pegged at $14.79 per share.

Zacks Rank & Stocks to Consider

Currently, WESCO has a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Keysight Technologies KEYS, ASE Technology ASX and Asure Software ASUR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Keysight Technologies has lost 19.9% in the year-to-date period. KEYS’ long-term earnings growth rate is currently projected at 9.1%.

ASE technology has lost 24.6% in the year-to-date period. The long-term earnings growth rate for ASX is currently projected at 23.1%.

Asure Software has lost 32.3% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WESCO International, Inc. (WCC) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance