We're Not Very Worried About PointsBet Holdings's (ASX:PBH) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether PointsBet Holdings (ASX:PBH) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business's cash, relative to its cash burn.

Check out our latest analysis for PointsBet Holdings

When Might PointsBet Holdings Run Out Of Money?

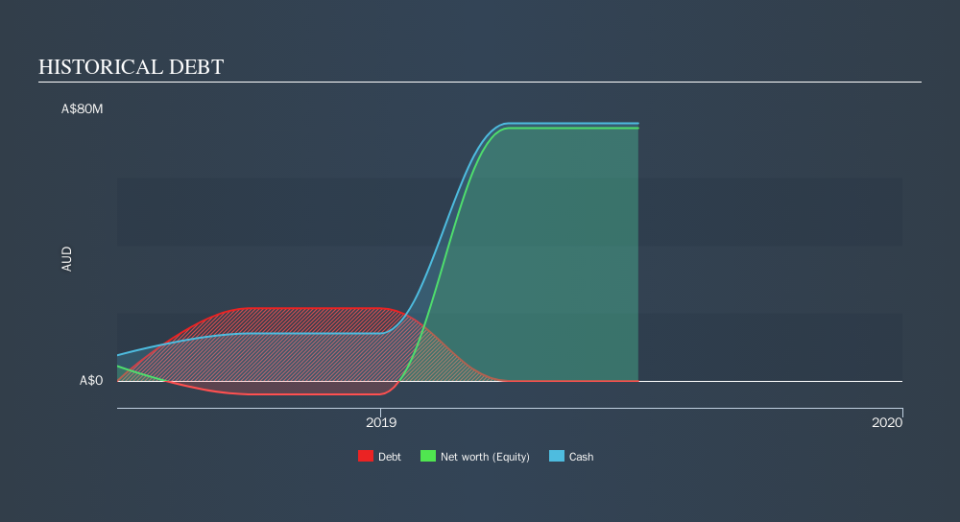

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2019, PointsBet Holdings had AU$76m in cash, and was debt-free. Looking at the last year, the company burnt through AU$37m. Therefore, from June 2019 it had 2.0 years of cash runway. That's decent, giving the company a couple years to develop its business. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. The image below shows how its cash balance has been changing over the last few years.

How Well Is PointsBet Holdings Growing?

One thing for shareholders to keep front in mind is that PointsBet Holdings increased its cash burn by 1993% in the last twelve months. Of course, the truly verdant revenue growth of 173% in that time may well justify the growth spend. Considering both these factors, we're not particularly excited by its growth profile. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can PointsBet Holdings Raise Cash?

PointsBet Holdings seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

PointsBet Holdings has a market capitalisation of AU$414m and burnt through AU$37m last year, which is 9.0% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About PointsBet Holdings's Cash Burn?

On this analysis of PointsBet Holdings's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: PointsBet Holdings insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance