WEC Energy (WEC) Q3 Earnings and Revenues Beat Estimates

WEC Energy Group WEC delivered third-quarter 2022 earnings per share (EPS) of 96 cents, beating the Zacks Consensus Estimate of 86 cents by 11.6%. The bottom line improved 4.4% from the year-ago quarter’s earnings of 92 cents per share. Third-quarter earnings were ahead of our estimate of 84 cents per share.

The year-over-year improvement in earnings was driven by positive results from WEC’s infrastructure and transmission segments and warmer-than-normal summer temperature-generating demand.

Revenues

Operating revenues of $2,003 million for the third quarter of 2022 topped the Zacks Consensus Estimate of $1,834 million by 9.2%. Also, WEC Energy’s top line grew 14.7% from $1,746.5 million in the year-ago quarter. Third-quarter revenues were ahead of our estimate of $1,817.2 million.

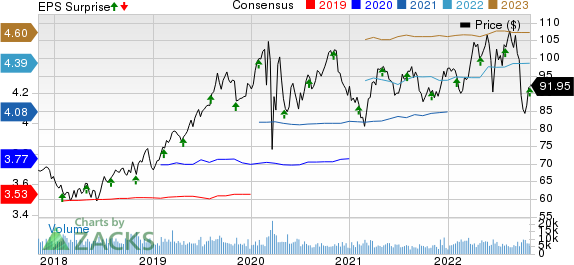

WEC Energy Group, Inc. Price, Consensus and EPS Surprise

WEC Energy Group, Inc. price-consensus-eps-surprise-chart | WEC Energy Group, Inc. Quote

Highlights of the Release

In the third quarter, the residential use of electricity dipped 4.4% year over year. The electricity consumption by small commercial and industrial customers decreased 1.3% year over year. The electricity used by large commercial and industrial customers, excluding iron ore mines, increased 16% on a year-over-year basis.

On a weather-normal basis, the retail deliveries of electricity in the third quarter, excluding the iron ore mine, inched up 0.3%.

Total operating expenses for the third quarter amounted to $1,598.8 million, up 17.9% from the year-ago quarter’s $1,356.5 million due to higher property taxes as well as the cost of sales.

Financial Position

As of Sep 30, 2022, WEC had cash and cash equivalents of $28.5 million compared with $16.3 million as of Dec 31, 2021.

As of Sep 30, 2022, WEC Energy had a long-term debt of $14,910.7 million compared with $13,523.7 million as of Dec 31, 2021.

Net cash provided by operating activities for the first nine months of 2022 was $2,059.5 million compared with $2,006.7 million in the year-ago period.

The capital expenditure in the first nine months of 2022 was $1,700.7 million compared with $1,627.9 million in the year-ago period.

Guidance

WEC Energy narrowed its earnings per share guidance for 2022 to the $4.38-$4.40 range from the $4.36-$4.40 band. The midpoint of the new range is $4.39 per share, lower than the Zacks Consensus Estimate of $4.40.

Zacks Rank

WEC Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

FirstEnergy Corporation FE delivered third-quarter 2022 operating earnings per share (EPS) of 79 cents, beating the Zacks Consensus Estimate of 77 cents by 2.6%.

The Zacks Consensus Estimate for FE’s fourth-quarter earnings per share is 53 cents, indicating growth of 3.92% from the year-ago quarter’s reported figure.

NextEra Energy, Inc. NEE reported third-quarter 2022 adjusted earnings of 85 cents per share, beating the Zacks Consensus Estimate of 79 cents by 7.6%.

The Zacks Consensus Estimate for NEE’s fourth-quarter earnings per share is 56 cents, implying growth of 36.6% from the year-ago quarter’s reported number.

Xcel Energy Inc. XEL posted third-quarter 2022 operating earnings of $1.18 per share, lagging the Zacks Consensus Estimate by 1.7%.

The Zacks Consensus Estimate for XEL’s fourth-quarter earnings per share is 67 cents, suggesting growth of 15.5% from the year-ago quarter’s actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance