WEC Energy Group (NYSE:WEC) Is Increasing Its Dividend To $0.78

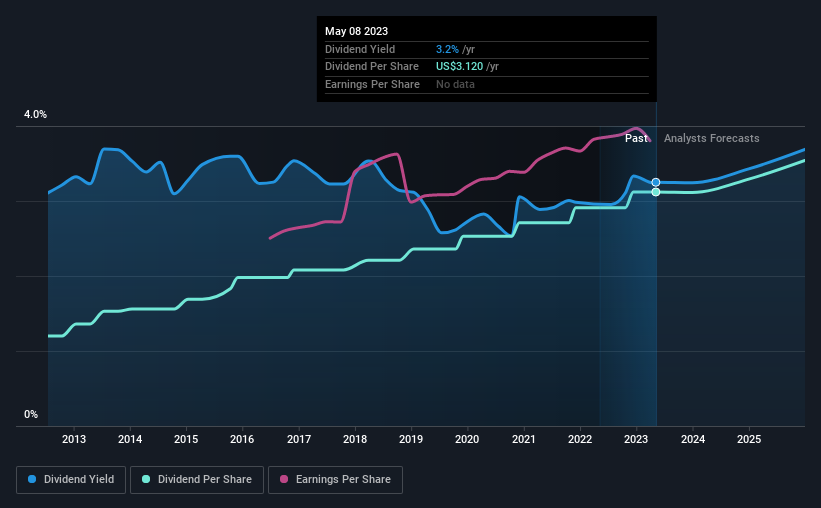

WEC Energy Group, Inc.'s (NYSE:WEC) dividend will be increasing from last year's payment of the same period to $0.78 on 1st of June. Based on this payment, the dividend yield for the company will be 3.2%, which is fairly typical for the industry.

Check out our latest analysis for WEC Energy Group

WEC Energy Group's Payment Has Solid Earnings Coverage

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, WEC Energy Group's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise by 24.9% over the next year. If the dividend continues on this path, the payout ratio could be 60% by next year, which we think can be pretty sustainable going forward.

WEC Energy Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the annual payment back then was $1.20, compared to the most recent full-year payment of $3.12. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. However, WEC Energy Group's EPS was effectively flat over the past five years, which could stop the company from paying more every year. The company has been growing at a pretty soft 1.8% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On WEC Energy Group's Dividend

Overall, we always like to see the dividend being raised, but we don't think WEC Energy Group will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for WEC Energy Group (1 shouldn't be ignored!) that you should be aware of before investing. Is WEC Energy Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance