Are website names the new real estate?

If you were to buy a house on a nice road, or a shop on a busy street, you can expect to pay a decent premium.

Investors are starting to realise the same goes for domain names.

Domain names like microsoft.com can represent dozens of different IP addresses, but the ownership of such a domain name is the equivalent of owning internet space.

And people will pay a lot for internet real estate, the new Domain Investment Index report from escrow.com has revealed.

Amid the cryptocurrency boom, the domain name of crypto.com sold for a rumoured US$12 million (AU$16.57 million). Ethereum.com is also rumoured to have sold for US$10 million (AU$13.8 million).

“Moreover, aside from domain names’ rate of return and relatively moderate levels of volatility, buying into domain investing can be inexpensive when compared to investment tools such as real estate, which can present a high financial barrier to entry for investors, while attracting additional costs such as land and property taxes,” Escrow.com researchers explained.

“By contrast, ongoing annual maintenance costs for domain names can be in the range of US$10 to 15 per annum.”

While most investors consider domain names an alternative investment that is used largely for capital gains, investors can also lease out the domain names just as physical real estate can be rented out.

And just as the commercial real estate market across the US and Australia has seen increases in prices sought, so too have domain names, with the number of transactions of US$5 million (AU$6.91 million) and above increasing steadily.

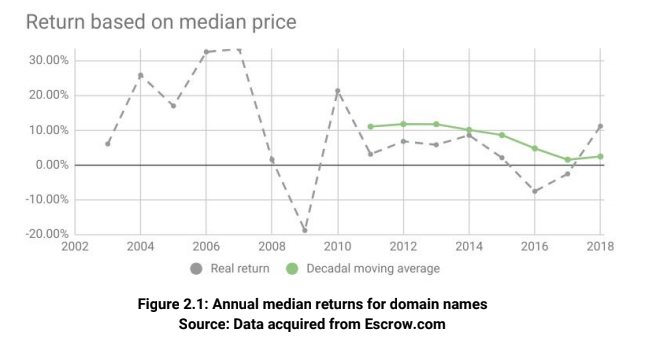

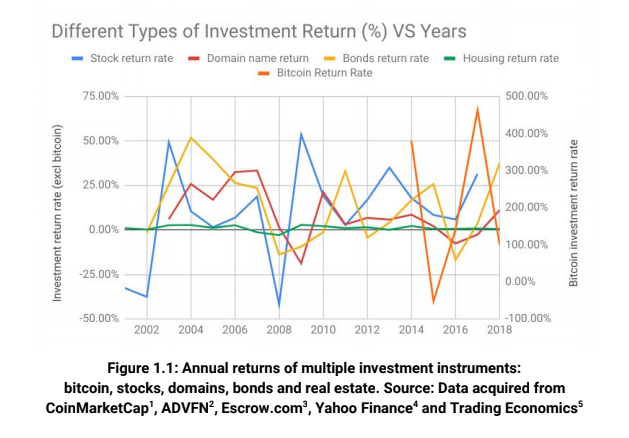

However, the domain name market has also experienced volatility in recent years, with some years delivering excellent rates of return and others no or negative returns.

But, argued Escrow.com, domain names have generally delivered more stability than investments in equities or cryptocurrencies.

And as consumers increasingly head online, Escrow.com expects the market will only grow.

“We believe that domain names as an asset class are undervalued. If you buy a shopfront it would cost millions.

“For example, Tiffany’s spends US$20 million (AU$27.62 million) a year renting its fifth avenue shopfront. Yet you can still buy an internet shopfront cheaply,” the analysts concluded.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Homes in these 20 areas are enjoying the best price growth

Now read: ‘I made $20K on Airtasker’: How seniors are redefining retirement

Now read: AMP appoints Andrea Slattery to its all-male company board

Yahoo Finance

Yahoo Finance