Weatherford International PLC Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

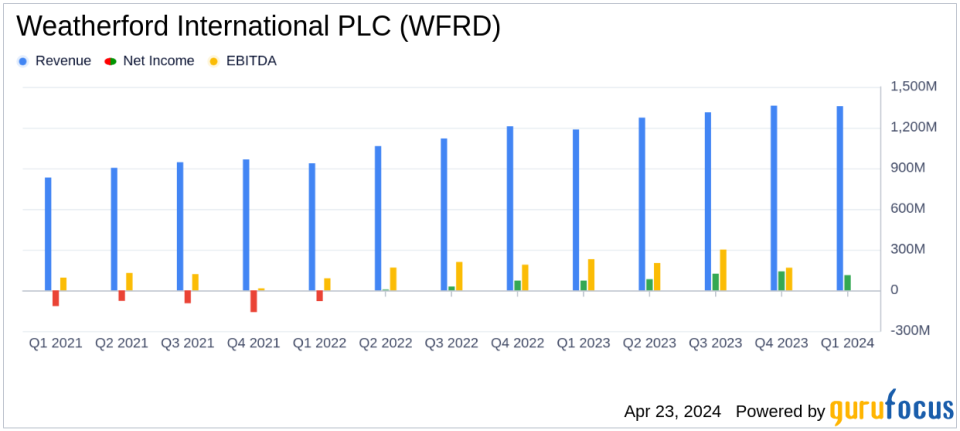

Revenue: Reported at $1,358 million, marking a 15% increase year-over-year, surpassing the estimated $1,324.73 million.

Net Income: Achieved $112 million with an 8.2% margin, a 56% increase year-over-year, exceeding the estimated $102.07 million.

Earnings Per Share (EPS): Recorded at $1.50, surpassing the estimated $1.44.

Adjusted EBITDA: Reached $336 million, a 24.7% margin, representing the highest in over 15 years and a 25% increase year-over-year.

Free Cash Flow: Adjusted free cash flow reported at $82 million, reflecting a significant year-over-year increase.

Debt Management: Repaid $167 million of 6.50% Senior Secured Notes and expanded credit facility to $680 million, enhancing financial flexibility.

Operational Highlights: Notable contracts awarded in Middle East, North Africa, and Asia, supporting a 32% revenue growth in these regions year-over-year.

Weatherford International PLC (NASDAQ:WFRD) announced a robust start to 2024, with its first quarter earnings released on April 23, 2024, showcasing significant year-over-year improvements and surpassing analyst revenue forecasts. The detailed financial performance can be accessed through the company's 8-K filing.

Company Overview

Weatherford International, a leader in diversified oilfield services, operates across global markets, specializing in artificial lift, tubular running services, and a variety of other critical oilfield operations. With a presence in approximately 75 countries, Weatherford's expertise spans from directional drilling and wireline evaluation to innovative technological solutions in well construction and completion.

Financial Highlights

The company reported a first quarter revenue of $1,358 million, a 15% increase from the previous year, nearly aligning with analyst expectations of $1,324.73 million. This growth was primarily driven by a 21% increase in international markets, highlighting the company's strong global footprint. Operating income saw a 26% increase to $233 million, while net income surged by 56% to $112 million, resulting in an 8.2% margin. Notably, the adjusted EBITDA margin reached 24.7%, the highest in over 15 years, demonstrating significant operational efficiency and profitability improvements.

Strategic Achievements and Operational Excellence

President and CEO Girish Saligram noted the exceptional execution by the Weatherford team, with continuous improvements in adjusted EBITDA margins and robust international and offshore activities. The company's strategic expansions, such as the increase in the credit facility to $680 million and significant debt reduction, underscore its strong financial management and commitment to sustainable growth. These efforts are complemented by new contracts and technological advancements in drilling and evaluation, well construction, and production services.

"Our One Weatherford team has once again demonstrated exceptional execution, delivering results that surpassed the previous quarter, with adjusted EBITDA margins setting another record," stated Girish Saligram.

Segment and Regional Performance

Weatherford's Drilling and Evaluation (DRE) segment reported a 13% year-over-year revenue increase, with significant activity in wireline and drilling services. The Well Construction and Completions (WCC) segment saw a 9% increase, driven by robust activity in the Middle East, North Africa, and Asia. Despite a slight decline in the Production and Intervention (PRI) segment, overall international revenue grew by 21%, emphasizing the company's strong position in global markets.

Outlook and Forward Guidance

With the solid first quarter performance, Weatherford has raised its full-year adjusted EBITDA margin guidance to 25% for 2024, a year ahead of schedule, while reaffirming its revenue projections. This optimistic outlook is supported by ongoing international and offshore strength, which continues to drive demand and offset challenges in the North American market.

Conclusion

Weatherford International's first quarter results reflect a strong trajectory for 2024, underpinned by strategic initiatives and operational excellence. The company's ability to exceed revenue expectations and enhance profitability margins positions it well for sustained growth in the competitive oilfield services sector.

For more detailed insights and further information on Weatherford International PLC's financial performance and strategic initiatives, stakeholders and interested investors are encouraged to review the full earnings report and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from Weatherford International PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance