Walgreens Boots Alliance Inc (WBA) Earnings: A Mixed Bag Amid Impairment Charges

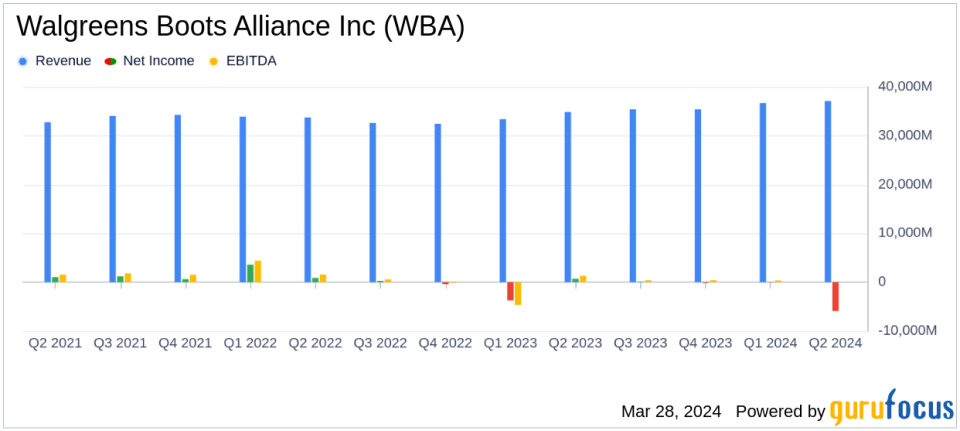

Revenue: Q2 sales increased by 6.3% to $37.1 billion, exceeding estimates.

Net Income: Reported a net loss of $5.9 billion due to non-cash impairment charges, contrasted with net earnings of $703 million in the prior year.

Earnings Per Share (EPS): Adjusted EPS at $1.20, up 3.4% and surpassing the estimated $0.8165.

Challenges: Faced a significant non-cash impairment charge related to VillageMD goodwill.

U.S. Retail Performance: Suffered from a challenging retail environment, leading to a decrease in adjusted operating income.

U.S. Healthcare: Achieved adjusted EBITDA profitability for the first time, signaling growth potential.

Free Cash Flow: Negative free cash flow reported, impacted by legal payments and seasonality.

On March 28, 2024, Walgreens Boots Alliance Inc (NASDAQ:WBA) released its quarterly earnings, providing insights into its financial health and operational challenges. The company reported a 6.3% increase in Q2 sales to $37.1 billion, outperforming analyst revenue estimates of $35.9 billion. However, the quarter was marked by a substantial net loss of $5.9 billion, primarily due to a $12.4 billion non-cash impairment charge related to VillageMD goodwill. This starkly contrasts with the net earnings of $703 million in the same quarter of the previous year. Despite the net loss, WBA's adjusted EPS of $1.20 exceeded the estimated $0.8165, reflecting a 3.4% increase year-over-year. For a detailed view of the company's financial performance, readers can access the 8-K filing.

Walgreens Boots Alliance, a leading retail pharmacy chain in the U.S., operates over 8,500 locations nationwide. The company's portfolio includes a significant presence in prescription drug sales, which accounts for two-thirds of its revenue, and a growing omnichannel experience in healthcare services.

Financial Performance and Challenges

WBA's U.S. Retail Pharmacy segment saw a 4.7% increase in sales, yet faced a decrease in adjusted operating income due to lower retail sales and other factors. The International segment experienced a sales increase but also a decline in adjusted operating income, mainly due to the absence of real estate gains from the prior year. The U.S. Healthcare segment, however, marked a significant milestone, achieving positive adjusted EBITDA for the first time, driven by growth from VillageMD and Shields.

The challenges presented by the impairment charges are significant, reflecting the need for strategic reviews and cost-saving initiatives. CEO Tim Wentworth expressed confidence in achieving $1 billion in cost savings for the year and emphasized the company's focus on customer engagement and value in a difficult retail environment.

Strategic Implications

The earnings report highlights WBA's financial achievements amidst a tough quarter. The adjusted EPS beat is particularly important as it suggests operational efficiency and resilience in a challenging market. The positive adjusted EBITDA in the U.S. Healthcare segment is a promising sign of WBA's strategic shift towards healthcare services and its potential for long-term growth.

The company's performance is crucial for investors, especially in the context of the healthcare providers and services industry. WBA's strategic moves, including a focus on cost savings and portfolio reviews, are aimed at driving growth and delivering value amidst a changing healthcare landscape.

In conclusion, while Walgreens Boots Alliance Inc (NASDAQ:WBA) faced significant challenges this quarter, the company's strategic initiatives and focus on healthcare services position it for potential growth. The earnings report, with its mixed results, underscores the importance of strategic agility in the evolving retail and healthcare sectors.

Explore the complete 8-K earnings release (here) from Walgreens Boots Alliance Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance