The Vmoto (ASX:VMT) Share Price Is Up 332% And Shareholders Are Delighted

Vmoto Limited (ASX:VMT) shareholders might be concerned after seeing the share price drop 10% in the last month. But that doesn't change the fact that the returns over the last year have been spectacular. Indeed, the share price is up a whopping 332% in that time. So it is not that surprising to see the stock retrace a little. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

Check out our latest analysis for Vmoto

While Vmoto made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last twelve months, Vmoto's revenue grew by 75%. That's a head and shoulders above most loss-making companies. But the share price seems headed to the moon, up 332% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

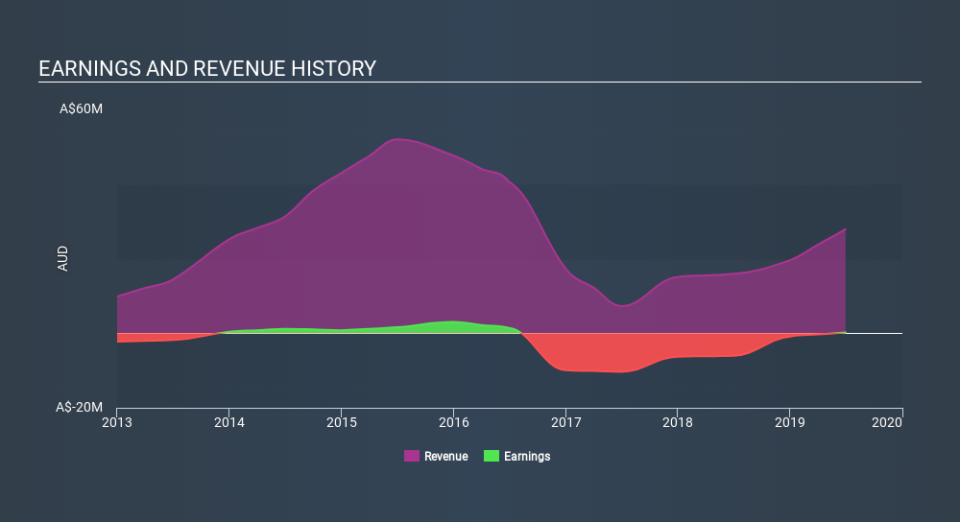

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Vmoto's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Vmoto has rewarded shareholders with a total shareholder return of 332% in the last twelve months. Notably the five-year annualised TSR loss of 9.9% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance