Visteon Corp (VC) Q1 2024 Earnings: Navigating Market Challenges with Strategic Wins

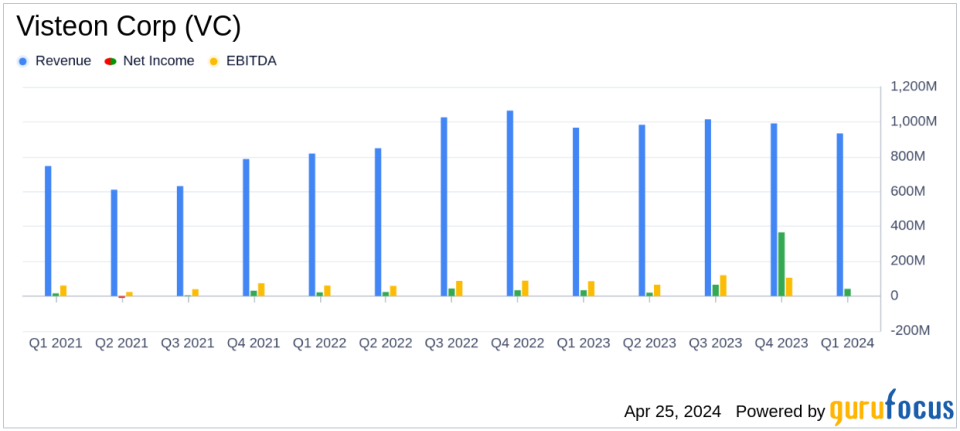

Reported Revenue: $933 million, falling short of estimates of $977.87 million.

Net Income: $42 million, below the estimated $48.36 million.

Earnings Per Share (EPS): $1.50, did not meet the expected $1.68.

Adjusted EBITDA: Increased to $102 million from $99 million year-over-year, demonstrating improved operational efficiency.

Operating Cash Flow: Reported at $69 million, showing a strong cash generation capability.

Adjusted Free Cash Flow: Amounted to $34 million, indicating solid financial health.

New Business Wins: Secured $1.4 billion, enhancing future growth prospects.

Visteon Corp (NASDAQ:VC) disclosed its financial results for the first quarter of 2024 on April 25, revealing a mix of challenges and strategic victories. The company reported net sales of $933 million, slightly below the analyst expectation of $977.87 million and a decrease from the previous year's $967 million. Net income stood at $42 million, also below the estimated $48.36 million but showing an improvement from $34 million in the prior year. The earnings per share (EPS) achieved were $1.50, compared to an analyst forecast of $1.68. For a detailed view, refer to Visteon Corp's 8-K filing.

About Visteon Corp

Visteon Corp, a prominent player in the automotive supplier sector, specializes in manufacturing advanced electronics products for major vehicle manufacturers like Ford, Nissan, and BMW. The company's product line includes information displays, instrument clusters, and infotainment systems, primarily under its Electronics segment. Operating globally, Visteon leverages its technological innovations to meet the evolving demands of a software-defined and electric vehicle future.

Performance Highlights and Strategic Developments

The slight decline in net sales was attributed to reduced recoveries due to an improved semiconductor supply and a 1% drop in customer vehicle production. However, Visteon's sales exceeded customer vehicle production volumes by 2%, buoyed by recent product launches and growth in electrification products. Notably, the company launched 26 new products across 14 OEMs, which included significant advancements like dual 12" displays and a SmartCore program on Scania commercial vehicles.

Visteon's strategic maneuvers in Q1 2024 have fortified its market position, with $1.4 billion in new business wins, highlighting a robust pipeline that promises sustained growth. These wins are pivotal, considering the company's focus on the digitalization of the cockpit and expansion into adjacent markets such as two-wheelers and commercial vehicles.

Financial Analysis

The company's gross margin improved to $119 million from $110 million in the previous year, reflecting strong operational performance and disciplined cost management. Adjusted EBITDA was reported at $102 million or 10.9% of sales, marking an increase from last year's $99 million, despite challenges like unfavorable foreign exchange impacts.

Visteon ended the quarter with a healthy financial position, with $507 million in cash and a net cash situation of $175 million, after accounting for debt. The company's commitment to shareholder returns continued with a $20 million share repurchase under its ongoing $300 million authorization.

Outlook and Forward Guidance

Looking ahead, Visteon maintains its full-year 2024 guidance, expecting sales between $4.0 billion and $4.2 billion and adjusted EBITDA between $470 million and $500 million. The adjusted free cash flow is anticipated to be between $155 million and $185 million. This guidance reflects the company's confidence in its operational strategies and market positioning amidst ongoing industry challenges.

President and CEO Sachin Lawande expressed pride in the company's Q1 achievements, emphasizing the strategic wins and product launches as drivers of near-term growth and long-term stability. "Our first quarter results highlight our continued progress on addressing the megatrends of digitalization and electrification that are rapidly changing the automotive industry," Lawande noted.

Conclusion

While Visteon faces market volatilities and production adjustments, its strategic initiatives and robust new business wins position it well to navigate current challenges and capitalize on future opportunities. Investors and stakeholders may look forward to a trajectory of growth fueled by innovation and market adaptability.

Explore the complete 8-K earnings release (here) from Visteon Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance