Visa (V) Achieves Token Milestone, Revolutionizes Security

Visa Inc. V recently announced a significant achievement in its tokenization technology, venturing into a new era of online security and financial prosperity. V mentioned that it has issued more than 10 billion tokens since 2014. With more than $40 billion in additional e-commerce revenues for firms globally and a staggering $650 million saved in fraud over the past year, Visa's tokenization technology has emerged as an epicenter of trust and innovation in the fintech industry.

This move bodes well for Visa as incremental e-commerce revenues generated in the future will directly contribute to its total revenues. Moreover, as V wins more merchants, issuers and customers, its transaction volumes and processing fees will improve as a result. By replacing sensitive personal data with cryptographic keys, tokenization ensures that payment information remains protected from cyber threats, resulting in a notable six-basis-point increase in payment approval rates globally and a substantial reduction in fraud rates by up to 60%.

Visa's pioneering move into data tokenization holds positive prospects for the future of digital commerce. By granting consumers control over their data, Visa aims to redefine the payment landscape, offering personalized and secure transactions powered by advanced AI algorithms. This move not only enhances consumer trust but also solidifies Visa's position as a leader in fintech innovation.

Per a recent Visa survey, less than 33% of consumers feel they have control over their data and slightly higher than 33% understand the usage of their data. To counter this issue among consumers, Visa is set to use data tokens to enhance security by tokenizing sensitive cardholder information. Customers will be able to approve or revoke sharing their data with merchants from their banking app. Move like this should help V drive its transaction volumes and improve its retention.

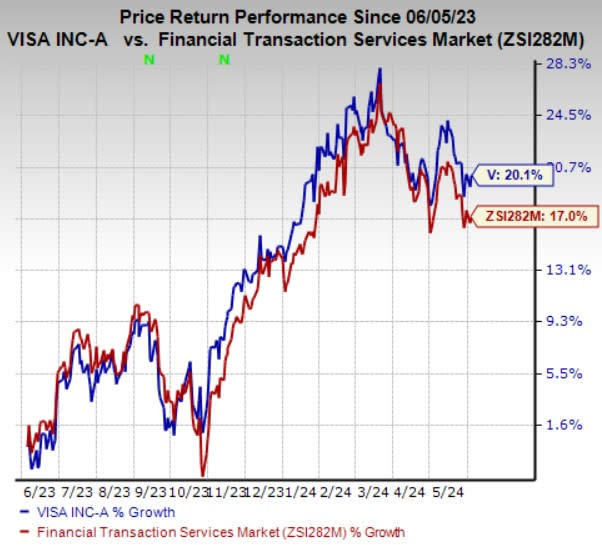

Shares of Visa have gained 20.1% in the past year compared with the industry’s 17% growth. V currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are RCM Technologies, Inc. RCMT, Huron Consulting Group Inc. HURN and Omnicom Group Inc. OMC. RCM Technologies currently sports a Zacks Rank #1 (Strong Buy), while Huron Consulting and Omnicom carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of RCM Technologies outpaced estimates in three of the last four quarters and missed the mark once, the average surprise being 17%. The Zacks Consensus Estimate for RCMT’s 2024 earnings indicates an improvement of 8.1% from the prior-year reported figure. The consensus estimate for revenues suggests growth of 5.6% from the year-ago reported number. The consensus mark for RCMT’s 2024 earnings has moved 7.5% north in the past 30 days.

Huron Consulting’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 28.4%. The Zacks Consensus Estimate for HURN’s 2024 earnings indicates an improvement of 18.7% from the prior-year reported figure. The consensus estimate for revenues suggests growth of 10.2% from the year-ago reported number. The consensus mark for HURN’s 2024 earnings has moved 1.4% north in the past 30 days.

The bottom line of Omnicom outpaced estimates in each of the last four quarters, the average surprise being 3.2%. The Zacks Consensus Estimate for OMC’s 2024 earnings indicates an improvement of 5.8% from the prior-year reported figure. The consensus estimate for revenues suggests growth of 6.2% from the year-ago reported number. The consensus mark for OMC’s 2024 earnings has moved 0.4% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

RCM Technologies, Inc. (RCMT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance