Vertex Pharmaceuticals' (VRTX) New AAT Corrector Enters Clinic

Vertex Pharmaceuticals Incorporated VRTX announced that the FDA has allowed it to initiate the first clinical study on a new candidate, VX-634, targeting alpha-1 antitrypsin deficiency (AATD), a rare, genetic disease, which can cause liver and lung disease.

The FDA cleared the Investigational New Drug application for VX-634, a small molecule AAT corrector, thereby allowing Vertex to initiate a first-in-human clinical study in healthy volunteers.

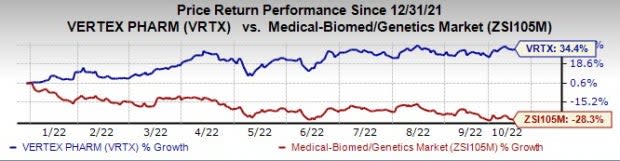

Vertex’s stock has risen 34.4% this year so far against the industry’s decline of 28.3%.

Image Source: Zacks Investment Research

We remind investors that Vertex’s two candidates for AATD disease, VX-814 and VX-814, failed earlier. In October 2020, Vertex discontinued the phase II study on VX-814 for AATD, based on the liver enzyme elevations observed and the determination that it would be difficult to safely achieve targeted exposure levels. In June 2021, Vertex decided not to pursue late-stage development of VX-864 for AATD. The decision was taken despite a phase II study on the candidate achieving its primary endpoint. Though the data provided proof of mechanism, the company believed that the magnitude of the treatment effect observed in the study was unlikely to lead to any substantial clinical benefit and thus it was not feasible to advance it to pivotal development.

Vertex said that VX-634 is the first of the next set of molecules with better potency and drug-like properties than the older AAT correctors. Clinical studies on some other AAT correctors are expected to begin in 2023.

Additionally, Vertex will begin a 48-week phase II study of VX-864 in a few weeks’ time to evaluate if longer-term treatment with VX-864 can result in polymer clearance from the liver and lead to greater increases in functional AAT levels in the plasma. The earlier phase II study on VX-64 did not address the candidate’s effects on the levels of liver polymer, an important clinical endpoint.

Vertex currently sports a Zacks Rank #1 (Strong Buy).

Other Stocks to Consider

Some other top-ranked biotech stocks are Castle Biosciences CSTL, Codiak BioSciences CDAK and Kamada KMDA, all with a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Castle Biosciences’ 2022 loss per share have narrowed from $3.07 to $2.81 while that for 2023 have narrowed from $3.08 to $2.93. Shares of Castle Biosciences have declined 43.8% in the year-to-date period.

Earnings of Castle Biosciences beat estimates in two of the last four quarters and missed the mark twice, witnessing an earnings surprise of 19.46%, on average.

In the past 60 days, estimates for Codiak BioSciences’ 2022 loss per share have narrowed from $1.94 to $1.81. During the same period, the loss estimates per share for 2023 have narrowed from $2.14 to $1.53. Shares of Codiak BioSciences have lost 93.9% in the year-to-date period.

Earnings of Codiak BioSciences beat estimates in three of the last four quarters and missed the mark just once, delivering an earnings surprise of 35.40%, on average.

In the past 60 days, estimates for Kamada’s 2023 earnings per share have increased from 1 cent to 26 cents. Shares of Kamada have lost 34.1% in the year-to-date period.

The earnings of Kamada missed estimates in three of the last four quarters and beat the mark just once, witnessing a negative earnings surprise of 212.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Kamada Ltd. (KMDA) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

Codiak BioSciences, Inc. (CDAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance