Verisk (VRSK) Q2 Earnings Beat Estimates, Revenues Lag

Verisk Analytics, Inc.VRSK reported mixed second-quarter 2020 results, with earnings surpassing the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings per share of $1.29 beat the consensus mark by 9.3% and rose 17.3% on a year-over-year basis. The upside can be attributed to cost discipline in the business and lower average share count.

Revenues of $678.8 million missed the consensus estimate by 0.7% but increased 4% year over year on a reported basis and 1.1% on an organic constant-currency (cc) basis.

So far this year, shares of Verisk have gained 25.7%, ahead of the 16.7% growth of the industry it belongs to and 2.2% increase of the Zacks S&P 500 composite.

Segmental Performance

Insurance segment revenues totaled $486.4 million, up 3.3% year over year on a reported basis and 2.5% in organic cc.

Within the segment, underwriting and rating revenues of $343.5 million rose 9.1% on a reported basis and 5.1% in organic cc. The upside was primarily driven by an annual increase in prices derived from the continued enhancements of the solutions’ contents within the industry-standard insurance programs, sale of expanded solutions to existing customers in commercial and personal lines, and contributions from catastrophe-modeling services. These increases were partially offset by a decrease in certain transactional revenues.

Claims revenues amounted to $142.9 million, declining 8.6% on a reported basis and 2.9% in organic cc. The top line was negativelyimpacted by the injunction ruling against roof-measurement solutions and decline in certain transactional revenues in connection with the COVID-19 pandemic.

Energy and Specialized Markets segment revenues of $154.4 million increased 12.4% year over year on a reported basis but declined 2.8% in organic cc. The uptick can be attributed tocontributions from Genscape acquisition, environmental health and safety-service solutions, core research, and weather-analytics solutions. These were partially offset by declines in cost-intelligence solutions' implementation projects, which did not reoccur, and consulting revenues in connection with the COVID-19 pandemic.

Financial Services segment revenues of $38 million declined 14.1% year over year on a reported basis and 2.7% in organic cc, owing to the impact of the COVID-19 pandemic and the recent dispositions.

Operating Results

Adjusted EBITDA of $348.3 million increased 14.5% on a reported basis and 12.4% in organic cc. Adjusted EBITDA margin came in at 51.3% compared with 46.6% in the prior-year quarter.

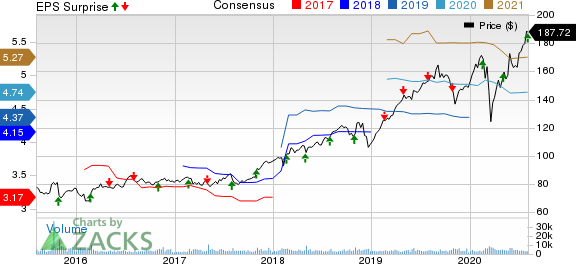

Verisk Analytics, Inc. Price, Consensus and EPS Surprise

Verisk Analytics, Inc. price-consensus-eps-surprise-chart | Verisk Analytics, Inc. Quote

Balance Sheet and Cash Flow

Verisk exited second-quarter 2020 with cash and cash equivalents of $309.4 million compared with $204.4 million at the end of the prior quarter. Long-term debt was $2.69 billion compared with $2.65 billion at the end of the prior quarter.

The company generated $249.5 million of cash from operating activities and capex was $56.7 million. Free cash flow was $192.8 million.

Share Repurchases & Dividend Payout

During the reported quarter, Verisk returned $218 million to shareholders through dividend payouts and repurchases

During the second quarter, the company repurchased nearly 0.5 million shares at an average price of $152.59 for a total cost of $75 million. As of Jun 30, the company had $379 million available under its share-repurchase authorization.

The company paid out a cash dividend of 27 cents per share on Jun 30. On Jul 29, the company's board of directors approved a quarterly cash dividend of 27 cents, payable on Sep 30, to shareholders of record as of Sep 15.

Currently, Verisk carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Equifax EFX reported better-than-expected second-quarter 2020 adjusted earnings of $1.60 per share, whichbeat the Zacks Consensus Estimate by 22.1% and improved 14.3% on a year-over-year basis. The reported figure exceeded the guided range of 78-88 cents.

IQVIA Holdings IQV reported second-quarter 2020 adjusted earnings per share of $1.18, which beat the consensus mark by 12.4% but decreased 22.9% on a year-over-year basis. The reported figure exceeded the guided range of $1.00-$1.09.

Robert Half RHI reported second-quarter 2020 earnings of 41 cents per share that beat the consensus mark by 17% but were down 58% year over year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance