Veeva Systems (VEEV) Q2 Earnings and Revenues Beat Estimates

Veeva Systems Inc. VEEV reported second-quarter fiscal 2020 earnings per share (EPS) of 55 cents, well ahead of the Zacks Consensus Estimate of 49 cents. The metric shot up 41% on a year-over-year basis.

This Zacks Rank #3 (Hold) company’s revenues totaled $266.9 million, outpacing the Zacks Consensus Estimate of $259.3 million. On a year-over-year basis, the top line improved 27.3%.

Segmental Details

Subscription Service

Second-quarter subscription service revenues summed $217.3 million, up 28.1% year over year. Per management, the solid momentum in bookings was maintained in the quarter.

Professional Service and Others

Professional Service revenues rose almost 23.9% to $49.6 million from the figure registered in the year-ago quarter.

Per management, outperformance by Veeva Commercial Cloud and Veeva Vault drove revenues across all segments.

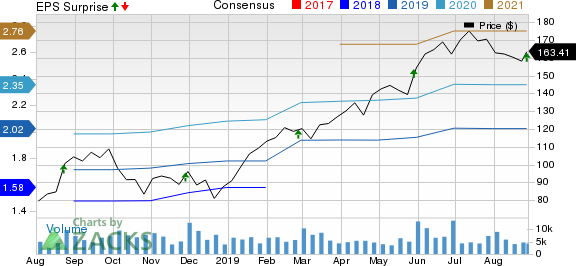

Veeva Systems Inc. Price, Consensus and EPS Surprise

Veeva Systems Inc. price-consensus-eps-surprise-chart | Veeva Systems Inc. Quote

Margin Details

In the reported quarter, adjusted gross profit increased 31.2% year over year to $202.4 million. Adjusted gross margin was 75.9%, which expanded 230 basis points (bps).

Adjusted operating income totaled $103.7 million, up 39.4% year over year. In the quarter under review, adjusted operating margin improved 330 bps to 38.8%.

Meanwhile, operating expenses totaled $122.8 million, up 25.9% year over year.

Guidance

For the fiscal third quarter, Veeva expects revenues between $274 million and $275 million. The Zacks Consensus Estimate is pegged at $268.9 million, below the projected range.

Adjusted EPS is anticipated within 54-55 cents. The Zacks Consensus Estimate is pinned at 51 cents, lower than the guided range. Adjusted operating margin is projected between $103 million and $104 million.

For fiscal 2020, Veeva has raised its revenue guidance.

Notably, the company projects revenues within $1,062 million and $1,065 million, compared with the earlier communicated range of $1,045-$1,050 million. The Zacks Consensus Estimate stands at $1.05 billion, below the guided range.

Adjusted EPS is anticipated within $2.11 and $2.13. The Zacks Consensus Estimate is pinned at $2.02, much below the guided range. Adjusted operating margin is projected between $401 million and $404 million.

Wrapping Up

Veeva Systems ended the fiscal second quarter on a strong note. Core Subscription business segment performed impressively in the quarter. An impressive guidance and a raised view for fiscal 2020 buoy optimism in the stock.

Apart from these, the company continues to benefit from its flagship Vault platform. In fact, Veeva Vault’s customer count has increased manifold in recent times. Markedly, Veeva Systems’ unique solutions include Veeva Vault, Veeva CRM, Veeva Network and Veeva OpenData. The company’s new CRM Sunrise UI and Nitro look promising as well. In Commercial Cloud, Veeva Systems has secured a number of deals. The company is confident about growth in new markets with products like EDC, Safety, Nitro and Vault.

On the flip side, high expenses on the operational side are worrisome. Also, intense competition and a saturating life sciences market remain potent threats. Volatility in the foreign currency exchange rate is an added concern.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks which posted solid results this earning season are Stryker Corporation SYK, Baxter International Inc. BAX and Intuitive Surgical, Inc. ISRG, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%.

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Revenues of $2.84 billion outpaced the Zacks Consensus Estimate of $2.79 billion by 1.9%.

Intuitive Surgical reported second-quarter 2019 adjusted EPS of $3.25, which beat the Zacks Consensus Estimate of $2.85. Revenues were $1.1 billion, surpassing the Zacks Consensus Estimate of $1.03 billion.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance