Value of Nvidia jumps by as much as Britain’s most valuable company

The US microchip giant Nvidia has gained the entire value of Britain’s biggest listed company in a single day as the artificial intelligence (AI) boom sent shares to a fresh record high.

Nvidia’s shares rose by 10.5pc in early trading on Thursday, adding $245bn (£193bn) to its market value. It came after the company said on Wednesday night that sales had more than trebled in a year.

The one-day gain is more than the entire market value of AstraZeneca, the FTSE 100’s most valuable constituent, which is worth around £192bn.

Nvidia’s shares have risen by 240pc in the last year as its advanced computer processors have become the bedrock of AI systems such as ChatGPT.

Its market value of $2.58 trillion now puts it within touching distance of the size of the entire FTSE 100, which is around $2.77 trillion.

The growth of Nvidia and other so-called “magnificent seven” stocks have propelled US stock markets in the last year, and created an uncomfortable parallel with the London Stock Exchange, which fast-growing technology companies are largely avoiding.

US stock indices jumped to a fresh record high on Thursday after they were boosted by Nvidia’s results and optimism surrounding future demand for AI.

Nvidia said on Wednesday night that revenues in its fiscal first quarter had risen to $26bn, up 262pc against a year earlier. Profits rose by 462pc to $15.2bn.

The company said it would carry out a stock split, in which existing shares are divided into multiple shares, which makes it cheaper to buy individual stock. Jensen Huang, its chief executive, also predicted that the company’s momentum would continue as it introduces more advanced chips.

Mr Huang, who founded Nvidia in 1993, is now worth more than $90bn.

The company has spent most of its life designing microchips for video game graphics, but the processors have proven to be adept at handling artificial intelligence tasks, leading demand for the chips to outstrip supply.

The company is now seen as a bellwether for AI spending, and its results on Wednesday night had been nervously anticipated by traders.

Read the latest updates below.

07:05 PM BST

Signing off...

Thanks for joining us today. We’ll be back in the morning to cover the latest markets news, but in the meantime I’ll leave you with news that Elon Musk has attacked President Biden’s tariffs on Chinese electric cars:

Elon Musk has attacked Joe Biden’s plans for a 100pc tariff on electric cars made in China despite Tesla potentially being poised to benefit from the levy.

Mr Musk told a technology conference in Paris that he preferred “no tariffs” when asked how the US president’s recent policies would affect Tesla.

Earlier this month, Mr Biden said he would raise import duties on Chinese electric vehicles from 25pc to 100pc as well as increasing taxes on components such as batteries.

The move could boost Tesla, America’s biggest seller of electric cars, and protect it from competitors such as BYD, the Chinese manufacturer which has threatened to dramatically undercut Mr Musk’s company.

“Neither Tesla nor I asked for these tariffs, I was surprised when they announced,” Mr Musk told the Viva Tech conference.

“Tesla competes quite well in the market in China with no tariffs and no differential support, in general I’m in favour of no tariffs. I’m also actually in favour of no tax incentives for EVs, provided also that the tax incentives for oil and gas must also be eliminated.

07:05 PM BST

Signing off...

Thanks for joining us today. We’ll be back in the morning to cover the latest markets news, but in the meantime I’ll leave you with news that Elon Musk has attacked President Biden’s tariffs on Chinese electric cars:

Elon Musk has attacked Joe Biden’s plans for a 100pc tariff on electric cars made in China despite Tesla potentially being poised to benefit from the levy.

Mr Musk told a technology conference in Paris that he preferred “no tariffs” when asked how the US president’s recent policies would affect Tesla.

Earlier this month, Mr Biden said he would raise import duties on Chinese electric vehicles from 25pc to 100pc as well as increasing taxes on components such as batteries.

The move could boost Tesla, America’s biggest seller of electric cars, and protect it from competitors such as BYD, the Chinese manufacturer which has threatened to dramatically undercut Mr Musk’s company.

“Neither Tesla nor I asked for these tariffs, I was surprised when they announced,” Mr Musk told the Viva Tech conference.

“Tesla competes quite well in the market in China with no tariffs and no differential support, in general I’m in favour of no tariffs. I’m also actually in favour of no tax incentives for EVs, provided also that the tax incentives for oil and gas must also be eliminated.

06:31 PM BST

Volkswagen says higher tariffs on Chinese cars won’t work long term

German carmaker Volkswagen is not a fan of the idea of hiking tariffs on Chinese cars, suggesting that a bigger tax would only provide a short-term respite.

Bloomberg reported that the car giant’s finance chief Arno Antlitz said that a higher tariff would have limited effect because Chinese manufacturers plan to establish factories in Europe.

Mr Antlitz said:

We have to use the next two to three years to become even more competitive on the cost side. It is very questionable whether the current tariff discussion leads into the right direction.

06:24 PM BST

Utility companies take a hit after National Grid said it wanted investors to hand over more cash

Britain’s top utility companies took a hit today after National Grid announced a rights issue to pay for infrastructure investment plans.

Shares in the power giant plunged 6pc, prompting falls in United Utilities, Severn Trent and Drax as investors worried about the health of the utility sector.

Danni Hewson, head of financial analysis at AJ Bell, said:

Utility stocks were always likely to come under pressure on the news that National Grid was shaking its tin to fund network upgrades.

But there must also be questions asked about the Labour Party’s plans for energy and where a publicly owned renewable energy company will fit into the mix.

What kind of pressure might it heap on water companies to invest in crumbling infrastructure whilst protecting the public from significant price hikes, and how will the country’s public transport network evolve?

Details matter and it’s hoped the next 42 days will bring more of those alongside the glossy videos and rousing stump speeches by all the parties.

06:03 PM BST

Investec sets aside £30m over car finance mis-selling scandal

UK lender Investec has set aside £30m for a car finance mis-selling scandal, the latest bank to book a provision over the review. Michael Bow reports:

The FTSE 250 group, one of the UK’s largest challenger lenders, took the accounting hit to deal with the cost of dealing with the review and any possible redress schemes.

The Financial Conduct Authority is probing discretionary commissions paid to second hand car dealers over fears customers were mis-sold loans. It could set up a compensation scheme after delivering a verdict on the review due in September.

Investec entered the vehicle finance business in 2015 when it bought Mann Island Finance. Ruth Leas, the chief executive, said: “We’ve included the litigation costs, operational costs, legal costs, and an estimation for redress. Of course, no one in the market knows which way the FCA is going to go on that.”

05:17 PM BST

Value of Nvidia jumps by as much as Britain’s most valuable company

The US microchip giant Nvidia has gained the entire value of Britain’s most valuable listed company in a single day as the artificial intelligence boom sent its shares to another record high. James Titcomb reports:

Nvidia’s shares rose by 10.5pc in early trading on Thursday, adding $245bn (£193bn) to its market value. It came after the company said on Wednesday night that sales had more than trebled in a year.

The one-day gain is more than the entire market value of AstraZeneca, the FTSE 100’s most valuable constituent, which is worth around £192bn.

Nvidia’s shares have risen by 240pc in the last year as its advanced computer processors have become the bedrock of AI systems such as ChatGPT.

Its market value of $2.58 trillion now puts it within touching distance of the market capitalisation of the entire FTSE 100, which is around $2.77 trillion.

The growth of Nvidia and other so-called “magnificent seven” stocks have propelled US stock markets in the last year, and created an uncomfortable parallel with the London Stock Exchange, which fast-growing technology companies are largely avoiding.

Nvidia said on Wednesday night that revenues in its fiscal first quarter had risen to $26bn, up 262pc against a year earlier. Profits rose by 462pc to $15.2bn.

The company said it would carry out a stock split, in which existing shares are divided into multiple shares, which makes it cheaper to buy individual shares. Jensen Huang, its chief executive, also predicted that the company’s momentum would continue as it introduces more advanced chips.

05:02 PM BST

Footsie closes down

The FTSE 100 dropped 0.4pc today.

The biggest riser was St James’s Place, up 4.8pc, followed by investment trust Scottish Mortgage, up 3.5pc. The biggest faller was National Grid, down 10.9pc, followed by RS Group, 6.5pc.

Meanwhile, the FTSE 250 similarly dropped 0.4pc.

The top riser was takeover target Hargreaves Lansdown, up 14.4pc, followed by defence company QinetiQ. The biggest faller was energy producer Drax, down 8.6pc, followed by National Express owner Mobico, down 7.6pc.

04:58 PM BST

Morgan Stanley shares drop after chairman announces departure

The chairman of Morgan Stanley said on Thursday he will step down at the end of the year as investors mull whether the bank can keep generating bumper profits amid fierce competition with Goldman Sachs.

James Gorman, who announced his plan at the bank’s annual shareholder meeting on Thursday, helped rescue the lender from the brink of failure following the global financial crisis.

He is credited with transforming the bank into a wealth management powerhouse.

The announcement came after giving up the chief executive position to Ted Pick in January, which he said on Thursday had been a “successful transition”.

Mr Pick has predicted a boom in mergers and acquisitions that he said would last 3 to 5 years.

Shares dropped more than 1pc in trading yesterday.

04:35 PM BST

Goldman Sachs prepares to put its Middle Eastern HQ in Saudi Arabia

Goldman Sachs is preparing to put its Middle Eastern headquarters in Saudi Arabia after the kingdom introduced rules requiring multinational companies to put their regional HQs there - if they want a reasonable chance of winning government contracts.

The Saudi government is also offering multinationals who comply with a 30-year exemption from corporation tax and easier access to visas.

Goldman is the first Wall Street bank to take a step toward complying with Saudi Arabia’s ultimatum for foreign firms to set up their Middle Eastern base there, Bloomberg reported.

The measure is part of Saudi’s national investment strategy, which aims to make the country one of the top 15 economies and diversify away from oil. The country has pledged to increase private sector participation in the economy to 65pc of GDP.

04:11 PM BST

Ticketing giant behind Taylor Swift’s record-breaking tour at risk of breakup

The US Department of Justice Department filed a sweeping competition lawsuit against online ticketing giant Ticketmaster and its parent company today, accusing them of running an illegal monopoly over live events.

The lawsuit seeks to break up a monopoly it claims is squeezing out smaller event promoters and hurting artists.

The Justice Department accuses Live Nation, the parent company, of a slew of practices that allow it to maintain a stronghold over the live music scene, including using long-term contracts to keep venues from choosing rival ticketers, blocking venues from using multiple ticket sellers and threatening venues that they could lose money and fans if they don’t choose Ticketmaster.

Live Nation has denied that it engages in practices that violate antitrust laws. When it was reported that the company was under federal investigation in 2022, the concert promoter said that Ticketmaster enjoys such a large share of the market because of “the large gap that exists between the quality of the Ticketmaster system and the next best primary ticketing system.”

A spokesman for LiveNation said: “We will defend against these baseless allegations, use this opportunity to shed light on the industry, and continue to push for reforms that truly protect consumers and artists.”

The lawsuit is the latest example of the Biden administration’s aggressive approach targeting companies accused of engaging in illegal monopolies that drive up prices.

Ticketmaster, which merged with Live Nation in 2010, is the world’s largest ticket seller, processing 500m tickets each year in more than 30 countries, including the UK.

It provides the ticketing for some of the most-sought events, including Taylor Swift’s worldwide The Eras Tour, which has reportedly become the highest-grossing tour of all time with over $1bn in revenue.

03:39 PM BST

Wizz Air shares jump 7pc as profits soar

Wizz Air shares have jumped 7pc in trading today after the low-cost airline revealed bumper demand for its flights.

Revenue for the year to the end of March jumped 30pc to €5bn (£4.3bn) as passenger numbers rose 21pc to 62m.

The company swing from a €535.1m loss to a €365.9m profit.

The rise in profits came despite the airline grounding 45 jets after the manufacturer of the engines issued a product recall.

Mark Crouch, analyst at investment platform eToro, said:

Record passenger numbers amid surging demand, improving load factors and lowering unit costs have all played their part in propelling the airline back to profitability.

There is though, an air of what might have been. Disruption caused by the conflicts in Ukraine and the Middle East has significantly impacted the company’s bottom line with thousands of flights cancelled. And the ongoing problems of production hiccups with their Pratt and Whitney engines is another headwind the low-cost carrier could do without.

With the summer season just around the corner, Wizz Air would have wanted all their ducks in a row heading into such a crucial period. Yet despite receiving significant compensation for the disruption, many of their planes will be grounded with 20pc of the fleet affected by the engine troubles.

03:33 PM BST

Handing over

I will pass the baton to Alex Singleton at this point, who will be with you for the rest of the day, but not before a quick look at the markets.

Technology stocks on Wall Street have surged after another blowout earnings report from chip maker Nvidia, which is up 8.7pc.

The FTSE 100 was down 0.2pc as campaigning gets underway for the snap election called by Rishi Sunak. The pound is down 0.1pc against the dollar to $1.272.

In commodities, oil is up 0.6pc at more than $82 a barrel.

03:23 PM BST

Cadbury owner fined €337m for restricting free movement of biscuits

The owner of Cadbury has been fined €337m (£287m) after it admitted restricting the movement of chocolate, coffee and biscuits within the EU to push up prices.

Our retail editor Hannah Boland has the details:

The EU antitrust watchdog said Mondelez, which also makes Oreo cookies and Ritz crackers among many other snacks, had struck anti-competitive agreements with distributors to “illegally restrict retailers from sourcing these products from member states where prices are lower”.

EU competition chief Margrethe Vestager said deals to carve up the EU market and stop sellers from trading across borders allowed Mondelez “to maintain higher prices” between 2015 and 2019.

In some cases, prices were as much as 40pc higher or lower in certain countries.

Read how the fine comes at a delicate time for Mondelez, which has faced a shareholder backlash over its decision to keep operating in Russia.

03:02 PM BST

US private sector grows at fastest pace in two years

US private sector output grew at its fastest pace in more than two years in May, a closely-watched survey showed, raising doubts about how quickly the Federal Reserve can begin cutting interest rates.

The headline S&P Global Flash US PMI Composite Output Index rose sharply from 51.3 in April to 54.4 in May, its

highest since April 2022.

Output has risen for 16 consecutive months, with the service sector leading the latest upturn, but business confidence was hit by concerns that strong economic growth will force the Fed to keep rates high to avoid an uptick in inflation.

Chris Williamson, chief business economist at S&P Global, said:

The data put the US economy back on course for another solid GDP gain in the second quarter.

Not only has output risen in response to renewed order book growth, but business confidence has lifted higher to signal brighter prospects for the year ahead.

However, companies remain cautious with respect to the economic outlook amid uncertainty over the future path of inflation and interest rates, and continue to cite worries over geopolitical instabilities and the presidential election.

🇺🇸 The S&P Global US Flash Composite PMI grew 3.1 pts to 54.4 (vs 51.1 expected) in May, a 25-month high.

US Services PMI: 54.8 (prev 51.3)

US Manufacturing PMI: 50.9 (prev 50.0)

"Both input costs and output prices rose at faster rates, with manufacturing having taken over as… pic.twitter.com/Mr3swd6DkV— MTS Insights (@MTSInsights) May 23, 2024

02:53 PM BST

Thames Water debt talks put on ice as Sunak calls election

Thames Water’s parent company has reportedly put debt talks with its creditors on ice after Rishi Sunak called a general election.

Ofwat had been due to announce its draft decision about the business plan put forward by Britain’s biggest water supplier on June 12.

The company is hoping to raise bills by 45pc to up to £627 a year by 2030 as it grapples with an £18bn debt pile.

Creditors to Thames Water Kemble Finance, the holding company of Britain’s largest supplier, had appointed advisers to manage the debt talks, Bloomberg reported, but Ofwat’s decision is expected to be delayed until after the July 4 general election under purdah rules.

02:43 PM BST

Activist calls on Rio Tinto to quit London

Rio Tinto is being urged to downgrade its London listing in a move that would force it to quit the FTSE 100.

Our employment editor Lucy Burton has the details:

Activist investor James Smith, the founder of Palliser Capital, has argued that the FTSE 100 mining giant should ditch its “clunky” primary London listing and unify its structure in Australia, where it has a secondary listing.

The current dual-listed structure is “extremely clunky and outdated” and the “root cause of the undervaluation”, Mr Smith said.

A byproduct of ditching its primary London listing would be that the mining giant is no longer eligible to be a constituent of the blue-chip index under stock market rules, although it would still be listed in London.

However his comments, made at an investor conference in Hong Kong, will likely spook the City as it comes as a raft of companies flee the struggling UK stock market either through defections to rival exchanges or takeovers.BHP announced plans to ditch its primary London listing in favour of the Australian market in 2021, while mining giant Glencore last year chose to spin off and list its coal business in New York rather than London.

Mr Smith’s presentation, seen by the Financial Times, argued that “this is an Australian business” as the vast majority of Rio’s earnings are generated in the country.

It added that the complexity of the dual-listed structure prevents the company from pursuing all-stock takeovers, at a time of growing consolidation in the mining sector.

London-listed Anglo American this week agreed to further talks with mining rival BHP over a possible takeover, despite rejecting a fresh £38.6bn approach from the Australian mining giant.

The FTSE 100 index has traditionally been dominated by oil and gas companies, as well as mining and commodity stocks, but a growing number are delisting for rivals such as New York.

Shell last month threatened to quit London if its valuation did not improve. Wael Sawan, the oil giant’s chief executive, said the company is looking at “all options” for its listing amid concerns it is under-appreciated by investors. The company has since said it is not actively considering a shift to New York.

One concern in the mining and oil and gas sectors has been about the growing focus on environmental, social and governance (ESG) measures in the UK as well as fears that there’s a negative perception of these industries in Europe, particularly among climate activists.

Rio Tinto and Palliser were invited to comment.

02:38 PM BST

Nvidia pushes Wall Street higher

The tech-heavy Nasdaq and the benchmark S&P 500 opened higher after Nvidia’s strong results boosted excitement in artificial intelligence technology stocks.

The Dow Jones Industrial Average rose 23.91 points, or 0.1pc, at the open to 39,694.95.

The S&P 500 opened higher by 33.25 points, or 0.6pc, at 5,340.26, while the Nasdaq Composite gained 194.84 points, or 1.2pc, to 16,996.39 at the opening bell.

02:28 PM BST

Volkswagen considers battery factory slowdown as electric car demand wanes

Volkswagen is debating whether to scale back the speed with which it launches its battery factories in Europe amid waning demand for electric vehicles.

Chief financial officer Arno Antlitz said the German carmaker may take longer to scale up production at the sites to full capacity, although it still plans to launch them next year.

Under its current €20bn (£17bn) plan, it aims supply cells for about three million electric vehicles by 2030, supporting 20,000 workers.

However, Mr Antlitz told Bloomberg in Munich that VW remains fully committed to its investment, dubbed PowerCo.

02:19 PM BST

Morgan Stanley chairman Gorman to step down

The chairman of Morgan Stanley will step down at the end of the year after nearly two decades at the Wall Street titan.

James Gorman, who announced his plan at the bank’s annual shareholder meeting, helped rescue the lender from the brink of failure following the global financial crisis.

He will step down after giving up the chief executive position to Ted Pick in January.

The Australia-born banker jumped from Merrill Lynch in 2006 to help rejuvenate Morgan Stanley’s wealth-management business and took over as boss in 2010 as it was grappling with the scars of the global financial crisis which began in 2008.

02:12 PM BST

Harry Potter publisher Bloomsbury posts record profit after fantasy boom

The publisher behind Harry Potter has posted record profits after a jump in demand for “romantasy” novels.

Our reporter James Warrington has the details:

Bloomsbury reported pre-tax profits of £49m in the year to the end of February, an increase of almost 60pc on the previous 12 months. Revenues increased by a third from £264m to £343m.

The business, which is best known for the Harry Potter series, has enjoyed booming trading in the past few years owing to the rise of the romantic fantasy genre.

Bosses hailed “extraordinary” demand for novels by Sarah J Maas, whose latest title House of Flame and Shadow was released in January and became a global number one bestseller.

This success helped drive demand for Sarah J Maas’s 15 previous novels, and sales of her books surged 161pc over the year. Bloomsbury has six further books under contract with the author.

Nigel Newton, chief executive of Bloomsbury, described Maas as a “publishing phenomenon”, adding: “Her books have captivated a huge audience, supported by major Bloomsbury promotional campaigns, driving strong word of mouth recommendation, particularly through social media channels.”

The publisher also cited strong sales for Katherine Rundell - the children’s author whose book Impossible Creatures was named Waterstones Book of the Year 2023 - and cookbooks by authors including Poppy O’Toole and Tom Kerridge.

01:51 PM BST

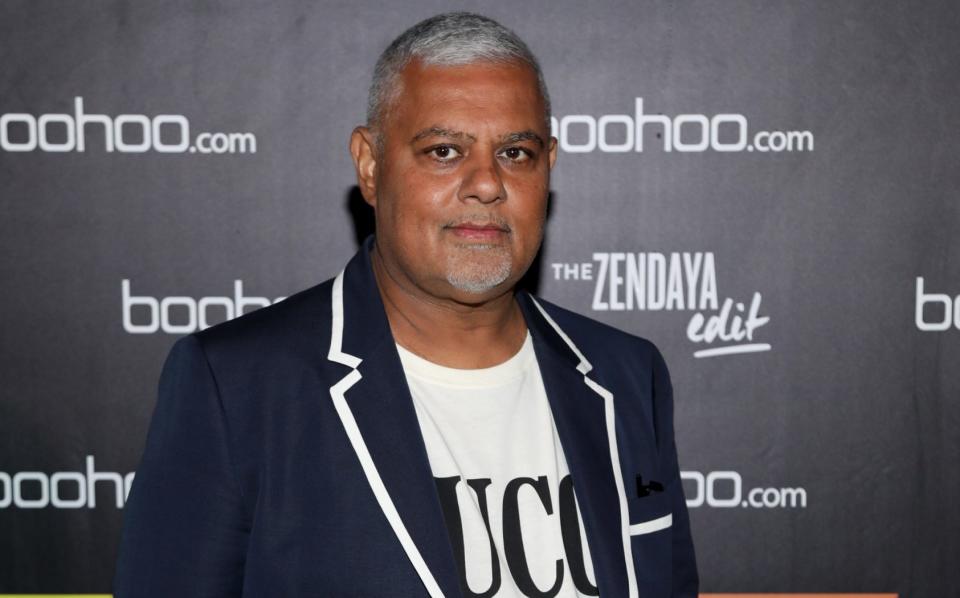

Boohoo ignores bonus rules to hand top bosses £1m each despite £160m loss

Boohoo has claimed its top bosses deserve £1m bonuses despite missing performance targets as it plunged to a £160m loss.

Our retail editor Hannah Boland has the details:

The fast fashion retailer said it had decided to ignore its bonus criteria, which would have meant chairman and co-founder Mahmud Kamani, chief executive John Lyttle and executive director Carol Kane would have received no annual bonus based on performance targets.

Boohoo said this would not be “an accurate reflection of the excellent work carried out during the year to set the business up for future success”.

It said it would also not “ensure that the management team is motivated and retained throughout the next financial year which will be pivotal for the group’s long-term success.”

Instead, Boohoo said it would be handing all three executive directors £1m bonuses, taking Mr Kamani and Ms Kane’s total pay packages for the year to £1.5m compared to around £1m a year earlier. Mr Lyttle’s total remuneration for the year was up 27pc to £1.7m from £1.3m last year. Part of the bonuses will be paid in cash, with the remainder in shares.

The decision comes despite a shareholder backlash over a similar move last year, when Boohoo opted to increase bonuses despite missing financial targets. Around a third of investors voted against the remuneration report at its last annual general meeting in June.

At the time, Boohoo said it would reflect on the vote and “looked forward to ongoing engagement with the group’s shareholders as it continues to shape the group’s future remuneration policy”.

01:35 PM BST

US unemployment claims fall

The number of people claiming for unemployment benefits in the US decreased slightly, official figures show, in a sign its jobs market remains robust.

Initial claims - which are seen as an indicator of lay offs - fell by 8,000 to 215,000 in the week ending May 18.

The four-week moving average was broadly steady, rising by 1,750 to 219,750.

01:19 PM BST

Aviva increases insurance premiums by a fifth

Insurance giant Aviva has seen UK general insurance premiums surge by nearly a fifth at the start of 2024 as it hiked the cost of cover.

The group reported a 19pc jump in UK general insurance premiums to £1.7bn for the three months to March 31, with personal lines up 27pc.

Aviva said this reflected “continued strong rate discipline in the high inflationary environment” as well as new business growth.

Overall, group wide general insurance premiums lifted 16pc to £2.7bn.

The insurance sector has been increasing the cost of cover in response to the soaring cost of repairs and labour.

Recent figures from the Association of British Insurers (ABI) showed that the average home insurance policy cost 19pc more - up £60 - year-on-year in the first quarter of 2024, while comprehensive motor cover was about a third, or £157, higher.

Aviva said it remains focused on “pricing appropriately” in its general insurance business over the remainder of the year.

01:02 PM BST

Royal Mail owner fails to deliver own results on time

The owner of Royal Mail has failed to publish its annual trading update, which had been scheduled for early this morning, as the group heads towards a potential overseas takeover.

London-listed International Distribution Services told markets it would publish its full-year financial results at 7am on Thursday, but by 1pm nothing had been released.

It comes a week after the company said it was “minded” to agree to a takeover by Czech billionaire Daniel Kretinsky.

Mr Kretinsky, whose EP Group owns a 27.5pc stake in the company, put forward a proposed bid worth about £3.5bn on May 15.

There have been no further announcements on the deal in the last week, but Business Secretary Kemi Badenoch said the Royal Mail’s universal service obligation will need to be protected in any sale of the company.

Shares in International Distributions Services have fallen 1.3pc.

12:31 PM BST

Turkey holds interest rates at 50pc

Turkey’s central bank today kept its key interest rate stable at 50pc for the second month in a row even as the country is struggling with soaring inflation.

The bank’s monetary policy committee said it had decided to keep the policy rate constant but that it remains highly attentive to inflation risks.

Ahead of the March 31 local elections, the central bank hiked its rate 45pc to 50pc as the inflation had become a constant headache for President Recep Tayyip Erdogan’s government.

Inflation reached 69.8pc year-on-year in April - up from 68.5 percent in March, according to official data published in early May.

The central bank said on Thursday that its monetary policy stance would “be tightened in case a significant and persistent deterioration in inflation is foreseen.”

12:12 PM BST

US stocks expected to jump as Nvidia fuels AI mania

Across the Pond, Wall Street is expecting a rally after Nvidia’s upbeat revenue forecast after markets closed on Thursday.

The AI chip leader jumped 6.8pc in premarket trading, breaching the $1,000 mark for the first time, as its net income rose more than sevenfold compared to a year earlier, jumping to $14.9bn in its first quarter.

Revenue more than tripled, rising to $26bn from $7.19bn in the previous year, putting it on track to add about $155bn (£121bn) in market value if premarket gains hold.

The semiconductor bellwether also announced a stock split, following an over 90pc surge in its shares this year that havs made it the third-most valuable US stock and a key driver of optimism on markets.

Mark Haefele, chief investment officer at UBS Global Wealth Management, said:

Nvidia’s earnings supported our expectations that the AI rally has plenty of more room to run.

We stay positive on the AI trend and maintain our preference for big tech given the advantageous market positions.

In premarket trading, the Dow Jones Industrial Average was up 0.1pc, the S&P 500 was higher by 0.6pc and the Nasdaq 100 was up nearly 1pc.

11:58 AM BST

Election has killed chance of June interest rate cut, says former Bank official

The impending general election has killed any chance of an interest rate cut in June, according to a former Bank of England policymaker.

Michael Saunders, a senior adviser to Oxford Economics, said higher than expected inflation meant officials were unlikely to reduce borrowing costs next month, with the election reduced those chances even further.

He told Bloomberg TV:

They themselves wouldn’t want to be a cause for volatility.

The Monetary Policy Committee would be especially reluctant to do a surprise rate change during an election campaign.

But in practice, a June rate cut is already ruled out by inflation figures.

11:42 AM BST

Rail workers to go on strike

Your getaway plans for the bank holiday weekend may have been scuppered after union bosses announced that workers at Northern Rail are to stage two strikes in a dispute over pay and conditions.

Members of the Rail, Maritime and Transport union (RMT), who work at Northern Rail gate lines, will walk out on Friday and again on Saturday June 8.

The union said its members, who are employed by a private contractor, are paid less than directly employed staff and do not receive other benefits.

RMT general secretary Mick Lynch said:

We cannot allow this injustice to continue which is why our members are taking more strike action this Friday and next month.

Our members are the first to interact with the travelling public and if there is any abuse, anti-social behaviour or assaults, they are on the receiving end.

Yet they are treated as second class workers, doing shifts alongside directly employed Northern Rail station staff.

All these workers want is to be treated equally and get the same pay and conditions as their colleagues in Northern Rail. RMT will continue our industrial campaign for as long as it takes to get justice for our members.

11:26 AM BST

NatWest share sale in jeopardy after election called, analysts warn

A sale of shares in NatWest to the general public could be in jeopardy after the Prime Minister called a general election, analysts have warned.

Shares in NatWest were down 2pc following reports that the timing of the election, set for July 4, could put the retail share offer on ice.

The Government is hoping to fully offload its ownership of the taxpayer-backed bank, which it bailed out during the 2008 financial crisis, by 2025 to 2026.

Chancellor Jeremy Hunt revealed plans to start selling its stake to ordinary investors as early as the summer.

It currently has a shareholding of about 27pc in the bank and has recently accelerated the process of whittling down its stake.

Analysts said this could prevent the Government from launching the highly-anticipated sale this summer, which was expected to offer NatWest’s shares at a discounted price.

Robert Sage and Stuart Duncan, analysts for investment bank Peel Hunt, said: “This share sale cannot take place before the General Election and the new government, which polls are currently suggesting is likely to be formed by the Labour Party, may or may not proceed with this initiative.”

Gary Greenwood, an analyst for Shore Capital Markets, said that in the event of a Labour victory “such plans are likely to be revisited and possibly amended”.

11:03 AM BST

HSBC fined £6.3m for failures with struggling customers

HSBC has been fined for failures in its treatment of customers who were in arrears or experiencing financial difficulty, the Financial Conduct Authority (FCA) said.

The regulator has fined the bank £6.3m after it failed to properly consider people’s circumstances when they had missed payments between June 2017 and October 2018.

This meant it did not always do the right affordability assessments when entering arrangements with people to reduce or clear their arrears.

Sometimes it took disproportionate action when people fell behind with payments, which risked people getting into greater financial difficulty.

The failings were caused by deficiencies in HSBC’s policies and procedures and the training of their staff, as well as inadequate measures to identify and address instances of unfair customer treatment, the regulator said.

10:55 AM BST

Election may hit confidence in markets, say economists

Confidence in the markets may take a temporary hit as a result of the general election, economists have warned.

Markets have remained static despite the latest PMI figures showed a slowdown in Britain’s services sector.

The pound remains little changed while the FTSE 100 has recovered from a fall of 0.3pc to be flat on the day amid hopes that a slowdown in services could yet support the case for a summer interest rate cut.

Thomas Pugh, economist at RSM UK, said:

The fundamentals of the economy should continue to recover over the next year as inflation continues to fall and households’ real income rises.

But there is a chance that the uncertainty associated with a general election campaign means confidence takes a temporary hit.

Indeed, after yesterdays near miss of the Bank of England’s 2pc inflation target and the June MPC meeting coming just two weeks before the general election it is now very unlikely that we will get an interest rate cut before August.

10:35 AM BST

Gas prices rise amid threats to supply

Energy prices have been a major focus of political attention since Vladimir Putin’s invasion of Ukraine sparked a surge in inflation.

As he launches his election campaign, Rishi Sunak may be glancing nervously at rising wholesale gas prices.

European natural gas has rallied higher for an eighth consecutive day, with the latest move triggered by an unplanned outage at Norway’s Kollsnes processing plant.

It comes after Austria warned on Wednesday of potential disruption to supplies from Russia, after an undisclosed European company won a court decision that halts payments to Kremlin-backed energy company Gazprom.

Dutch front-month futures, Europe’s benchmark contract, have risen as much as 4.4pc to nearly €36 per megawatt hour - and have climbed by 56pc since the end of February.

The UK-equivalent contract has risen by as much as 6.4pc today.

Aldo Spanjer, senior commodities strategist at BNP Paribas, said that if the Norwegian maintenance is delayed, it will be “bullish”, meaning prices would likely rise further.

He added: “The market is very sensitive to Norwegian maintenance or any other supply issue.”

10:08 AM BST

Bank of England will ‘take comfort’ from services slowdown, say economists

While the Prime Minister may not be over the moon, the latest slowdown in the services sector will provide some comfort to the Bank of England, according to economists.

Traders delayed bets on the first interest rate cut from June to as late as November after figures on Wednesday showed services inflation fell much less than expected in April from 6pc to 5.9pc.

Andrew Wishart, senior UK economist at Capital Economics, said the further fall in the services output “suggests that services inflation will continue to drop”. He added:

Overall, the flash May PMIs provide support to the idea that the April CPI inflation were more noise than signal.

With the economy slowing relative to the strong pace recorded in the first quarter and inflation continuing to ease, the survey suggests that the Bank will be able to press ahead with a first cut at the August meeting.

09:49 AM BST

Economy’s largest sector hit by slowdown in blow to Sunak

Britain’s dominant services sector suffered its weakest growth in output in six months in a blow to Rishi Sunak as he launches his election campaign.

The closely-watched S&P Global Flash UK PMI showed that the largest sector in Britain’s economy slowed down in May.

However, the figures also showed the manufacturing sector enjoyed its fastest growth in more than two years.

The Prime Minister began his election campaign by highlighting that the economy “is growing faster than our major competitors”, saying “we have turned a corner and brought economic stability back”.

He pointed to inflation falling “back down to normal” after dropping to 2.3pc in April, although high inflation in the services sector prompted traders to push back bets on interest rate cuts from as early as June to as late as November.

Chris Williamson, chief business economist at S&P Global, suggested the figures indicated that Britain “continues to recover from the mild recession seen late last year”. He added:

The survey also brings welcome news of a cooling in service sector inflation, which is needed to open the door

for the Bank of England to start cutting interest rates.A temporary surge in wage-related cost growth seen in April is showing signs of fading in May.

Firms are also reporting that strong competition is limiting their scope to raise prices, especially in the face of weakened demand due to the elevated cost of living.

09:23 AM BST

Interest rate cuts may be slower in eurozone, say economists

Strong growth by private sector businesses may force the European Central Bank to cut interest rates at a slower pace, economists have said.

The latest HCOB Flash Eurozone PMI showed a fifth consecutive months of increasing output from the private sector in May.

The European Central Bank is expected to cut interest rates from their record highs of 4pc in June.

Franziska Palmas, senior Europe economist at Capital Economics, said:

The ECB is still very likely to go ahead with a rate cut in June but if the economy continues to hold up well cuts further ahead may be slower than we had anticipated.

Policymakers have given very strong signals that a cut in June is coming and we think they will go ahead, but the recent strength in the surveys and continued strength in services price pressure will lend support to those in the Governing Council advocating for a pause in July.

09:12 AM BST

Eurozone businesses most confident in two years ahead of interest rate cuts

Private sector companies in the eurozone said they were their most confident in more than two years, according to a closely-watched survey, ahead of expected interest rate cuts in June.

The HCOB Flash Eurozone PMI hit 52.3 in May as business reported their strongest growth in a year, with faster increases in activity, new orders and employment.

Business confidence in the single-currency bloc has hit its highest level in 27 months, with the European Central Bank widely expected to begin cutting interest rates from their record highs of 4pc in June.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said:

This looks as good as it could be. The PMI composite for May indicates growth for three months straight and that the eurozone’s economy is gathering further strength.

Encouragingly, new orders are growing at a healthy rate while the companies’ confidence is reflected by a steady hiring pace.

This time, there is also some good news for the European Central Bank (ECB) as the rates of inflation for input and output prices in the services sector has softened compared to the month before.

This will be supportive for the apparent stance of the ECB to cut rates at the meeting on June 6.

Quite the positive PMI release for the Eurozone this morning as growth gained momentum this month and inflation - especially for services - is easing according to the survey. pic.twitter.com/0gEyQlP8LZ

— Bert Colijn (@BertColijn) May 23, 2024

08:58 AM BST

French private sector output shrinks

French private sector businesses suffered a fresh contraction in output in May amid a downturn in its services activity, according to a closely-watched survey.

The HCOB Flash France PMI fell to 49.1, indicating that production shrank for the first time this year, as the rate of input cost inflation quickened fractionally to a six-month high.

A reading below 50 signals a contraction in output.

Meanwhile, business activity rose in Germany for the second month running and at a faster rate.

The HCOB Flash Germany PMI hit 52.2 in May, which was its highest in a year.

Germany Composite PMIhttps://t.co/pLUA65WmuN pic.twitter.com/PeuJSm3JID

— TRADING ECONOMICS (@tEconomics) May 23, 2024

08:46 AM BST

FTSE 100 falls as campaigns get underway

UK stock markets were mixed as political parties kicked off their general election campaigns.

The blue-chip FTSE 100 index was down 0.2pc, while the FTSE 250 edged up by 0.1pc.

The pound strengthened by 0.1pc against the dollar to $1.273.

The main focus for markets today will be the S&P Global purchasing managers’ index (PMI) figures, which will give an indication of how the economy is performing.

Among corporate news, National Grid slumped 8.9pc to the bottom of the FTSE 100 after it said would raise about £7bn through new shares.

Rolls-Royce was last down 0.2pc after the engineering company kept its annual forecast unchanged.

Wizz Air jumped as much as 6.8pc after the European low-cost airline forecast a higher annual profit.

Hargreaves Lansdown surged 14.9pc to the top of the FTSE 250 after the investment platform rejected a £4.7bn takeover proposal.

AJ Bell gained 12pc after the investment platform reported its interim results.

08:32 AM BST

Economic growth equal between Labour and Tories since 1955

A fascinating chart from Simon French, chief economist at Panmure Gordon, about the difference in economic growth in Britain under Conservative and Labour governments:

What does economic & market data tell us about historical performance under Conservative & Labour govts? Since 1955: GDP: no difference; GBP better under Tories; Equities better under Labour; Profit margins higher under Tories; Deficits lower under Labour. Note out this AM… pic.twitter.com/W6jtqDRKzR

— Simon French (@Frencheconomics) May 23, 2024

08:25 AM BST

Sunak: We have brought economic stability back

The Prime Minister said he has launched his general election campaign now because his record shows he has a clear plan for the country.

Speaking on BBC Radio 4’s Today programme, he said that when he became Prime Minister “inflation was running at close to 11pc” while “the cost of living was a major challenge”.

He said inflation is now “back down to normal” after official figures showed it had dropped to 2.3pc in April.

He said: “The economy is growing faster than our major competitors, wages have been rising sustainably, so I think it is clear that whilst there’s more work to do, of course, and people are only just starting to feel the benefits, we have turned a corner and brought economic stability back.”

He added:

I believe I’ve got a clear plan, I’m prepared to take bold action, that’s what my record demonstrates and that’s what’s necessary to deliver a secure future for everyone, their families and our country in an increasingly uncertain world.

That’s why I think now is the right time for us to have this conversation.

08:12 AM BST

Pound flat as election campaigns get underway

The pound held steady near two-month highs a day after Rishi Sunak called a snap general election.

Sterling was flat on the dollar at $1.272 after rising by 0.3pc on Wednesday after data showed inflation did not slow as much as expected in April.

It was also steady versus the euro, which is worth a little over 85p, which is close to the pound’s strongest since February.

The start of the election campaign is unlikely to have a major effect on markets, according to analysts.

Francesco Pesole, FX strategist at ING, said:

The last time UK politics had any material impact on the pound outside budget announcements was when there was Liz Truss - and that was related to the budget too - outside of that it was the Brexit discussions.

Sterling now is trading almost entirely on the back of monetary policy in the UK and the U.S., so the question we should be asking ourselves is ‘Will the election have any clear implications for Bank of England timing for rate cuts?’ and we don’t think so.

Sunak’s predecessor Liz Truss’s short lived premiership in 2022 was derailed by a programme of unfunded tax cuts which caused a sell off in UK government bonds, and also hit the pound.

08:06 AM BST

UK markets subdued after Sunak calls election

The FTSE 100 has been given its first chance to react to the Prime Minister’s decision to call a snap election on July 4.

The UK’s flagship stock market has edged up 0.1pc to 8,375.41 while the midcap FTSE 250 was flat at 20,701.11.

07:58 AM BST

Nationwide profits fall as it hands out loyalty payments

Nationwide Building Society has revealed lower earnings over the past year but said it handed out a record amount of cash to its members - and plans to keep up a new loyalty scheme.

The building society reported a statutory pre-tax profit of £1.8bn for the year to April 4, down about a fifth from the £2.2bn reported this time last year.

The lender said the decline was largely due the £344m handed out to eligible members in June last year through its fairer share loyalty scheme - and it would be making a second payment this year.

It will also offer a member-only £200 incentive to encourage more people to switch their main current account to the lender.

But the society, like rival high street banks, also revealed that the benefits of higher interest rates were largely offset by a fiercely competitive mortgage market throughout the year.

07:39 AM BST

National Grid to spend £30bn on new pylons across UK

National Grid is to spend £30bn building new pylons and transmission systems across the UK countryside as it “rewires the nation” to accelerate decarbonisation, the company has pledged.

Our energy editor Jonathan Leake has the latest:

The announcement, planned for weeks, will now play into the election campaign where one of the key debates will be over how fast the UK should decarbonise its electricity supply and the impact on consumer bills.

Labour has pledged to achieve this by 2030 while the Conservatives have warned this would raise consumer bills too fast.

National Grid’s new cables will carry electricity from wind farms in Scotland or offshore to power-hungry cities mainly in England.

It will eventually cut greenhouse gas emissions - but at the price of potentially thousands of pylons intruding on treasured landscapes and extra charges on bills.

John Pettigrew, National Grid’s chief executive announced the move alongside the company’s full year results for the year to March 2024, including another £30bn to be invested in the USA.

He said: “We’re announcing today a new five-year financial framework. We will be investing £60bn in the five years to the end of March 2029 – that’s nearly double the level of investment of the past five years.

“Our readiness to take this step is underscored by another year of strong financial and operational performance, with underlying operating profit and underlying EPS both up 6% at constant currency, with record investment of £8.2bn across the group.”

National Grid is planning to raise £6.8bn by issuing 1bn new shares to help fund its network expansion.

07:30 AM BST

Vets face investigation over whether they are ripping off pet owners

The veterinary industry faces a formal investigation from the competition regulator to examine whether pet owners are being ripped off.

The Competition and Markets Authority said it would examine whether profits made by vets are competitive, whether consumers are getting the right information, and whether the limited choice of vets in some local areas was impacting customers.

It said an inquiry group made up of independent experts and chaired by Martin Coleman will now oversee an investigation.

It comes after it launched a consultation in March on the veterinary sector, which received 56,000 responses.

CMA chief executive Sarah Cardell said:

The message from our vets work so far has been loud and clear – many pet owners and professionals have concerns that need further investigation.

We’ve heard from people who are struggling to pay vet bills, potentially overpaying for medicines and don’t always know the best treatment options available to them.

We also remain concerned about the potential impact of sector consolidation and the incentives for large, integrated vet groups to act in ways which reduce consumer choice.

07:28 AM BST

Election victory for Labour ‘is not in the bag’, say small business bosses

An election victory “is not in the bag” for Labour, the head of Britain’s largest small business lobby group has said, after Rishi Sunak called a snap general election.

Federation of Small Businesses (FSB) national chairman Martin McTague said each party “needs to win the votes of these business owners” if they are to secure victory on July 4.

Mr Sunak called the election on the day official figures showed inflation returning to its normal range from the Bank of England’s target, from 3.2pc to 2.3pc in April.

Yet Labour leads the Conservatives heavily in the polls.

Mr McTague told BBC Radio 4’s Today programme:

We are seeing increasing confidence with our members but it is very hard to interpret whether that is because they have confidence in the Conservative Party’s management of the economy, or they are starting to feel confident about an incoming Labour government.

We know it is not in the bag. Either party needs to win the votes of these business owners.

07:26 AM BST

Good morning

Thanks for joining me. We begin the day with the outlook on the impending general election from business leaders.

The head of the Federation of Small Businesses, which represents more than 500,000 small enterprises and traders, said victory is not in the bag for either party, although they are starting to feel more confident.

5 things to start your day

1) Traders bet against summer rate cut despite fall in inflation | Looming election and higher-than-predicted price rises push expectations back to November

2) CVC and Abu Dhabi mount £5bn bid for Hargreaves Lansdown | Cheerleader for UK stock market at risk of being taken private

3) Barclay family launches forced sale of Very Group | Dwindling business empire to offload retailer in bid to tackle mounting debts

4) Anglo American agrees to takeover talks with BHP | FTSE mining giant to begin negotiations with rival to find a simpler deal

5) Jeremy Warner: The economic stars aligned for an early election. The Tories had nothing left to lose | Sunak knows all too well that the break in the clouds won’t last forever

What happened overnight

Several Asian share benchmarks fell as markets digested the implications of policymakers in major economies preferring to take a patient approach to cutting interest rates.

Geopolitical tensions were also at the forefront of investors’ minds as China’s military started two days of “punishment” drills held in five areas around Taiwan just days after new Taiwan President Lai Ching-te took office.

That sent Chinese blue chips falling 0.9pc, while Hong Kong’s Hang Seng Index similarly slid 1.4pc.

In the broader market, MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.3pc, while Australia’s S&P/ASX 200 index lost 0.5pc, also hurt by a pullback in some commodity prices.

More hawkish-than-expected minutes of the Federal Reserve’s latest policy meeting, higher than expected UK inflationand a sobering assessment of New Zealand’s inflation problems from the country’s central bank have caused investors to reduce their bets of the pace and scale of global rate cuts expected this year.

In America, the S&P 500 dropped 0.3pc to 5,307.01, while the tech-rich Nasdaq Composite index declined 0.2pc to 16,801.54. The Dow Jones Industrial Average of 30 leading US companies finished down 0.5pc at 39,671.04.

Yahoo Finance

Yahoo Finance