USDCAD Breakdown Stalls at Key Support- May Opening Range in Focus

DailyFX.com -

Talking Points

USDCAD responds to key near-term support heading into month close

Scalps target rebound – rally to offer favorable shorts

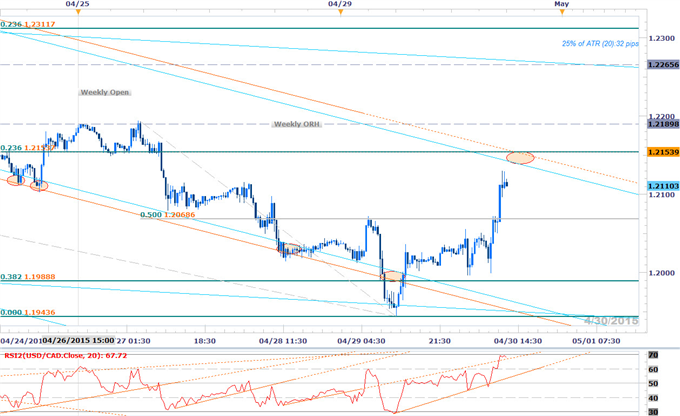

USD/CAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

USDCAD rebounds off key support confluence into 1.1976/88

Resistance eyed at weekly highs / ML confluence (highlighted region)

Broader outlook remains weighted to the downside below January median line (bearish invalidation)

Support break targets objectives at 1.1850 & 1.1726

Topside breach eyes resistance objectives at 1.2312 & 1.2384

Daily RSI resistance trigger pending

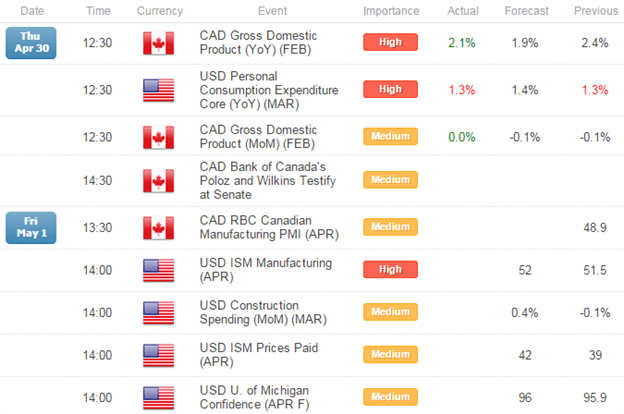

Event Risk Ahead: US ISM Manufacturing & Canada Manufacturing PMI tomorrow

USD/CAD 30min

Notes:The USDCAD has continued to trade within the confines of a well-defined median-line formation off the March 31st high with yesterday’s rebound off key daily support charging a rally back towards the upper MLP at 1.2150. A breach above this region risks a rally back towards the operative daily ML, currently around 1.2265 backed by the 23.6% retracement at 1.2311. Note that we are closing out April trade with the May opening range in focus as we head into next week.

Bottom line: looking for a resolution to this week’s range heading into May with a breach above targeting the January ML (favorable short entries?). Interim support 1.2068 backed by 1.1978 & this week’s low / ML support at 1.1944. A quarter of the daily ATR yields profit targets of 29-32 pips per scalp. Caution is warranted heading into event risk out of the US & Canada tomorrow with the manufacturing data on tap for both counterparties likely to fuel added volatility in USD & CAD crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

AUDJPY Breakout Scalps Target 200 DMA Ahead of BoJ, China PMI

Scalp Webinar: USD Risks Fresh Lows Ahead of Slowing GDP, FOMC

Scalp Webinar: USD Correction In Focus- Kiwi at Risk Sub 7700

NZDUSD Breakout Stalls at 7700 Resistance- Short Scalps Pending

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance