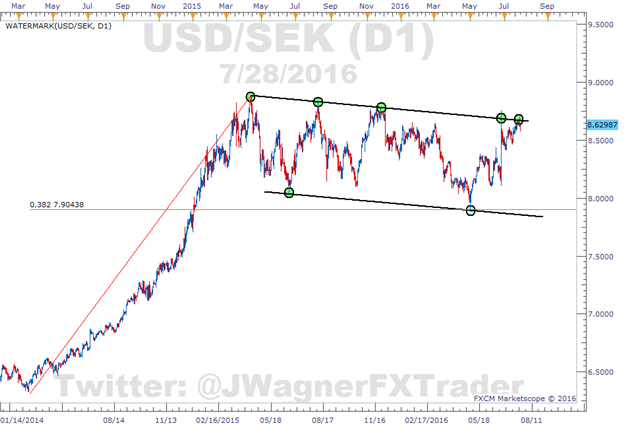

USD/SEK Threatens Break of 15 Month Bullish Flag Pattern

DailyFX.com -

USD/SEK has been on my radar for the past several months. For those who are USD bulls, this pair may be a way to trade that bias.

We have a bullish flag pattern that has been taking shape over the past 15 months. There are 5 occasions where price has been resisted by the same trend line. When drawing a parallel of that line, it has supported prices in 2 other instances. One of which also coincided with the 38.2% retracement level in May 2016.

Chart created using FXCM’s Trading Station

The market thinks those trend lines are important so we’ll use the recent spike high on June 24 (wake of Brexit vote) as a trigger to go long.

If price is successful in pressing above 8.76, then it would have broken above the flag and pressed to new post-Brexit highs.

Market Interpretation: Breakout

Bias: Long USD/SEK

Entry: Near 8.7610

Stop Loss: Near 8.5700 (-1910)

First Target: 8.9520 (+1910)

Second Target: 9.3000 (+5390)

This trading opportunity includes a positive risk to reward ratio as we are risking 160 pips to target 520 pips (first target). We discuss this as one of our Traits of Successful Traders in pages 3-9 of our TOST guide. Grab it here.

Interested in a quarterly outlook for USD?Download our quarterly forecast here.

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at hisBio Page.

To receive additional articles from Jeremy via email, join Jeremy’s distribution list.

Check out the latest standings for the FXCM trading contest HERE.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance