USD/JPY Trades Below Resistance on Unchanged FOMC Policy Outlook

Talking Points:

Fed reiterates commitment to measured taper and unchanged target rate

FOMC guidance says economic growth improved since March

USD/JPY continues to trade below resistance

Want to trade with proprietary strategies developed by FXCM? Find out how here.

Actual | Expected | Prior | |

Fed QE3 Pace (APR) | $45B | $45B | $55B |

FOMC Rate Decision (APR 30) | 0.25% | 0.25% | 0.25% |

The US Dollar only posted a small gain against the Yen when the FOMC announced its decision to decrease its monthly asset purchases by an additional 10 billion dollars and the accompanying statement did not significantly stray from the previous month’s forward guidance.

The Federal Reserve tapered asset purchases by 10 billion dollars for the fourth consecutive meeting, and the statement with the release said that the FOMC will likely taper its quantitative easing in further measured steps at future meetings, although the taper is not on a preset course. The Fed also announced that it will likely be appropriate to maintain the current rate target for considerable time after quantitative easing ends. The vote on the monetary policy was unanimous among FOMC members.

The FOMC further said that growth in economic activity has picked up since the Fed’s March meeting, rebounding from a weather related slowdown in the winter. The central bank predicted that economic activity will continue to expand at a moderate pace and labor market conditions will continue to improve gradually. The statement also announced that longer-term inflation expectations have remained stable.

Because the forward guidance was similar to comments we heard in March, and because the taper was expected by Bloomberg surveyed analysts, the US Dollar did not break out of the downward movement seen earlier today following the disappointing GDP release for Q1.

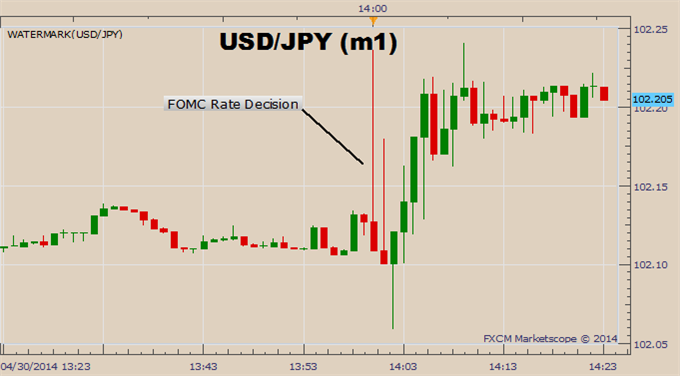

USD/JPY 1-Minute: April 30, 2014

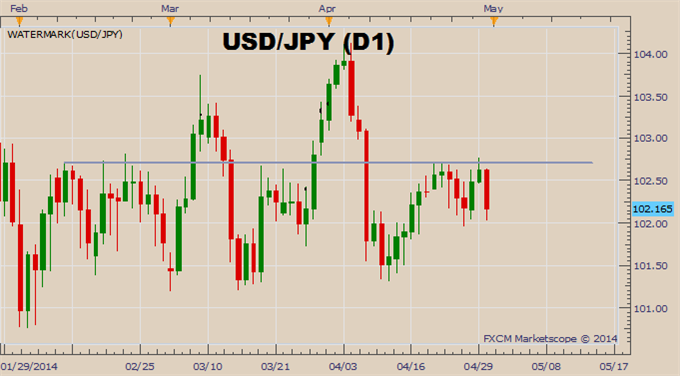

The US Dollar rose about 10 pips against the Yen following the release, and USD/JPY continues to trade below resistance at 102.70, corresponding to a weekly high set on February 11. Senior Currency Strategist Kristian Kerr warns that a recent extreme in Yen sentiment suggests that USD/JPY is vulnerable to a downside break in May.

USD/JPY Daily:April 30, 2014

Charts created by Baruch Spier using Marketscope 2.0. Add DailyFX Support/Resistance to your charts at FXCM Apps.

-- Written by Baruch Spier, DailyFX Research. Feedback can be sent to bbspier@fxcm.com .

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance