USD/JPY Marches Towards 120.00, RSI Pushes Deeper Into Overbought

DailyFX.com -

Talking Points:

- AUD/USD Outperforms Following Fed Rate-Hike, Strong Australia Employment.

- USD/JPY Marches Towards 120.00 as RSI Pushes Deeper Into Overbought Territory.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

AUD/USD | 0.7359 | 0.7431 | 0.7358 | 47 | 73 |

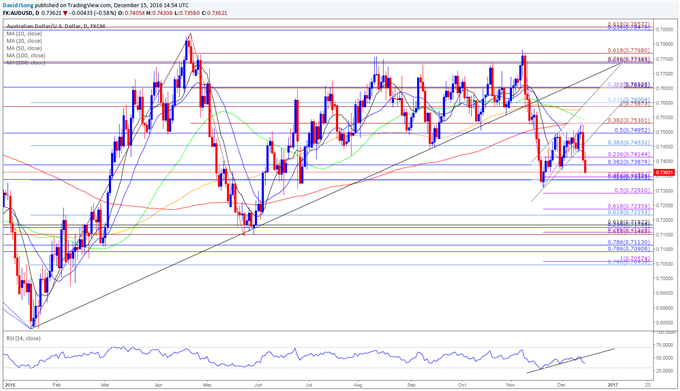

AUD/USD Daily

Chart - Created Using Trading View

The Australian dollar is faring better than its major counterparts following the 2016 Fed rate-hike, but the broader outlook for AUD/USD is becoming increasingly tilted to the downside as a bear-flag formation appears to be playing out; may see a fresh series of lower highs & lows as the pair fails to preserve the ascending channel from the November low (0.7311), with the Relative Strength Index (RSI) highlighting a similar dynamic.

The 39.1K rise in Australia Employment accompanied by the pickup in the labor force participation rate may encourage the Reserve Bank of Australia (RBA) to retain the current stance at the next policy meeting on February 9 as ‘forward-looking indicators point to continued expansion in employment in the near term,’ and the aussie may continue to outperform especially against the Euro and the Japanese Yen as Governor Glenn Stevens and Co. appear to be gradually moving away from the easing cycle.

Downside targets remain favored as AUD/USD slips to fresh monthly lows, with a close below 0.7390 (38.2% retracement) opening up the next downside hurdle around 0.7330 (50% retracement) to 0.73350 (38.2% expansion), with the next region of interest coming in around 0.7290 (50% expansion).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

USD/JPY | 118.27 | 118.66 | 117.01 | 123 | 165 |

USD/JPY Daily

Chart - Created Using Trading View

It seems as though it will only be a matter of time before USD/JPY takes out the 120.00 handle and work its way towards 2016-high (121.69) as the pair starts to carve a series of higher highs & lows, while the momentum indicator continues to push into overbought territory; need to see the textbook RSI sell signal (move below 70) to raise the scope for a near-term pullback.

Even though the Bank of Japan (BoJ) is widely expected to retain the current program at its last 2016 interest rate decision on December 20, Governor Haruhiko Kuroda and Co. may keep the door open to further insulate the real economy especially as the Federal Open Market Committee (FOMC) stays on course to further normalize monetary policy in 2017; more of the same from the BoJ may do little to curb the resilience in the U.S. dollar as Fed Funds Futures now show an 80% probability for another rate hike in June 2017.

Break/close above the Fibonacci overlap around 118.30 (50% expansion) to 118.90 (50% expansion) may open up the next topside target around 119.90 (61.8% expansion) to 120.00 (38.2% expansion) as long as the RSI holds in overbought territory.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

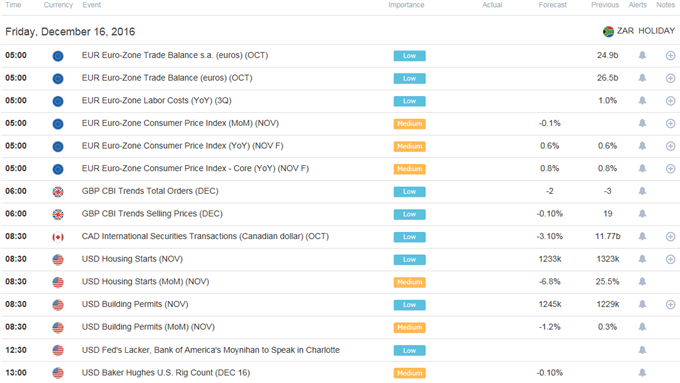

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

Gold Trades to New Lows, Silver Stays Stubbornly Strong

USD/CAD Technical Analysis: CAD Building Momentum Into LT Support

Technical Focus: EUR/USD - How Does this End?

GBP/USD Weakness to Be Viewed as Opportunity

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance