USD/JPY Coiling Ahead of U.S. GDP- Breakout Levels to Watch

DailyFX.com -

USDJPY consolidation at risk heading into U.S. GDP revision

Updated targets & invalidation

Compete to Win Cash Prizes with FXCM’s Forex Trading Contest!

USDJPY 30min

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: USDJPY is in consolidation near the bottom of an ascending channel formation extending off the 5/11 low ahead of tomorrow’s U.S. 1Q GDP revision. Consensus estimates are calling for a sizeable upward revision from 0.5% q/q to 0.9% q/q with personal consumption seen rising to 2.1% from 1.9%. We’ll be looking for a break of this range with risk weighted to the downside on a weaker-than-expected read. Remember, expectations for a Fed rate-hike next month have been on the rise and committee members remain adamant that the central bank will continue to be data dependent- so the numbers need to hold up.

While I do like USDJPY higher, a break below near-term support at 109.46/53 would risk a more prominent correction with such a scenario targeting support objectives at 108.96 & 108.65. Interim resistance stands at the weekly open at 110.09 (we failed there today) with a breach above 110.39 needed to clear the way for an advance towards 110.65 & channel resistance at 111.16. We’ll be continuing to track this pair and other USD setups daily on SB Trade Desk.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

A summary of the DailyFX Speculative Sentiment Index (SSI)shows traders remain net long USDJPY- the ratio stands at +1.52 (60% of traders are long)-bearishreading

Yesterday the ratio was +1.36 (58% of open positions were long); long positions are 3.3% higher than yesterday

Open interest is 1.3% lower than yesterday and 2.6% below its monthly average.

Previously, pullbacks in from extremes in long-exposure have been hallmarks for near-term corrections/pauses in price. That said, the recent reduction in in long-positioning seems to be leveling off, suggesting the short-side in price remains a material threat near-term heading into the close of the week.

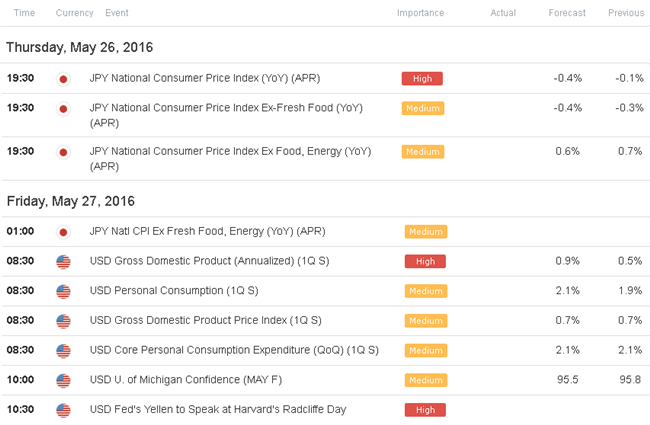

Relevant Data Releases This Week

Other Setups in Play:

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance