USD Index At Critical Juncture Going Into August, AUD Rally To Fizzle

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10013.15 | 10037.69 | 10007.84 | -0.10 | 56.01% |

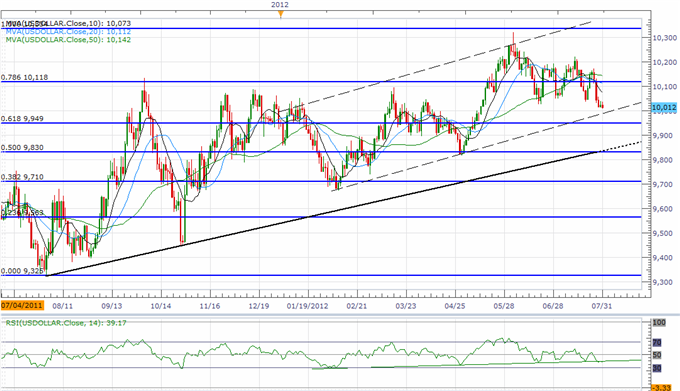

The Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) is 0.10 percent lower from the open after moving 56 percent of its average true range, but we may see the greenback track higher ahead of the Federal Open Market Committee interest rate decision as the developments coming out of the world’s largest economy dampens the scope for more monetary support. As price action breaks the downward trend carried over from the previous week, we should see the rebound from 10,000 gather pace over the next 24-hours of trading, but we will be keeping a close eye on the 30-minute relative strength index as it continues to find interim resistance around the 60 figure. In turn, the dollar may hold steady going into the rate decision, and the fresh batch of central bank rhetoric is likely to heavily impact the greenback as market participants weigh the prospects for future policy.

As the USDOLLAR holds above the 10,000 figure and maintains the ascending channel from earlier this year, we may see the greenback strengthen further in the coming days, but the bullish momentum could be tapering off as the relative strength index threatens the upward trend from the beginning of 2012. Although the FOMC keeps the door open to expand its balance sheet further, we should see the central bank move away from quantitative easing and soften its dovish tone for monetary policy as the committee sees the recovery gradually gathering pace over the coming months. In turn, a more upbeat Fed should pave the way for a meaningful correction in the index, and the ongoing shift in the policy outlook may continue to foster a bullish outlook for the USD as market participants scale back bets for QE3.

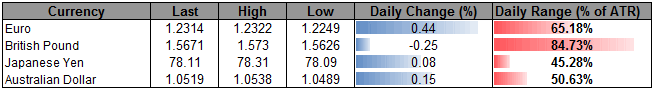

The greenback weakened against three of the four components, led by a 44 percent rally in the Euro, while the Australian dollar climbed 0.15 amid the rise in market sentiment. Indeed, currency traders appear to be scaling back their bearish outlook for the aussie as Credit Suisse overnight index swaps now show expectations for a 75bp worth of rate cuts over the next 12-months, but the short-term rally in the AUDUSD appears to be losing steam as the relative strength index remains capped by the 68 figure. As the aussie-dollar maintains the downward trend from the 2011 high (1.1079), the pair could be carving out a lower top going into August, and we may see a sharp correction in the exchange rate should the FOMC interest rate decision sap risk-taking behavior.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong

To be added to David's e-mail distribution list, send an e-mail with subject line "Distribution List" to dsong@dailyfx.com.

Join us to discuss the outlook for the major currencies on the DailyFX Forums

Meet the DailyFX team in Las Vegas at the annual FXCM Traders Expo, November 2-4, 2012 at the Rio All Suite Hotel & Casino. For additional information regarding the schedule, workshops and accommodations, visit the FXCM Trading Expo website.

Yahoo Finance

Yahoo Finance