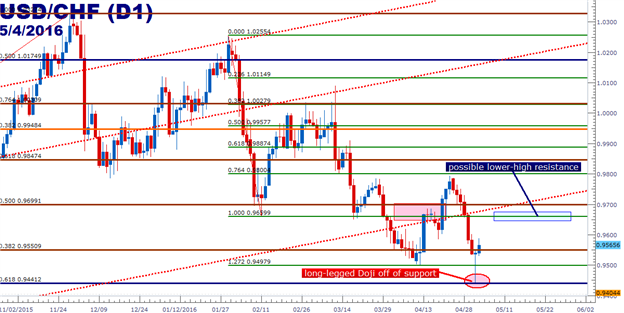

USD/CHF Technical Analysis: Long-Legged Doji Off of Support

DailyFX.com -

To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

USD/CHF Technical Strategy: Flat, previous short stopped out.

If you’re looking for trade ideas, check out our Trading Guides; they’re free.

SSI remains stretched in Swissy by a tune of >+3.28-to-1 and this is bearish. Click here to learn more about SSI.

USD/CHF has provided an interesting display of price action over the past seven months. From mid-October of last year until the end of November, Swissy rallied all the way from .9475 up to a high of 1.0327. This was a strong, consistent burst higher that set a 5-year high in the pair.

But since that high was set in early December, it’s been a markedly different story for the Swissy. As the Federal Reserve backed away from the median expectation for a full four interest rate hikes in 2016, the US Dollar has gotten obliterated and this is quite evident in the technical formation on USD/CHF. The issue at current is one of entry protocol, as the most recent swing high took place at the .9800 vicinity, and given current price action, this would amount to an approximate ~230 pip risk outlay.

But perhaps more vexxing for the idea of continuation setups is the recent support hit that we’ve seen at the .9441 level, which is the 61.8% Fibonacci retracement of the ‘big picture’ move in the pair, taking the 2005 high to the 2011 low. Not only did we get a support hit, but the day that support came into play produced a long-legged Doji, which can often pop up around a significant market turn.

At this point, the potential reward down to support of .9441 (approximately 132 pips as of this writing), obviates the setup given the 230 pip risk level that might be required to trade the setup.

More interesting would be continued development of the bearish structure, which could come to fruition should a ‘lower-high’ print at the prevoius resistance area around .9660.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance