USD/CAD Daily Fundamental Forecast – October 13, 2017

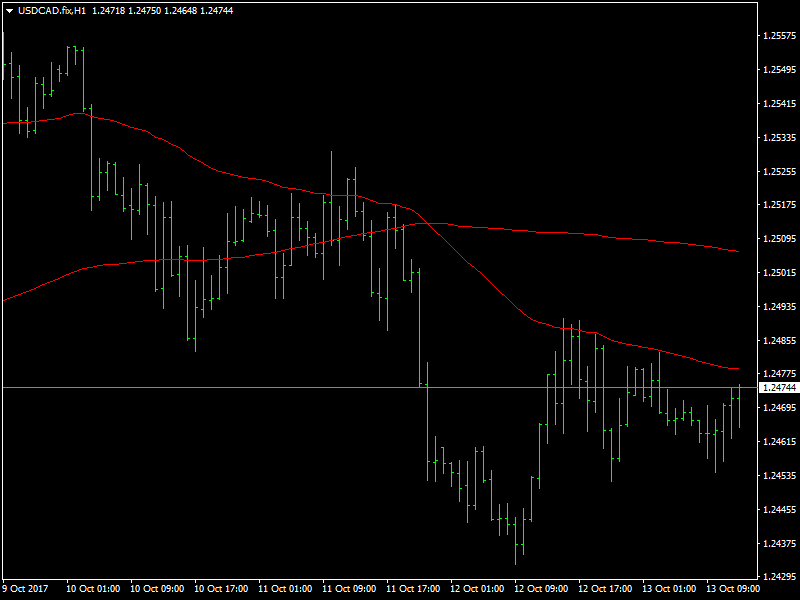

The price action has been choppy on the USDCAD pair over the last 24 hours. We can see that the pair is trying to move up but the dollar has been unable to generate any kind of momentum during this period and that is why we are seeing such choppy action. The oil prices have also been holding steady over the last 24 hours and continuing to trade near its range highs and this has also lent support for the CAD.

USDCAD Awaits Data

The CAD is able to hold steady due to the higher oil prices and also due to the continuing faith in the BOC that it would hike rates sooner rather than later. The BOC has attained such a reputation mainly due to the fact that it has been pro-active with all its action relating to monetary policy. It hiked the rates when most of the market did not expect it to and has also sounded hawkish whenever it needed to be. This has helped to keep the CAD buoyant over the last few weeks and it is likely to continue to be so in the short and medium term.

On the other hand, the dollar is still waiting some data that would help it to bring about a turnaround in its outlook. The data over the last few weeks have primarily failed to build enough support for the dollar and this in turn has led to the weakening of the dollar across the board. The Fed has also not yet supported the dollar as the market would have liked and hence we are seeing the dollar being steady at best.

It is under these circumstances that some of the most important pieces of data are going to be released today from the US. We have the CPI and the retail sales data from the US later in the day and these are likely to determine the short term direction for the dollar. If the inflation comes out stronger, then the dollar is likely to get a huge release of pressure which is then likely to push it higher.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance