USD/CAD Daily Fundamental Forecast – February 16, 2018

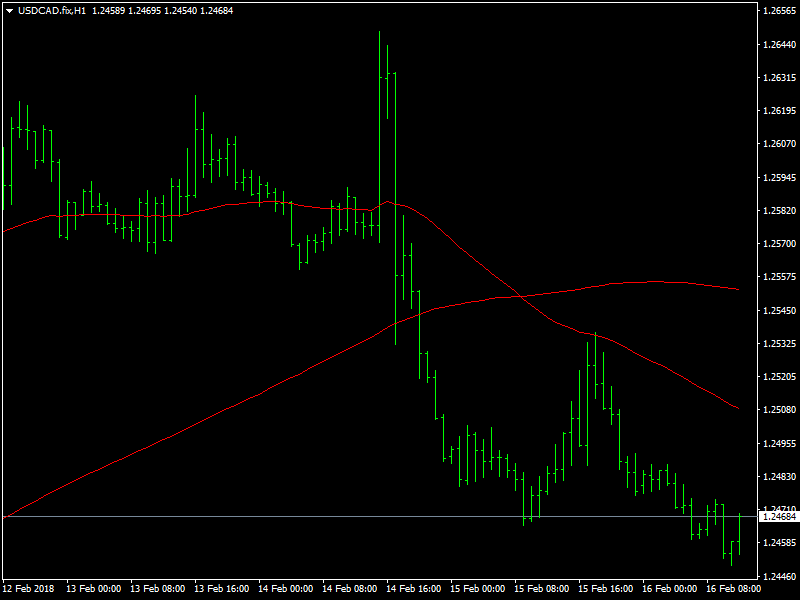

The USDCAD pair continues to trade in a weak manner as the dollar is on the backfoot all across the markets. We can see the dollar at some crucial points of support and resistance across the markets and now it remains to be seen whether it is going to buckle under pressure and go down even further or whether it is going to move higher.

USDCAD Looking for Direction

As we look around, we do not find any major fundamental or economic reason for the weakness in the dollar. It is true that the incoming data has been slightly weak but this has not lead to any change in the outlook for the interest rate hikes from the Fed as the data has not been disastrous. It could be said that the increase in the stock indices could be one of the factors for the weakness in the dollar but if this were the case, then we could safely say that this is not likely to last long.

The stock markets in the US seem to be correcting higher as a form of correction of the move lower than we had seen in the markets last week and once the correction is done, we have to wait and see whether the bulls have the strength to push it even further. It is at this juncture that the dollar is likely to come under even more pressure which could lead it to crack further but as long as the data come in in a strong and steady manner, as it has been over the last few weeks, we doubt whether this would happen in the short term.

Looking ahead to the rest of the day, we do not have any market changing data from the US or Canada for the day and hence we believe that there may be consolidation on either side of 1.25 for the rest of the day.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance