USD/CAD Daily Fundamental Forecast – October 2, 2017

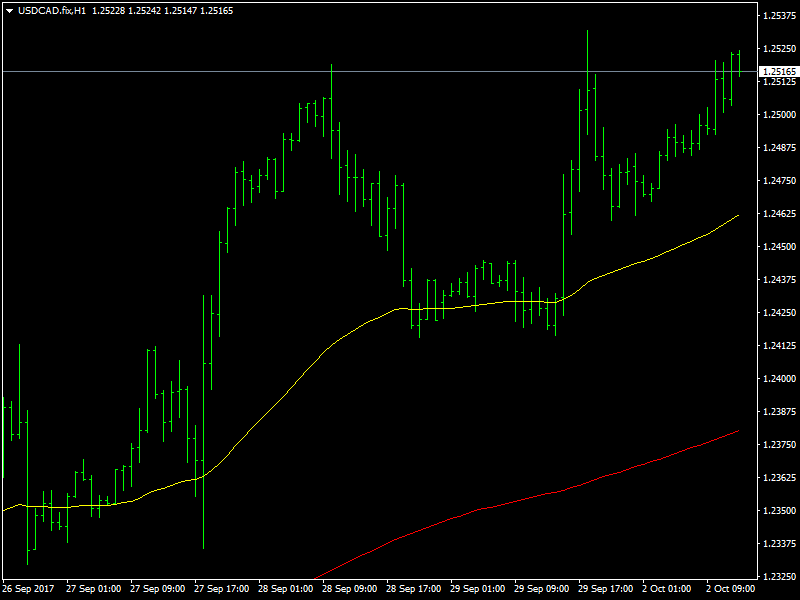

The USDCAD pair has been trading in a choppy manner on either side of 1.25 over the last couple of days. This is to be expected considering the fact that the pair is near a strong resistance region and a clean break through this region could open up the possibility of this pair moving up by over 200 pips from here.

USDCAD Moving Higher Still

The pair seems to have the tendency to make strong moves in a specific direction once it has made up its mind. While it went on a 1800 pip move within a matter of couple of months sometime back, it has now bounced by close to 500 pips over the past couple of weeks as we are seeing the pair rebound. Now the rebound seems to be assuming dangerous proportions as far as the bears in the pair are concerned and this is likely to lead to even more gains as more and more bears bail out.

It has to be said that the main cause for such a move is due to the strength of the dollar which has been rebounding over the last few days due to strong support from the Fed and the expectation that there would be a rate hike in December. On the other hand, the BOC has thrown a spanner in the works as Poloz has said that he doesnt have a timeline in mind for the next rate hike. The market had assumed that the BOC would also hike one more time this year and hence this statement from Poloz was a surprise and has placed the CAD on the backfoot.

Looking ahead to the rest of the day, we do not have any major news from Canada but we have the ISM Manufacturing PMI data from the US. The dollaris likely to continue its recovery which is likely to lead to even more choppy action on either side of 1.25 during the course of the day.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 2, 2017 Forecast

E-mini Dow Jones Industrial Average (YM) Futures Analysis – October 2, 2017 Forecast

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 2, 2017 Forecast

US Futures Point to a Higher Open, Manufacturing Data Coming from States Soon

Yahoo Finance

Yahoo Finance