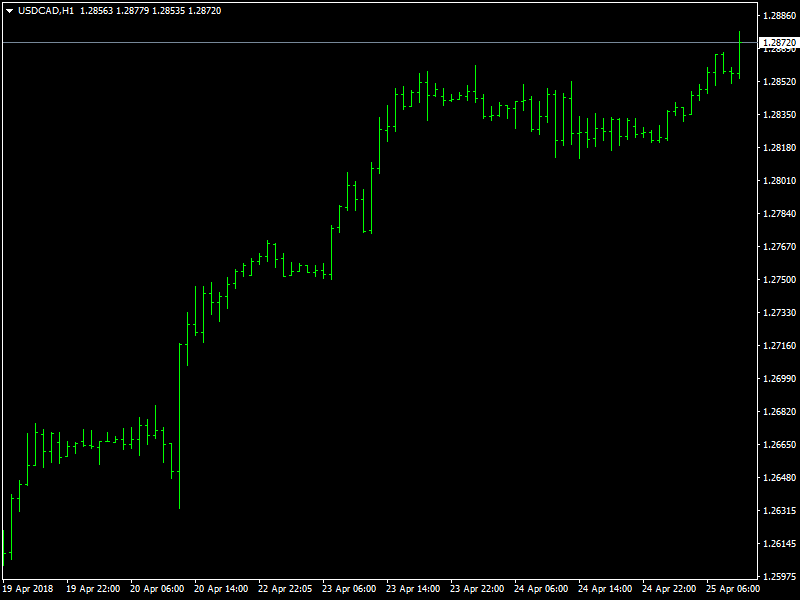

USD/CAD Continues Its Rise

The pair has continued to zoom ahead over the last 24 hours as the prices have been pushing higher through the 1.28 region and continue to move up. The dollar strength is there in the markets for everyone to see and this is the factor that has been helping the prices higher over the last few days.

USDCAD Towards 1.29

It has been a roller coaster ride in this pair over the last few weeks with the bears seemingly in control at one point of time and then the control passing over to the bulls at another time. This is something that is a bit difficult for the long term traders but the short and medium term traders do seem to be enjoying the moves a lot. The pair shot higher through the 1.30 region towards the 1.32 region a few weeks back only to correct on the back of CAD strength. There was a period of strong incoming data from Canada and this pushed the prices lower.

But this has not lasted long as the incoming data from Canada began to fail and the employment and retail sales data came in much weaker than expected. Though the data from the US has also been pretty choppy, the lack of specific timelines for rate hikes from the BOC and the weakening oil prices since the beginning of the week has led to a reversal in the move lower and now we are seeing the prices trade just short of the 1.29 region as of this writing.

Looking ahead to the rest of the day, we do not have any major economic news or data from the US or Canada and so we can expect the bullishness in the pair to continue. We do not have any major data for the rest of the week as well and hence the impact of all these on this pair should be minimal which would be conducive for the current trend to continue.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance