USCB Financial Holdings Inc (USCB) Q1 Earnings: Slight Dip in Profitability Amid Strong Deposit ...

Earnings Per Share (EPS): Reported EPS of $0.23 for Q1 2024, surpassing the estimated $0.21.

Net Income: Achieved $4.6 million, exceeding estimates of $4.02 million.

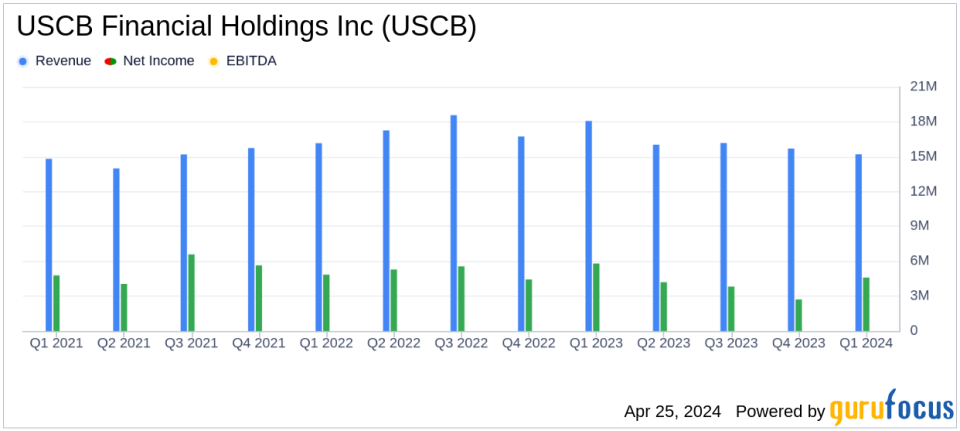

Revenue: Net interest income before provision for credit losses stood at $15.2 million, below the prior year's $15.997 million, indicating a decrease in revenue performance.

Dividend Announcement: Initiated a quarterly dividend program at $0.05 per share, reflecting a commitment to shareholder returns.

Share Repurchase Program: Announced a new repurchase program for 500,000 shares, underscoring confidence in the company's financial health and future prospects.

Asset Growth: Total assets increased by 15% year-over-year to $2.5 billion, demonstrating significant growth.

Deposit Growth: Total deposits rose by 14.9% from the previous year to $2.1 billion, highlighting strong customer trust and business expansion.

On April 25, 2024, USCB Financial Holdings Inc (NASDAQ:USCB) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The community banking entity reported a net income of $4.6 million, or $0.23 per diluted share, a slight decrease from the previous year's $5.8 million, or $0.29 per diluted share. This performance aligns closely with analyst expectations, which projected earnings of $0.21 per share and a net income of $4.02 million.

USCB Financial Holdings Inc, a stalwart in the community banking sector, operates U.S. Century Bank, which is among Florida's largest community banks. The bank offers a comprehensive suite of financial products and services, enhancing community engagement through its support of various local organizations.

Financial Highlights and Strategic Initiatives

The first quarter saw a robust increase in deposits, up by $165.7 million, signaling strong customer confidence and successful execution of the bank's organic growth strategies. This includes new production hires and innovative business verticals aimed at aggregating deposits. The bank's total assets grew by 15.0% year-over-year to $2.5 billion, with loans and deposits increasing by 15.2% and 14.9%, respectively.

Chairman, President, and CEO Luis de la Aguilera commented on the strategic direction, highlighting the initiation of a dividend program and the adoption of a new 500,000 share repurchase program, reflecting a strong commitment to shareholder value.

Operational and Financial Metrics

Despite the growth in deposits and assets, the bank experienced a decrease in net interest income and margin, with net interest income before provision for credit losses falling by 5.2% to $15.2 million. The net interest margin also contracted from 3.22% to 2.62%. Additionally, the efficiency ratio deteriorated from 56.32% to 63.41%, indicating higher costs relative to revenue.

Asset quality remained stable with non-performing loans to total loans at a minimal 0.03%. The bank's capital adequacy remains strong, with total risk-based capital ratios at 12.98% for the company and 12.89% for the bank.

Looking Forward

Looking ahead, USCB Financial Holdings Inc is optimistic about sustaining diversified growth in both loans and deposits, bolstered by a thriving Florida economy. The strategic focus remains on enhancing shareholder value through prudent capital management and operational efficiency.

For more detailed information and to join the upcoming conference call discussing these results, stakeholders are encouraged to visit the Investor Relations section of USCB's website.

This earnings snapshot provides a comprehensive view of USCB Financial Holdings Inc's current financial health and strategic direction, essential for investors considering this community-focused bank's stock.

Explore the complete 8-K earnings release (here) from USCB Financial Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance