US jobs shock leaves traders reeling as hopes of interest rate cut sink

The US economy added more jobs than expected last month in a blow to hopes that the Federal Reserve could start interest rate cuts from September.

Nonfarm payrolls grew by 272,000 in May, up from a downwardly revised 165,000 in April, according to the US Bureau of Labor Statistics.

Economists had estimated that the US economy would add 180,000 new jobs in May, with the unemployment rate expected to have held steady at 3.9pc.

Money markets indicate it could be December by the time interest rates are cut in the US after the higher-than-expected employment figures.

Before the figures, traders had been pricing in an interest rate cut in the US by November.

In the UK, traders cut bets on an interest rate cut by the Bank of England in August, although a first move is still priced in for November.

06:20 PM BST

Have a good weekend!

That’s all from us this week. I’ll leave you with the latest headlines:

How Mike Lynch scored a stunning victory over the US after 12-year fraud saga

Investors are already getting out of Labour-landslide Britain

https://Amazon accused of breaching UK sanctions by selling facial recognition tech to Russia

05:47 PM BST

LVMH names new deputy finance chief in boardroom reshuffle

LVMH has named a deputy to its long-time chief financial officer as the luxury goods giant prepares for a leadership shake-up.

The company, controlled by the world’s richest man Bernard Arnault, appointed Cecile Cabanis as deputy finance director.

Ms Cabanis will report to LVMH’s finance chief Jean-Jacques Guiony, who will gradually handover his responsibilities over an 18 month period.

The new joiner is currently deputy chief executive officer of asset manager Tikehau Capital. She will join the Dior and Louis Vuitton owner in June.

“Cécile will report to him as they begin a transition period to prepare for a future succession,” LVMH said, adding that she will join the company’s executive committee.

Guiony has been in the role for the past two decades, overseeing the company’s purchase of Tiffany & Co., Bulgari, Loro Piana and Belmond.

He will have new responsibilities which will be announced in due time, LVMH added.

The appointment comes amid a wider management overhaul as LVMH prepares a new generation of leaders to steer the luxury giant in the future.

04:39 PM BST

FTSE 100 closes in the red

The FTSE 100 has ended trading 0.48pc lower to 8,245.37, weighed down by top laggards Fresnillo, Prudential, Intermediate Capital Group and Antofagasta.

The blue chip index has shed 0.36pc in the past five days.

04:02 PM BST

Middle classes face 70pc tax trap under Hunt’s benefit shake-up

Thousands of middle class parents will face a new 70pc tax trap under Jeremy Hunt’s proposed overhaul of child benefits.

The Tory plan will mean a tax cliff-edge for some families with household earnings above £120,000, at which they will lose 70p of every additional £1 they earn.

Dan Neidle, an expert at Tax Policy Associates, said that the “psychologically significant” penalty would hit earners paid between £120,000 and £125,140 with three children.

Economics editor Szu Ping Chan has the story...

03:39 PM BST

Handing over

It is the weekend so I am heading off. Adam Mawardi will keep posting live updates from here.

For anyone thinking of a drop of plonk this evening, check out this new “instant in-house wine ageing service” launching at central London restaurant.

Inventor Michael Pritchard has created the Winewizard, which makes wine instantly taste as though it is at least twice as expensive - turning a £5 bottle into a £10 one.

As well as making it taste more expensive, it neutralises sulphite additives, which can significantly reduce the likelihood of a hangover. Bottoms up!

03:13 PM BST

Fed will cut rates in September, says Citi

One of the last major investment banks predicting a summer interest rate cut in the US has pushed back its prediction after the unexpectedly high employment numbers.

Citi said it was changing its forecast for a first rate reduction by the Federal Reserve from July to September after the American economy added 272,000 jobs in May, well ahead of expectations of 180,000.

Analyst Andrew Hollenhorst said:

The jobs report does not change our view that hiring demand, and the broader economy, is slowing and that this will ultimately provoke the Fed to react with a series of cuts beginning in the next few months.

The household survey continues to show much weaker job creation, with household employment down 483k – pushing the unemployment rate up to 4pc despite a decline in labour force participation.

02:57 PM BST

Pound slumps as traders push back hopes of US rate cuts

The pound has fallen sharply after the unexpectedly large employment figures from the US, which dampened hopes of early rate cuts from the Federal Reserve.

Sterling has dropped 0.6pc to $1.272, putting it on track for a first weekly loss in four weeks and quashing what could have been its strongest rally since March last year.

By contrast, the pound was up slightly against the euro at €1.176 following a first interest rate cut in five years from the European Central Bank on Thursday.

02:38 PM BST

Wall Street slumps after US jobs shock

US stock indexes fell at the open after data showed job growth accelerated far more than expected in May.

The Dow Jones Industrial Average fell 24.93 points, or 0.1pc, at the open to 38,861.24 after investors cut back bets on a September start to rate cuts.

The S&P 500 opened lower by 9.15 points, or 0.2pc, at 5,343.81, while the Nasdaq Composite dropped 48.99 points, or 0.3pc, to 17,124.14 at the opening bell.

02:30 PM BST

Canada employment ‘little changed’ amid interest rate cuts

Canada’s employment situation was “little changed” in May, official figures showed on the week it became the first G7 nation to cut interest rates.

Some 27,000 new jobs were added in the month while the unemployment rate edged up to 6.2pc, its national statistics agency said, as population growth continued to outpace job creation. About 90,000 jobs had been added in April.

The unemployment rate has trended up over the past year, rising 1.1 percentage points since April 2023, across all major demographic groups, Statistics Canada said in a statement.

The Bank of Canada on Wednesday cut interest rates from 5pc to 4.75pc.

02:08 PM BST

US jobs growth ‘slams door shut’ on hopes of July rate cut, say analysts

Seema Shah, chief global strategist at Principal Asset Management, said the latest jobs data “slams the door shut on a July rate cut” as the US economy takes “one step forward, two steps back”.

Paul Ashworth, chief North America economist at Capital Economics, warned that the “rise in the unemployment rate was for all the wrong reasons” after a “massive” 408,000 drop in household employment outpacing a 250,000 decline in the labour force.

Neil Birrell, chief investment officer at Premier Miton, said the figures put a “severe dent” in hopes of a gradual cooling of the labour market. He added:

With wage growth higher than expected as well, the economy is still moving along at quite a rate it seems, which is bad news for anyone banking on the Fed cutting rates soon.

After this number, the end of the year might be nearer the mark for the Fed to follow the rate moves in Canada and the eurozone.

02:02 PM BST

US bond yields spike after strong jobs data

US government borrowing costs spiked higher after the latest US jobs numbers dimmed hopes of a September interest rate cut by the Federal Reserve.

The yield on 10-year US Treasury bonds spiked by 13 basis points to 4.42pc as the American economy added more jobs than expected in May.

Bond yields began rising across the UK and Europe as traders cut bets on early interest rate cuts and forecast that a first move by the Fed could come as late as December.

The European Central Bank cut interest rates for the first time in five years on Thursday, but policymakers have been at pains to say it is not the start of a trend and the next decision will be “data dependent”.

01:54 PM BST

Traders push back bets on interest rate cuts

Money markets indicate it could be December by the time interest rates are cut in the US after higher-than-expected jobs figures.

Traders are no longer pricing in an interest rate cut in the US by November, as had been the case before official figures showed the US economy added 272,000 jobs in May, well over estimates of 180,000.

Average wage rises also increased from 4pc to 4.1pc in May, indicating that consumer spending power remains strong in the face of interest rates at their highest level since 2001.

In the UK, traders cut bets on an interest rate cut by the Bank of England in August, although a first move is still priced in for November.

7/ Wage growth stronger M/M in May than in April.

Despite that, the overall trend of deceleration seems like it might still be intact? Average hourly earnings are growing by around 4% annualized in the last 3 months. pic.twitter.com/0bxsNRllPf— Guy Berger (@EconBerger) June 7, 2024

01:43 PM BST

Wall Street on track for slump after jobs shock

US stock markets are on track to fall at the opening bell later after stronger-than-expected employment figures.

The Labor Department’s report showed nonfarm payrolls rose by 272,000 jobs in May, against expectations of an increase of 180,000.

Average hourly earnings rose 0.4pc on a monthly basis, compared to an expectation of 0.3pc growth, dimming hopes of interest rate cuts from the Federal Reserve in September..

The unemployment rate rose to 4pc versus a forecast of 3.9pc.

In premarket trading, the Dow Jones Industrial Average was down 149 points, or 0.4pc, the S&P 500 was down 16.75 points, or 0.3pc and Nasdaq 100 futures were down 35 points, or 0.2pc.

01:37 PM BST

US unemployment rises to 4pc

The US unemployment rate edged up slightly from 3.9pc to 4pc in May, with the number of people out of work little changed at 6.6m.

Average hourly earnings increased from an upwardly revised 4pc in the year to April to 4.1pc in May.

Charts:

1/ Another robust nonfarm payroll gain in May. Increases are comparable in magnitude to a year ago - the deceleration stopped a long time ago.

(Small asterisk due to probable future benchmark revisions.)

Small downward revisions to the prior 2 months. pic.twitter.com/LTOyrG9jUv— Guy Berger (@EconBerger) June 7, 2024

272,000 US jobs were added in May (vs. 182k consensus estimate), the 41st consecutive month of jobs growth.https://t.co/l5IYmkf6Ih pic.twitter.com/x92gDXDO6L

— Charlie Bilello (@charliebilello) June 7, 2024

01:31 PM BST

US employment smashes predictions in blow to hopes of rate cuts

The US economy added more jobs than expected last month in a blow to hopes that the Federal Reserve could start interest rate cuts from September.

Nonfarm payrolls grew by 272,000 in May, up from a downwardly revised 165,000 in April, according to the US Bureau of Labor Statistics.

Economists had estimated that the US economy would add 180,000 new jobs in May, with the unemployment rate expected to have held steady at 3.9pc.

01:16 PM BST

Eurozone borrowing costs rise despite interest rate cut

Government borrowing costs are rising in the European debt market as officials in the eurozone insisted the continent is not on the verge of a flurry of interest rate cuts.

Germany’s 10-year yield, the benchmark for the euro area, rose to 2.57pc, while the Italian 10-year bond yield rose to 3.91pc.

European Central Bank policymakers warned that the final stage of pushing inflation down to 2pc could be tough after cutting interest rates for the first time in five years on Thursday.

The Bundesbank said that German inflation is proving stubborn, driven by a continued strong rise in wages.

By contrast to Europe’s debt market, the yield on 10-year UK gilts has risen by just one basis point today to 4.18pc.

01:00 PM BST

Mike Lynch to campaign against US extradition treaty after fraud acquittal

Mike Lynch is preparing to campaign against Britain’s extradition treaty with the US after the tech entrepreneur was acquitted of fraud following a six-year battle with America’s justice system.

Our technology editor James Titcomb and senior technology reporter Matthew Field have the latest:

The Autonomy founder has said he will work with former Cabinet minister David Davis to push for reform of the treaty, which allows the US to extradite British citizens far more easily than Britain can extradite Americans.

Mr Lynch, who was controversially extradited to the US last year to face criminal charges, was cleared on Thursday by a San Francisco jury after an 11-week trial over his role in the sale of his business.

Mr Davis, who spoke to Mr Lynch in the wake of his acquittal, said: “He said: ‘David, we’ve got work to do to put this extradition treaty right.’”

Read on Mr Lynch’s long road to this point.

12:26 PM BST

Oil rebounds as Saudi Arabia hints production revival is not guaranteed

The price of oil has rebounded from its four month lows after the Opec cartel announced plans earlier this week to ramp up supplies later in the year.

Brent crude, the international benchmark, was last up 0.5pc above $80 a barrel after some members of the alliance signalled they could yet cancel plans to revive production from October.

Saudi Energy Minister Prince Abdulaziz bin Salman led ministers in outlining that a future increase in production would be contingent on market conditions.

John Evans, an analyst at brokers PVM Oil, said:

Opec+ members set about a charm offensive yesterday with the big guns of the pact deployed in a show of unison.

[The] intervention showed decent success as it was very well timed.

12:10 PM BST

Pound on track for longest rally in over a year amid bets on interest rate cuts

The pound is on track for its longest rally in more than a year as investors prepare for key figures which could outline when the US could cut interest rates.

Sterling was unchanged against the dollar today at just under $1.28 but is set for a rise of 0.4pc this week to around its highest level since March.

It is on course for a fourth consecutive week of gains, which is its longest spell since March last year.

Against the euro, sterling has performed far more modestly recently. It is roughly flat against the single European currency, a day after the European Central Bank delivered its first rate cut in five years.

The strength of sterling will come into focus when the US reveals its latest nonfarm payrolls data later, which will indicate the strength of the jobs market in the world’s largest economy.

Signs of weakness could lead traders to ramp up bets on US interest rate cuts in September, which would boost the value of the pound.

Lydia Boussour, a senior economist at EY-Parthenon, said the employment report will likely “provide further evidence that the labour market isn’t as strong as it was a year ago”.

Henk Potts, market strategist at Barclays Private Bank, added: “We anticipate that we could see a further softening in labour market conditions, but expect that the unemployment rate will peak at just 4pc in the coming months, which would still be low when compared to historical standards.”

11:57 AM BST

Memestock investors stung as GameStop reveals £25m loss and share sale

Investors in GameStop, the video games retailer which has become a symbol of the memestock craze, were stung as the company revealed losses of $32.3m (£25.2m).

The company said it would capitalise on the recent surge in its share price by issuing 75m shares, sending its stock price down 14pc in premarket trading.

Its shares surge by about 180pc earlier this month after the return to social media of Keith Gill, the man who helped rally interest in the company in 2021 aimed at hurting short sellers.

Interest quickly died down but then surged again after he appeared to reveal a position in the company worth more than $500m in a Reddit post.

He is expected to hold his first livestream on YouTube in three years later today.

11:41 AM BST

Zuber Issa quits as EG Group co-boss and buys forecourts

The break up of the Issa brothers’ business empire does not only stretch to Zuber’s sale of his stake in Asda to US private equity.

Their petrol station business EG Group has announced today that it has sold its remaining UK forecourt business and some food service sites to Zuber for £228m.

Zuber Issa will also step down as co-chief executive of EG Group but will keep his shareholding and continue as a non-executive director, while his brother Mohsin will become sole chief executive.

EG Group said it will use the cash to repay debt and shore up its balance sheet.

A joint statement from the brothers said:

Given our shared background in building great businesses, the board and everyone at EG understand Zuber’s desire to return to his entrepreneurial UK roots by acquiring the remaining UK forecourt business including new-to-industry developments and certain standalone food service concessions – as well as dedicating more time to his family and our charitable activities.

11:30 AM BST

US markets muted ahead of jobs figures

US stocks were little changed ahead of a crucial employment report being published later.

The benchmark S&P 500 and the Nasdaq closed Thursday’s session slightly lower, dragged by falling technology stocks despite touching intraday record highs.

Some megacap technology stocks that took a hit in the previous session were also slightly higher premarket, but overall trading was subdued ahead of the May nonfarm payrolls data.

Economists estimate that the US economy added 185,000 new jobs in May, with the unemployment rate expected to hold steady at 3.9pc.

Markets have struggled to anticipate the Fed’s moves this year. Expectations for early rate reductions as soon as March dissipated quickly, as economic data indicated a tight jobs market and persistent price pressures.

However, Thursday’s weekly jobless claims report was the latest in a string of data suggesting the labour market is easing, potentially giving policymakers more confidence that they can ease rates while avoiding resurgent inflation.

Traders now see a 68pc chance of a September rate reduction, according to the CME’s FedWatch tool, and have priced in about two cuts this year, according to data from LSEG.

In premarket trading, the Dow Jones Industrial Average and S&P 500 were little changed and Nasdaq 100 futures were up 0.1pc.

11:10 AM BST

Zuber Issa offloads Asda stake as billionaire brothers separate business empire

Zuber Issa, one of the billionaire brothers who bought Asda in 2021, has sold his stake in the supermarket to US private equity as the siblings divide up their business empire.

TDR Capital will take a majority stake in Britain’s third largest supermarket, with Zuber’s brother Mohsin holding 22.5pc and Walmart 10pc.

Zuber is separately trying to buy out parts of the EG Group petrol station empire that he built with Mohsin, in the latest move to disentangle the brothers’ fortunes.

Details of the proposed EG Group deal were laid out to investors in March, who were told that the business is in “active discussions with Zuber Issa regarding the sale” of UK assets.

After securing a 67.5pc stake in Asda, TDR Capital’s managing partners Gary Lindsay and Tom Mitchell said:

By combining our investment and sector expertise with Asda’s heritage of delivering value for customers, we have already made significant progress in transforming Asda.

We have added a scale convenience business, grown Asda’s store footprint from 623 to 1,200 stores and food-to-go sites, and launched a hugely successful loyalty app, which now has six million active customers, accounting for around half of total sales.

We remain focused on investing in Asda’s stores and online, as well as its colleagues through the highest pay in the traditional supermarket sector, to drive sustainable, long-term growth.

10:43 AM BST

Eurozone wages rise more than expected in blow to ECB after rate cut

Wages grew at a faster pace than expected across the eurozone, official figures show, in a blow to policymakers at the European Central Bank a day after cutting interest rates for the first time in five years.

Compensation per employee rose by 5.1pc in the first three months of the year, up from a revised 4.9pc in the previous quarter, data from the ECB show.

The rise was higher than the 4.6pc expected by economists and comes after President Christine Lagarde raised concerns about wage rises being a risk to inflation as eurozone interest rates were cut from a record 4pc to 3.75pc on Thursday.

She had said there was “no question” that wages remain elevated, although she insisted they were on a “declining path”.

Rising wages are considered a risk to inflation as they can allow consumers to keep pace with rising prices.

Latvian central bank chief Martins Kazaks warned today: “Domestic price pressures remain strong. The labour market is tight and unemployment is low, which keeps upward pressure on wages.”

Latest data also showed that the eurozone economy grew by 0.3pc in the first quarter of the year, following a decline of 0.1pc at the end of 2023.

Euro area #GDP up by 0.3% in Q1 2024, +0.4% compared with Q1 2023 https://t.co/aFCUMWTXT3 pic.twitter.com/n9hXlSX2Fu

— EU_Eurostat (@EU_Eurostat) June 7, 2024

10:19 AM BST

China exports grow despite heavy tariffs

China’s exports grew more quickly and for a second month in May, suggesting factory owners are managing to find buyers overseas and providing some relief to the economy as it battles to mount a durable recovery.

Outbound shipments from the world’s second-largest economy grew 7.6pc in value in the year to in May, customs data showed.

It comes despite increased tariffs on Chinese goods, with the White House notably introducing raising the tax on Chinese-made electric cars from 27.5pc to 102.5pc, an almost four-fold increase.

But imports increased at a slower pace of 1.8pc after a 8.4pc jump in the previous month, highlighting the fragility of domestic consumption amid a protracted property crisis.

Frederic Neumann, chief Asia economist at HSBC, said:

Headline export numbers are surprisingly good, and that confirms the underlying trend, volumes are running very high.

China is currently so competitive, that even trade restrictions wouldn’t really slow the export juggernaut that’s underway.

Zichun Huang, China economist at Capital Economics, added: “We expect exports to stay strong in the coming months, supported by a weaker real effective exchange rate. Foreign tariffs are unlikely to immediately threaten exports.”

10:06 AM BST

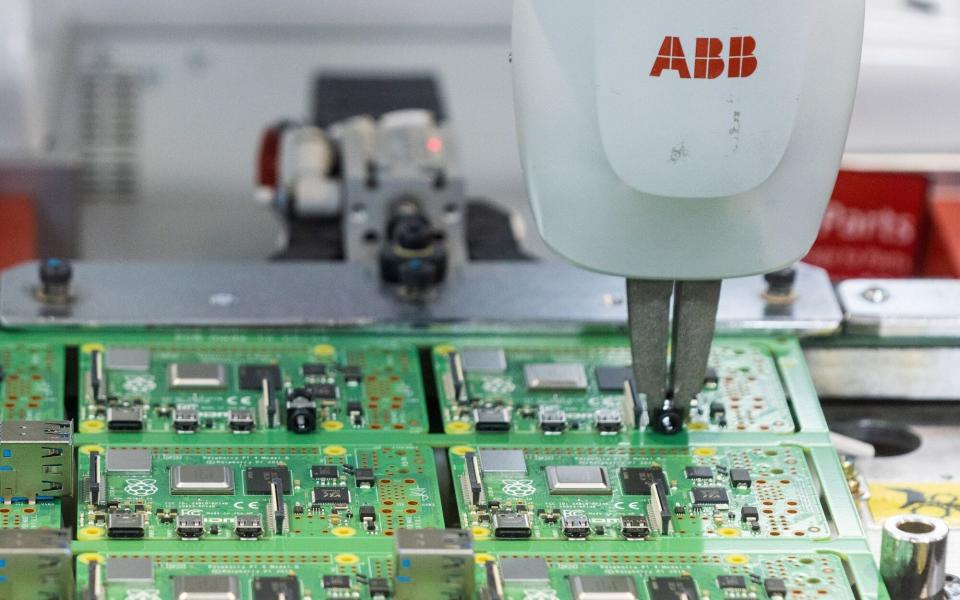

Raspberry Pi expects to hit valuation of £540m in listing

The British microcomputing company Raspberry Pi reportedly expects its shares to float in London at the top end of its expected price range.

The Cambridge company, which is majority owned by the Raspberry Pi Foundation charity, said it expects a price of £2.80 per share in its initial public offering (IPO), which will raise about £179m, according to Bloomberg.

The company, which makes low-cost computers popular with amateur coders and teachers, will start trading on June 14.

The IPO is expected to give the company a market capitalisation of £540m.

09:50 AM BST

Long ferry delays amid French strikes

Ferry passengers attempting to sail from Calais to Dover are suffering major disruption due to strike action in the French port.

Operators P&O Ferries, Irish Ferries and DFDS have cancelled, delayed or rerouted sailings because of the national dispute over pension reforms.

P&O Ferries issued an alert to customers shortly before 8am which stated: “Our check-in is currently suspended.

“Rest assured if you miss your booked departure, we will get you on the next available.”

It advised passengers travelling to Calais to use toilet facilities before they reach the port, bring refreshments and “plan for a wait on arrival”.

Irish Ferries cancelled at least four sailings on Friday, while DFDS rerouted all its Calais-Dover crossings to Dunkirk, which is around 30 miles to the east of Calais.

⚠️ #POCALAIS ANNOUNCEMENT:

Please be advised that due to ongoing industrial action, our check in is currently suspended. Rest assured if you miss your booked departure, we will get you on the next available. Thank you for your patience.— P&O Ferries Updates (@POferriesupdate) June 7, 2024

09:35 AM BST

World food prices rise for third straight month

The United Nations world food price index rose for a third consecutive month in May, as higher cereals and dairy product prices outweighed decreases in prices for sugar and vegetable oils.

The UN Food and Agriculture Organisation’s (FAO) price index, which tracks the most globally traded food commodities, averaged 120.4 points in May, up 0.9pc from its revised April level.

09:24 AM BST

Gas prices fall as pipeline to UK fixed

Natural gas prices have fallen after a fault with a pipeline between Norway and Britain was fixed.

Dutch front-month futures, Europe’s benchmark contract, slumped as much as 2.9pc after a spike this week following the outage.

Flows to the Easington terminal in East Yorkshire have resumed after disruption with a platform linked to the Nyhamma gas processing plant.

Norwegian gas accounted for 32pc of Europe’s total supply in the first five months of the year, up from 29pc in 2023.

09:10 AM BST

River and seaside pollution rises under Welsh Water

Wales’ largest water company saw a rise in sewage pollution, flooded sewers and leakage last year, despite spending hundreds of millions of pounds on improving its infrastructure.

Welsh Water, which serves three million people in Wales, Herefordshire and parts of Deeside, recorded 107 pollution incidents in the last financial year, up on 89 the year before, a 20pc rise.

Like many water firms, Welsh Water has been mired in controversy in recent months, amid an industry-wide scandal over dire performance on leaks, raw sewage spills and poor customer service.

The company was already downgraded for the second year running in 2023 as a result of the 89 sewage pollution incidents, five of which were classed as “having a high or significant impact”.

Natural Resources Wales reduced the company’s rating of three stars to two stars in June 2023, meaning it “requires improvement”.

Welsh Water did not say how many of the 107 pollution incidents recorded this year were serious.

Alastair Lyons, chairman of Welsh Water, said: “Our plans have to find the right balance of being financeable, deliverable and affordable for our customers without storing up problems for future generations.

“Whilst there’s still much more to do, we are making good progress against the commitments we’ve made.”

Another lovely section or river flowing into the #afoneden 😳😱 #sac #sssi @DwrCymru @NatResWales pic.twitter.com/v6Pqp7fnaa

— North Wales Rivers Trust (@NorthWalesRT) June 5, 2024

08:49 AM BST

UK markets fall ahead of US employment data

The FTSE 100 edged lower as investors awaited a the US jobs report due later today.

The blue-chip index was down 0.2pc, putting it on track for a fourth consecutive weekly loss.

The mid-cap FTSE 250 was down 0.2pc, and was poised to log a second consecutive weekly loss.

The US nonfarm payrolls data out this afternoon is closely watched for the narrative on labour market conditions. Any surprise increase could deliver a nasty shock to markets.

Following rate cuts by the European Central Bank and the Bank of Canada earlier this week, traders expecting that the US Federal Reserve might initiate cuts as soon as September, making the payrolls data a make or break.

In UK markets, industrial metal miners lost as much as 0.7pc after copper prices slid on mixed Chinese trade data.

Among individual stocks, Redcentric fell 3.9pc after Wiit said it had no plans to make a takeover offer for the IT services group.

C&C Group was the top loser on the mid-cap index with a 9.6pc drop after the Irish drinks producer announced it had taken a €17m (£14.5m) hit from a botched software upgrade.

08:28 AM BST

Bundesbank cuts growth forecast for German economy

The Bundesbank has lowered its growth forecast for the German economy this year as its manufacturing sector battles against a slump in orders and production.

The central bank of Europe’s largest economy predicted gross domestic product would increase by 0.3pc this year, down slightly from its December forecast of 0.4pc.

It also revised down its growth forecast for 2025 from 1.2pc to 1.1pc, although it raised its 2026 forecast from 1.3pc to 1.4pc.

Bundesbank President Joachim Nagel said: “The German economy is extricating itself from the period of economic weakness.

“Households are benefiting from strong wage growth, a gradual decline in inflation and a stable labour market.”

The fall in growth predictions comes despite the European Central Bank cutting interest rates for the first time in five years on Thursday from a record high of 4pc to 3.75pc.

However, the ECB raised its forecasts for inflation across the eurozone for this year and in 2025.

Mr Nagel, a member of the Governing Council which sets interest rates, added: “While the inflation rate in Germany is continuing to decline, the pace is subdued. We on the ECB Governing Council are not driving on auto-pilot when it comes to interest rate cuts.”

It comes as official figures today showed German manufacturers unexpectedly produced less goods for a second consecutive month.

Industrial production in the most dominant sector of its economy decreased by 0.1pc in April after a drop of 0.4pc the previous month, according to the Federal Statistics Office. Analysts had predicted an increase.

08:05 AM BST

UK markets flat ahead of US jobs figures

Stock markets in London were subdued ahead of key US employment figures which could indicate how soon the Federal Reserve will cut interest rates.

The FTSE 100 was little changed at 8,283.17 while the midcap FTSE 250 fell 0.2pc to 20,673.69.

08:00 AM BST

Boss of Magners maker steps down after accounting errors

Beer and cider maker C&C has announced its boss will be stepping down after just one year at the helm, after overseeing accounting errors which cost it millions of pounds.

Patrick McMahon will leave the role immediately, having stepped up from his position as finance chief to become the group’s chief executive in May last year.

The decision came after C&C said it had found failures in the company’s accounting and that opportunities had been missed to spot and address issues.

It flagged discrepancies in the inventory and balance sheet, which earlier this year were investigated by an independent accounting firm.

The brewer, which makes Bulmers, Magners and Tennent’s, last year revealed it took a hit after implementing a new software system at Matthew Clark and Bibendum, a British subsidiary.

This led to the departure of its previous chief executive, David Forde, who had overseen the implementation of the botched system.

On Friday, it said the accounting issues had cost it 17 million euros (£14.5 million) worth of adjustments to profits in previous years, and that there “will clearly be an impact” to its finances over the latest year.

07:50 AM BST

German industry slumps again in blow to recovery

German manufacturers produced less goods for a second consecutive month in a further blow to the recovery of Europe’s largest economy from a downturn at the end of last year.

Industrial production in the most dominant sector of its economy decreased by 0.1pc in April after a drop of 0.4pc the previous month, according to the Federal Statistics Office. Analysts had predicted an increase.

Production was down 3.9pc compared to the same month last year.

It comes after data on Thursday showed manufacturers said incoming orders fell 0.2pc compared to the previous month, which was below analyst estimates of a 0.6pc jump.

Separate figures today showed sales in its services sector grew by 0.9pc in April, while exports rose by 1.6pc and imports by 2pc compared to the previous month.

German industrial production fell by 0.1% month-over-month in April 2024, easing from a 0.4% drop in March, but missing market estimates of a 0.3% rise. https://t.co/Wet9gVbX3y pic.twitter.com/ro0XWHeqeK

— TRADING ECONOMICS (@tEconomics) June 7, 2024

07:35 AM BST

Bellway boosts sales amid falling mortgage rates and inflation

Elsewhere in the property market, housebuilder Bellway said falling inflation and improving consumer confidence have helped push up its sales.

The developer said it is on track to build about 7,500 homes this year as it increased its anticipated overall average selling price.

Bellway said in an update to shareholders that it expects to sell homes for typically around £305,000, up from previous guidance of £295,000.

It said its private reservation rate per outlet per week had reached 0.62, up from 0.58 in 2023, as it built more homes, averaging 245 between February and June, compared to 239 in the same period last year.

It said trading through the spring selling season had been “robust” after an easing of mortgage rates and inflation improved affordability, along with an increase in wages.

As a result, its forward order book has increased 4,411 homes to 5,346 at the start of June, worth £1.5bn, although this was down from 6,172 homes and £1.7bn at the same time last year.

Chief executive Jason Honeyman said:

We have been encouraged by ongoing healthy levels of customer interest and combined with the strength of our outlet opening programme, we continue to expect a year-on-year increase in the forward order book at 31 July 2024.

As a result, Bellway remains in a strong position to return to growth in financial year 2025.

07:19 AM BST

Interest rate cuts will tempt buyers back to the market, say estate agents

Estate agents appear to be shrugging off the slight dip in house prices last month.

Foxtons chief executive Guy Gittins said:

Today’s house price figures provide further proof that the UK property market is in great form and, while this may have started with an initial spring surge in buyer interest, we now look set for a summer of sustained market activity.

In recent weeks we’ve seen buyer enquiries peak to some of their highest levels in recent years and sellers are responding favourably with the same peak being seen in the number of offers accepted. This is despite the fact that interest rates are yet to come down.

We’ve also seen no inkling of election related jitters on either the side of buyers or sellers.

Yopa boss Verona Frankish added that the expectation of an interest rate cut is “tempting many buyers back to the market over the following months and when it does materialise, we expect the current rate of house price growth to accelerate”.

07:12 AM BST

No surprise that house prices have fallen amid election, says estate agent boss

Sam Mitchell, chief executive of Purplebricks, said:

It is no surprise that with rates edging up and a date set for the General Election, there is some uncertainty about the housing market.

However, as there are no housing “giveaways” or unrealistic policies that can distort people’s expectations, the market seems to be continuing as if it is business as usual.

For the housing market, rates edging up actually seems to have created some buyer urgency to get themselves in gear to act sooner rather than later.

There are also some relatively new mortgage providers keeping their rates the same and offering more flexible products which is particularly beneficial for first time buyers.

We are seeing the property market continue on its road to recovery, with good stock coming to market and a sharp increase in viewings.

What we need in the coming months is for the new government to focus on policy that will help people across the country get on the property ladder, through lower mortgage and interest rates, lower transaction costs, and lower rents.

07:10 AM BST

North West has fastest growing house prices in UK

House prices stalled over last month but there were pockets of high annual growth across the UK.

The North West is the strongest performing region in the UK, where house prices grew 3.8pc on an annual basis in May.

The average price of a property in the North West is now £232,258.

Northern Ireland continues to show strong annual growth, up 3.2pc in May, pulling back slightly from 3.3pc in April.

House prices in Scotland also increased, with a typical property now costing £204,952, up 1.9pc. In Wales, house prices grew at a more modest 0.7pc to £219,483.

Eastern England recorded the largest decline in annual growth across the UK. House prices there now average £329,853, down 0.8pc compared to May last year.

Unsurprisingly, London continues to have the most expensive average price tag, now at £536,821, up marginally by 0.2pc compared to last year.

07:09 AM BST

House prices stall as high interest rates bite

House prices fell last month as high borrowing costs caused growth in the property market to stall.

Average prices fell by 0.1pc between April and May, the Halifax house price index showed, as interest rates remained at 16-year highs of 5.25pc.

Values had briefly rebounded in April following four months of declines.

It meant the average home was worth £288,688, which was still 1.5pc higher than the same month last year, and the sixth consecutive month of annual growth.

It comes as a rival index from Nationwide showed house prices climbed in May for the first time in three months, rising by 0.4pc after a decline of 0.4pc the previous month.

Amanda Bryden, head of mortgages at Halifax, said:

Market activity remained resilient throughout the spring months, supported by strong nominal wage growth and some evidence of an improvement in confidence about the economic outlook.

This has been reflected in a broadly stable picture in terms of property price movements, with the average cost of a property little changed over the last three months.

A period of relative stability in both house prices and interest rates should give a degree of confidence to both buyers and sellers.

07:04 AM BST

Good morning

Thanks for joining me. We begin with data showing house prices stalled between April and May.

Average property values fell by 0.1pc over the month to £288,688, the Halifax house price index showed.

5 things to start your day

1) British tech tycoon Mike Lynch cleared in $11bn US fraud trial | A San Francisco jury have aquitted the man dubbed Britain’s Bill Gates in the end of a 13-year legal saga

2) Britain more reliant than ever on imported power to keep the lights on | France to plug gaps during bad weather as UK faces first winter without coal-fired backup

3) Greek industrialist plots launch of new British energy company | Evangelos Mytilineos’s Metlen plans to rival Octopus after listing on London stock market

4) No end in sight for Britain’s worklessness crisis, warns CBI | Trade body says failure to address rise in long-term sickness will prolong recovery

5) Britain’s pothole crisis to deepen as councils battle £6bn funding gap | Rising costs and growing demand for services drives budget shortfall for local authorities

What happened overnight

Stocks and bonds lost steam on the eve of a key US jobs reading that will help shape the outlook for the Federal Reserve’s next steps.

Equities stalled near all-time highs as traders refrained from big bets ahead of the data.

Hong Kong’s Hang Seng index declined 0.6pc to 18,367.73, and the Shanghai Composite index was down 0.4pc to 3,036.08.

It came as China trade data showed that exports in May rose faster than expected at 7.6pc compared to the previous year, while imports were weaker than market forecasts.

Japan’s benchmark Nikkei 225 edged 0.1pc lower to 38,661.04 after Friday data showed the household spending figures in April were up 0.5pc year-on-year.

This is the first increase since February 2023, a key indicator to assess the country’s economy as central bank officials prepare to hold the policy meeting next week.

Australia’s S&P/ASX 200 climbed 0.4pc to 7,853.40. South Korea’s Kospi added 0.8pc to 2,709.63.

The S&P 500 was little changed on Thursday after notching its 25th record in 2024.

US 10-year yields fluctuated near 4.29pc. Swap markets continued to pencil in the start of the Fed rating cut in November, with a strong likelihood of another reduction in December.

The euro rose as the European Central Bank raised inflation forecasts after cutting rates.

Options traders are raising bets that bitcoin will reach a record high by the end of the month with optimism for US interest rate cuts and inflows into exchange-traded funds rising.

Yahoo Finance

Yahoo Finance