US adds 156,000 jobs, unemployment rate climbs to 4.7%

The US labor market continues to hum.

US companies added 156,000 nonfarm payrolls in December, which was a bit lighter than the 175,000 expected. On the plus side, November’s payrolls number was revised up by 19,000 to 204,000.

December marked the 75th straight month of job growth in the US.

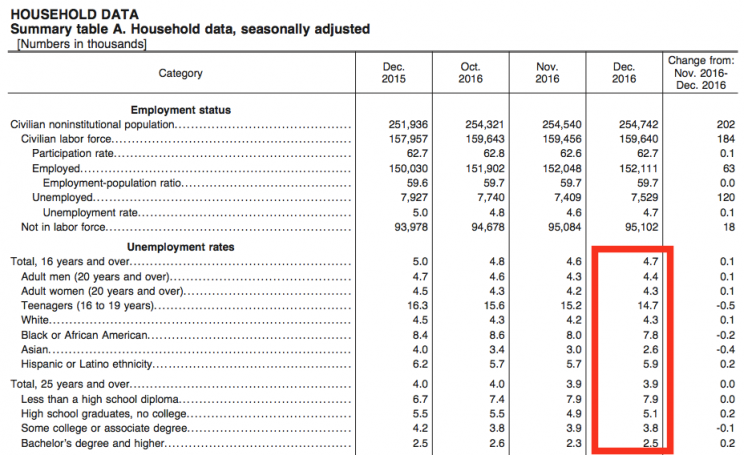

As expected, the unemployment rate ticked up to 4.7% from 4.6% in November. This came as the labor force participation rate climbed to 62.7% from 62.6% a month ago.

Importantly, wages are heating up. Average hourly earnings grew 0.4% month-over-month, which was better than the 0.3% expected. It was also a significant improvement from the 0.1% decline in November.

On a year-over-year basis, average hourly earnings climbed by 2.9%, which is the fastest pace of growth since June 2009.

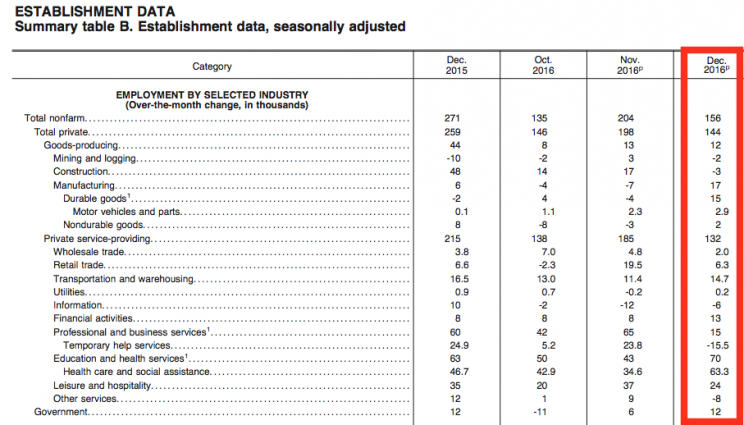

Below is a look at jobs added by industry.

Manufacturing jobs, which have been closely watched lately, increased by 17,000 during the month. This included the addition of 2,900 payrolls in the motor vehicles and parts industry.

Below is a look at unemployment rates by demographic.

Surveys reflected a healthy labor market.

Since the election, business and consumer surveys have been upbeat about the election of Republican Donald Trump.

Importantly, employment sub-indexes for the ISM manufacturing, Philly Fed, and Kansas City Fed survey jumped in December.

On the services side, employment indexes from the Philly Fed and New York Fed signal job growth. However, the employment sub-index of the national ISM non-manufacturing index signal a deceleration in growth.

The election of Trump is a bit of a wild card for the next several months as he has promised major policy changes that could affect behavior.

“Many corporate executives may hold off key business decisions awaiting clarity on taxes,” UBS’s Art Cashin said this week. “That could hurt the economy. So it’s time to tee things up.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Yahoo Finance

Yahoo Finance