US Growth Companies With At Least 10% Insider Ownership

Amidst a backdrop where Asian stocks are rallying and commodities like copper and gold are reaching record highs, the U.S. market is showing signs of optimism, particularly with the Dow Jones Industrial Average surpassing the 40,000 mark for the first time. In such a buoyant environment, growth companies with high insider ownership in the United States may offer an intriguing opportunity for investors seeking firms with strong internal confidence and potential resilience.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 26% | 21% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.4% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Li Auto (NasdaqGS:LI) | 29.3% | 21.4% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.8% | 98% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 75.4% |

We'll examine a selection from our screener results.

Alkami Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States, with a market capitalization of approximately $2.70 billion.

Operations: The company generates its revenue primarily from internet software and services, totaling approximately $280.96 million.

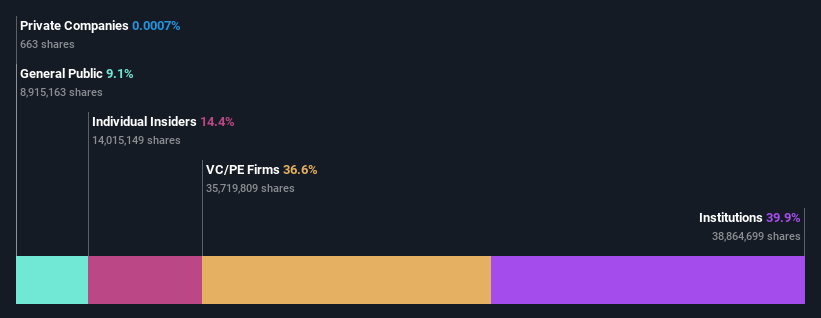

Insider Ownership: 14.4%

Alkami Technology, Inc. is navigating a challenging but promising growth trajectory. Despite experiencing shareholder dilution over the past year and posting a net loss of US$11.43 million in Q1 2024, improvements from the previous year's US$16.96 million loss indicate progress. The company forecasts robust annual revenue growth at 21.1%, outpacing the US market average significantly, with expectations to reach profitability within three years. Recent strategic innovations like the SDK Wizard, Merlin, demonstrate Alkami's commitment to maintaining its competitive edge in financial technology services.

Coupang

Simply Wall St Growth Rating: ★★★★☆☆

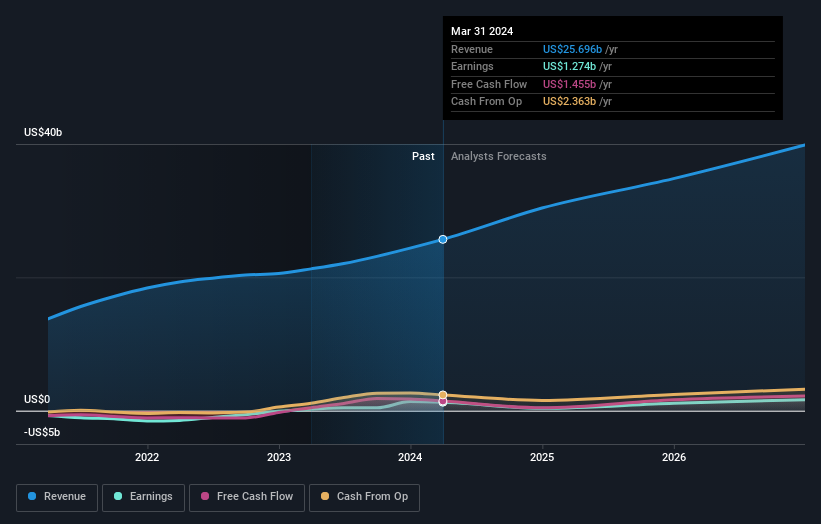

Overview: Coupang, Inc. operates a comprehensive retail business in South Korea primarily through its mobile apps and websites, with a market capitalization of approximately $41.12 billion.

Operations: The company generates its revenue primarily from Product Commerce, which totaled $24.43 billion, and Developing Offerings, amounting to $1.27 billion.

Insider Ownership: 10%

Coupang, Inc. has shown a mixed performance with significant earnings growth of 511.6% over the past year, yet its revenue growth forecast of 13.3% per year falls below high-growth benchmarks. Insider activity has been relatively stable with more shares bought than sold recently, indicating some confidence from insiders despite the company trading at 34.9% below its estimated fair value. Recent strategic moves include a share repurchase program and addition to the NASDAQ Internet Index, reflecting potential stabilization and strategic positioning efforts.

Click here and access our complete growth analysis report to understand the dynamics of Coupang.

Upon reviewing our latest valuation report, Coupang's share price might be too optimistic.

UiPath

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UiPath Inc. operates globally, offering a comprehensive automation platform with robotic process automation solutions, primarily serving markets in the United States, Romania, the United Kingdom, and the Netherlands, with a market capitalization of approximately $11.69 billion.

Operations: The company generates revenue primarily through its software tools segment, amounting to $1.31 billion.

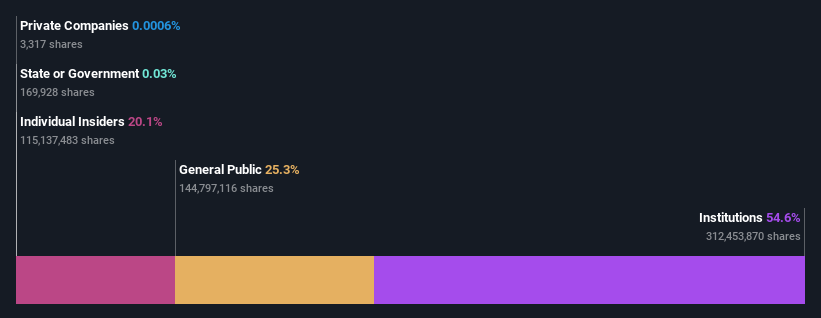

Insider Ownership: 20.1%

UiPath has recently strengthened its leadership with key hires from major tech companies, aiming to enhance its product offerings in automation and AI integration. Despite a substantial increase in revenue to US$1.31 billion and turning a net profit this year, the company's revenue growth forecast of 15.6% per year is modest compared to some high-growth peers. Insider ownership remains significant, reflecting confidence in the strategic direction despite past shareholder dilution. The firm's focus on integrating cutting-edge AI into its platforms positions it well for future innovation-driven growth.

Click here to discover the nuances of UiPath with our detailed analytical future growth report.

Our valuation report here indicates UiPath may be undervalued.

Turning Ideas Into Actions

Get an in-depth perspective on all 180 Fast Growing US Companies With High Insider Ownership by using our screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:ALKT NYSE:CPNG and NYSE:PATH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance