US Dollar Falls Back Following Weak Data Throughout Morning

Fundamental Headlines

- Americans’ Views on Economy are Most Pessimistic Since November – Bloomberg

- Merkel Resurfaces in Canada – Bloomberg

- Jobless Claims Trend Shows Job Market Slowly Healing – Reuters

- Bank Deal Rankles Regulators – WSJ

- Dow Inches Down as Factories Slow – WSJ

Asian/European Session Summary

The US Dollar was among the top performers this morning, trailing the frontrunner the British Pound by a mere -0.11%, just over two-hours ahead of the crucial US data dump beginning at 08:30 EDT / 12:30 GMT. A number of factors led to this, including but not limited to: increased flows into the US Dollar and out of the Japanese Yen; rising European sovereign debt yields in Italy and Spain on the shorter-end of the yield curve; and expectations for strong data this morning.

However, the US Dollar hit a wall ahead of the US cash equity open as the data disappointed overall and peripheral European bond yields started to fall (higher prices). Mainly, we point for four data points that were released this morning:

Initial Jobless Claims (AUG 11) increased to 366K from 364K, survey 365K

Building Permits (JUL) increased to 812K from 760K (+6.8%), survey 769K

Housing Starts (JUL) decreased to 746K from 754K (-1.1%), survey 756K

Philadelphia Fed Index (AUG) increased to -7.1 from -12.9, survey -5.0

Initially, it appeared that this data wasn’t that disappointing: Initial Jobless Claims barely missed; Building Permits moved to their highest level in four-years; Housing Starts were down marginally; and the Philadelphia Fed Index, despite falling short of expectations, improved. Nonetheless, a lack of an improvement in the labor market and a second consecutive report showing that manufacturing contracted in the Northeastern region of the US was enough to dampen optimism.

But the data were enough to provoke a US Dollar sell-off: in conjunction with the US Dollar being overbought on shorter-term time frames, especially against the Euro and the Japanese Yen, and with the majors sitting at significant levels (the EURUSD was at trendline support off of the July 24 and the August 2 lows; and the USDJPY hitting former swing levels to the upside), the disappointing data provided the necessary fundamental catalyst to send the US Dollar lower on the day.

The Euro was also aided (and thus the US Dollar was damaged) by a rebound in peripheral European bond yields midway through the European session. The Italian 2-year note yield has fallen to 3.158% (-11.1-bps) while the Spanish 2-year note yield has eased to 3.794% (-19.0-bps).

EURUSD 5-minute: August 16, 2012

Charts Created using Marketscope – Prepared by Christopher Vecchio

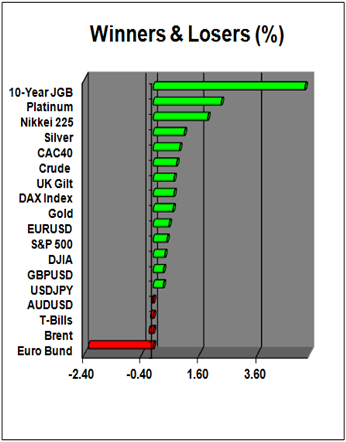

The Swiss Franc is the top performer today, following the Euro higher against the US Dollar; the two are up by +0.56% and by +0.55%, respectively. The British Pound is also performing marginally better, gaining +0.35% against the US Dollar. The Australian Dollar is mostly unchanged, with the AUDUSD falling by -0.04%, while the USDJPY has moved higher on the day, gaining +0.34%.

24-Hour PriceAction

Key Levels: 15:55 GMT

Thus far, on Thursday, the Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) is trading lower, at 10035.19 at the time this report was written, after opening at 10048.18. The index has traded mostly higher with the high at 10077.29 and the low at 10030.37.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, send an e-mail with subject line "Distribution List" to cvecchio@dailyfx.com

Yahoo Finance

Yahoo Finance