Upstart Holdings (NASDAQ:UPST): Forecasts Need to Rise Significantly to Justify Lofty Valuation

This article originally appeared on Simply Wall St News.

Upstart Holdings, Inc . ( NASDAQ:UPST ) shares have now risen 135% since the company released second quarter results less than six weeks ago. The company received yet another boost today when WSFS Bank announced that it is launching a digital personal loans product powered by Upstart’s software.

Upstart and Affirm Holdings ( NASDAQ:AFRM ), appear to now be the preferred stocks in the fintech space, as larger fintech companies PayPal ( NASDAQ: PYPL ) and Square ( NYSE: SQ ) have traded lower over the same period. The question now is whether Upstart has run too far too quickly.

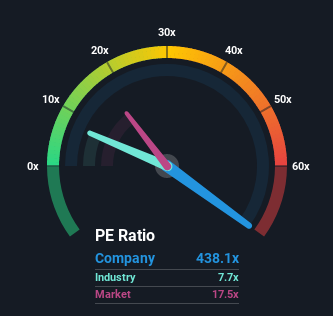

The stock is now trading on a price-to-earnings (or "P/E") ratio of 438.1x, compared to the US market average of 17x. If we include today’s price move, Upstart has traded as high as 482 times trailing 12-month earnings. A large gap between the stock’s P/E and the market P/E isn’t surprising when you consider that the company’s earnings have grown at 7 times the rate of the market over the last five years, and accelerated in the last 12 months.

See our latest analysis for Upstart Holdings

But for a stock to justify such a high P/E ratio, it will have to continue to grow earnings at a much faster rate than the average listed company. The following chart indicates analyst forecasts for Upstart’s earnings over the next three years.

If we assume that the company will deliver in line with the best estimate at the end of 2023, the current price of $325, would represent a P/E ratio of 189. That would still be quite high if earnings were only growing at around 30% - as implied by that estimate. Clearly, estimates will need to rise substantially to justify the current price multiple.

Is There Enough Growth for Upstart Holdings?

It’s worth noting that not many analysts cover Upstart, and the 2023 estimate above is the average of forecasts from just two analysts. In addition, estimating future revenue and profits for a company like Upstart is very difficult. The company is now in an exponential growth phase, and there’s a very wide range of possible outcomes.

P/E ratios aren’t very robust valuation tools on their own, particularly for growing companies. But they do give us an idea of the market’s optimism about a company. When the market is optimistic about a stock, the positive sentiment needs to be maintained by earnings releases, analyst upgrades and other company news.

The Key Takeaway

Upstart’s current valuation is indeed lofty, but if the growth rate we have witnessed over the last 12 months continues, the P/E ratio will decline very quickly. But a high multiple is a significant risk for a stock price if the positive sentiment isn’t maintained.

In Upstart’s case it’s important that the company continues to raise guidance, and that analyst forecasts continue to rise. You can track these forecasts and any risks that may arise with our free analysis for Upwork Holdings.

You might also be able to find a better investment than Upstart Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance