United Technologies (UTX) Q3 Earnings & Revenues Top, Up Y/Y

United Technologies Corporation UTX reported better-than-expected third-quarter 2019 results. Quarterly adjusted earnings came in at $2.21 per share, surpassing the Zacks Consensus Estimate of $2.03. The bottom line was also higher than the year-ago figure of $1.93.

Revenues came in at $19,496 million, up 18.1% year over year. The top line also outpaced the consensus estimate of $19,313 million. The rise was driven by 5% contribution from organic sales growth and 14% positive impact of acquisitions, partially offset by 1% negative impact of currency translation.

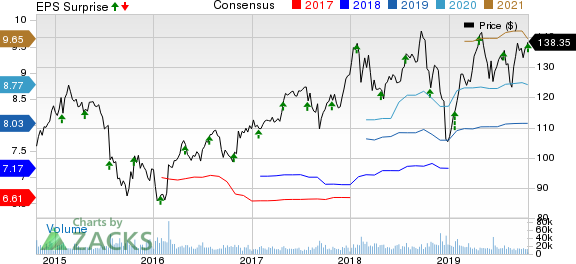

United Technologies Corporation Price, Consensus and EPS Surprise

United Technologies Corporation price-consensus-eps-surprise-chart | United Technologies Corporation Quote

Segmental Breakup

Otis’ revenues for the reported quarter were $3,307 million, up 2.6% year over year. Aggregate sales for Carrier totaled $4,822 million, down 1.2%. Pratt & Whitney’s third-quarter revenues were $5,283 million, up 10.3% while the same for Collins Aerospace Systems surged 64.2% to $6,495 million.

Costs and Margins

Cost of products and services sold during the third quarter was $14,211 million, up 13.4% year over year.

Selling, general and administrative expenses jumped 25.2% to $2,104 million.

Adjusted operating profit margin was 15.3%, up 120 basis points.

Balance Sheet/Cash Flow

Exiting the third quarter, United Technologies had cash and cash equivalents of $7,341 million, up from $6,152 million on Dec 31, 2018. Long-term debt was $37,782 million, down from $41,192 million recorded at the end of 2018.

During the July-September quarter, the company generated $2,490 million cash from operating activities compared with $1,762 million reported a year ago. Its capital expenditures were up 28.1% to $529 million.

Outlook

United Technologies is poised to grow on the back of strength in its aerospace business, cost reduction and operational excellence initiatives. The Rockwell Collins acquisition (closed in November 2018) is not only expected to fortify the company's existing product portfolio but also aid in launching innovative solutions for aerospace customers.

The company has revised 2019 earnings guidance to $8.05-$8.15 per share from $7.90-$8.05 projected earlier. For 2019, it currently expects its revenues to be in the range of $76-$76.5 billion compared with the $75.5-$77 billion range guided earlier. It continues to expect 4-5% organic sales growth for 2019.

Zacks Rank & Stocks to Consider

United Technologies currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same space are HC2 Holdings, Inc. HCHC, Macquarie Infrastructure Company MIC and KushCo Holdings Inc. KSHB. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

HC2 Holdings delivered average positive earnings surprise of 48.55% in the trailing four quarters.

Macquarie’s earnings surprise in the last reported quarter was 26.04%.

KushCo’s earnings surprise in the last reported quarter was 14.29%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Technologies Corporation (UTX) : Free Stock Analysis Report

Macquarie Infrastructure Company (MIC) : Free Stock Analysis Report

HC2 Holdings, Inc. (HCHC) : Free Stock Analysis Report

KUSHCO HOLDINGS, INC. (KSHB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance