What Type Of Returns Would Rattler Midstream's(NASDAQ:RTLR) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Rattler Midstream LP (NASDAQ:RTLR) share price slid 54% over twelve months. That's well below the market return of 25%. Rattler Midstream hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Rattler Midstream

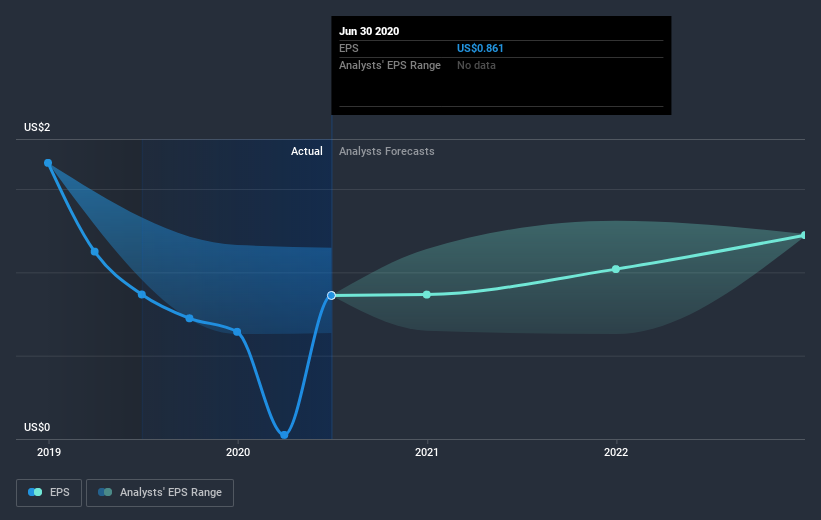

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Rattler Midstream had to report a 0.5% decline in EPS over the last year. The share price decline of 54% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The P/E ratio of 9.72 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Rattler Midstream, it has a TSR of -49% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While Rattler Midstream shareholders are down 49% for the year (even including dividends), the market itself is up 25%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 14%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Rattler Midstream better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Rattler Midstream (of which 1 can't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance