What Type Of Returns Would City of London Group's(LON:CIN) Shareholders Have Earned If They Purchased Their Shares Three Years Ago?

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term City of London Group plc (LON:CIN) shareholders have had that experience, with the share price dropping 48% in three years, versus a market decline of about 12%. And the ride hasn't got any smoother in recent times over the last year, with the price 30% lower in that time.

View our latest analysis for City of London Group

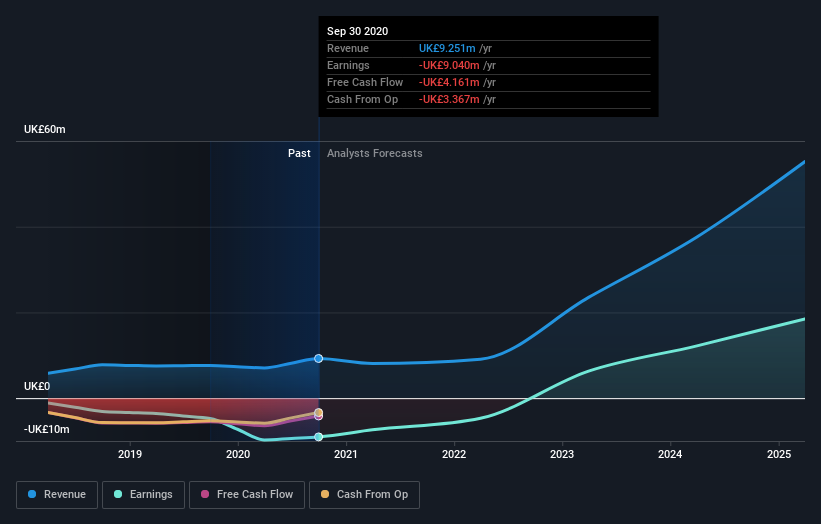

City of London Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling City of London Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

The last twelve months weren't great for City of London Group shares, which cost holders 30%, while the market was up about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 14% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand City of London Group better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with City of London Group (including 1 which is a bit concerning) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance