How you could have tripled your cash after the GFC

The Covid-19 crisis has rattled global economies and stock markets – but interest in investing has also spiked during this period as people search for methods to make their money go further.

Australians may be familiar with the Australian benchmark index, the ASX/S&P 200, and even the three main American indices.

But you might be less familiar with other international indices, such as Germany, Japan or Canada’s main bourses.

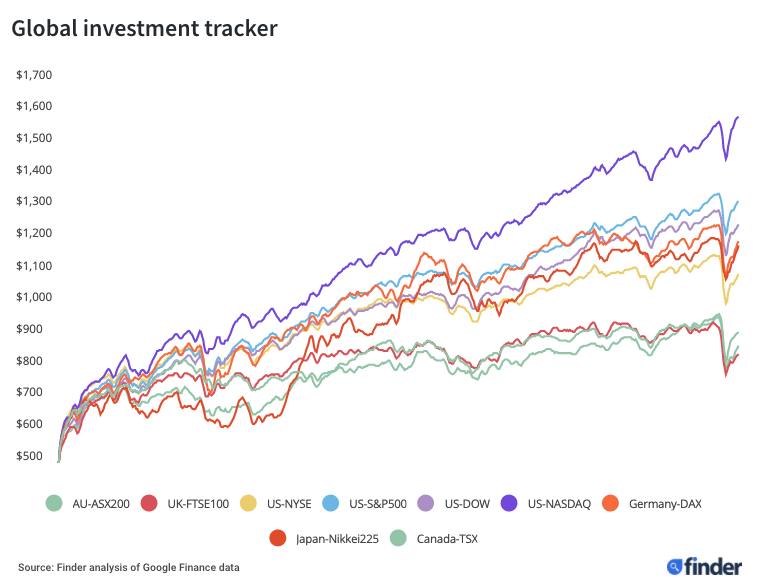

If you’re putting money in the stock market, it’s worth knowing about other major global stock markets – because it could be the difference between seeing returns of 72 per cent or 317 per cent.

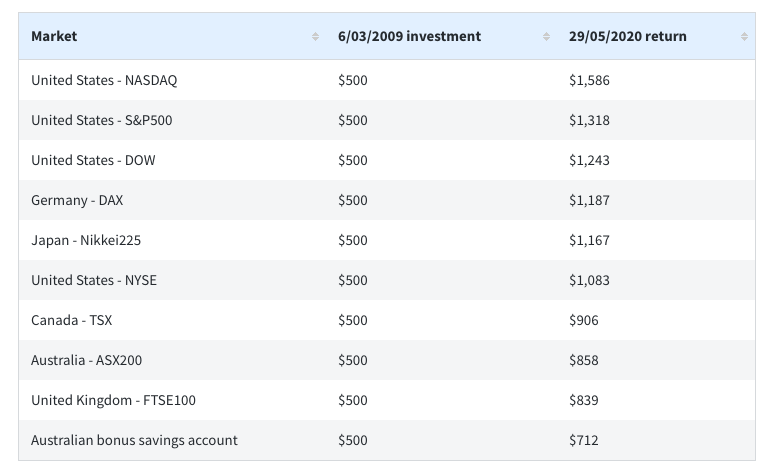

If you had invested $500 at the tail-end of the global financial crisis, you would have gotten the most bang for your buck by investing in the United States’ three major indices.

According to analysis from Finder, $500 would become $1,586 if invested in NASDAQ 11 years ago, $1,318 if invested in the S&P500, or $1,243 if invested in the Dow Jones.

That’s compared to a much less impressive $858 if you had invested in the ASX200.

Also read: Stocks are being smashed: Is now a good time to buy shares?

Also read: What wise investors do in a volatile stock market

Also read: Warren Buffett's advice on investing during uncertain times

In fact, at least four other global stock markets performed better than the ASX following the GFC: investing in Germany’s DAX, Japan’s Nikkei225 and Canada’s TSX would have given you greater returns on your investment.

Which stock market should I invest in after Covid-19?

Of the nine indices, the NASDAQ has fared the best following the GFC, said Cooke.

“A lot of that growth has come from the explosion of big tech companies such as Facebook, Google and Apple.

“With these companies starting to eat up bigger and bigger chunks of previously non-tech markets such as advertising, there is plenty of potential for them to continue to outpace other industries,” he said.

And it still has some ways to go. “The NASDAQ ... still has plenty of potential to provide the best long-term return in my view.”

But investors should keep in mind that past performance is no guarantee of the future.

What you shouldn’t do with your money

Whichever way you look at it, however, there is one thing that is certain: investing in stock markets will be better for your money than leaving it sitting in your bank account.

“A savings account would have returned around $712 over the same period,” said Cooke.

“The moral of the story here is that the stock market, even in turbulent times, tends to provide a better return than savings accounts over a longer period of time.”

But different markets will produce “drastically” different returns, with UK’s FTSE100 and the ASX200 barely outperforming a savings account, Cooke added.

“When deciding where to keep your hard-earned cash in future, it may be worth broadening your horizons and looking outside Australia.”

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance