Tri Pointe Homes Inc (TPH) Q1 Earnings: Surpasses Analyst Revenue Forecasts with Robust Growth

Earnings Per Share (EPS): Reported at $1.03, significantly surpassing the estimated $0.76.

Net Income: Achieved $99 million, exceeding estimates of $73.45 million.

Revenue: Totaled $918 million, surpassing the forecast of $875.19 million.

Home Deliveries: Increased by 31% year-over-year to 1,393 homes.

Homebuilding Gross Margin: Recorded at 23.0%, a slight decrease from the previous year's 23.5%.

New Home Orders: Grew by 12% year-over-year to 1,814 orders.

Backlog: Expanded by 35% year-over-year, with the value of backlog rising 30% to $2.0 billion.

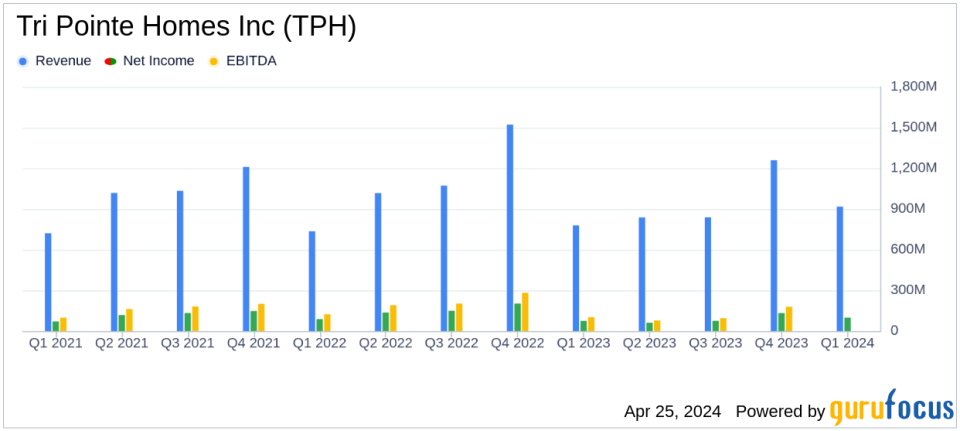

On April 25, 2024, Tri Pointe Homes Inc (NYSE:TPH) disclosed its first quarter results through an 8-K filing, revealing a significant outperformance in revenue and earnings per share (EPS) against analyst expectations. The company reported a home sales revenue of $918 million and diluted EPS of $1.03, both exceeding the estimated figures of $875.19 million and $0.76 respectively.

Company Overview

Tri Pointe Homes Inc is a leading American construction company specializing in the design and building of single-family homes and condominiums. Operating under six regional brands, including prominent names like Maracay Homes, TRI Pointe, and Pardee Homes, the company has a strong presence in key markets such as California, Arizona, and Nevada. Annually, Tri Pointe completes around 4,000 homes with an average selling price of approximately $500,000, also engaging in land sales and development.

Q1 Performance Highlights

The first quarter saw Tri Pointe Homes achieving a 20% increase in home sales revenue year-over-year, reaching $918 million. The company delivered 1,393 homes during this period, marking a 31% increase from the previous year, although the average sales price of homes delivered saw a decrease of 9% to $659,000. Despite a slight dip in homebuilding gross margin percentage to 23.0% from 23.5%, the adjusted homebuilding gross margin percentage improved slightly to 26.4%.

Net income for the quarter was notably strong at $99 million, a 33% increase from the previous year's $74.7 million, resulting in a diluted EPS of $1.03. This performance is a significant improvement and well above the analyst's EPS estimate of $0.76.

Operational and Strategic Developments

During the quarter, Tri Pointe Homes wrote 1,814 net new home orders, up 12% from the previous year, and ended the period with 2,741 homes in backlog, a 35% increase. The average sales price of homes in backlog decreased by 4% to $712,000. The company's strategic expansions include entering new markets in Orlando, Florida, and the Coastal Carolinas, aligning with its vision to enhance presence in fast-growing regions.

Financial Health and Future Outlook

Tri Pointe Homes concluded the first quarter with a robust balance sheet, showcasing total liquidity of $1.6 billion. The debt-to-capital ratio stood at 31.2%, reflecting a healthy financial structure. Looking ahead, the company has raised its full-year guidance for deliveries, average sales price, and homebuilding gross margin percentage, anticipating continued strong demand and market conditions.

Management's Perspective

CEO Doug Bauer expressed satisfaction with the quarter's results, highlighting the achievement of key metrics at the high end of their guidance. He noted, "The strong demand we have experienced to start the year has allowed us to reduce incentives and increase pricing in select communities." COO Tom Mitchell also emphasized the strategic expansions as a significant step towards sustained growth.

Investor and Analyst Reactions

The positive earnings report and strategic expansions are likely to bolster investor confidence in Tri Pointe Homes' growth trajectory and operational efficiency. The company's ability to exceed analyst forecasts and its proactive management of market opportunities position it favorably for future quarters.

For detailed financial figures and further information, refer to the full 8-K filing by Tri Pointe Homes Inc.

Explore the complete 8-K earnings release (here) from Tri Pointe Homes Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance