Toronto-Dominion (TD) Stock Down 5.1% Despite Q1 Earnings Rise

Toronto-Dominion Bank’s TD first-quarter fiscal 2021 (ended Jan 21) adjusted net income climbed 10% from the prior-year quarter to C$3.38 billion ($2.63 billion).

Results were supported by higher non-interest income and decline in provisions. However, fall in loan balance and lower net interest income (NII) were headwinds. These were perhaps the reasons why the shares of Toronto-Dominion 5.1% fell on the NYSE following the release late last week.

After considering certain non-recurring items, net income was C$3.28 billion ($2.55 billion), increasing 13% year over year.

Adjusted Revenues & Expenses Increase

Total revenues amounted to C$10.81 billion ($8.4 billion), up 2% on a year-over-year basis.

NII declined 2% year over year to C$6.03 billion ($4.68 billion). However, non-interest income came in at C$4.78 billion ($3.71 billion), up 8%.

Non-interest expenses increased 6% to C$5.74 billion ($4.46 billion).

Efficiency ratio was 53.1% compared with 50.9% on Jan 31, 2020. Rise in efficiency ratio indicates a fall in profitability.

Provision for credit losses plunged 66% year over year to C$313 million ($343.2 million).

Solid Balance Sheet, Capital & Profitability Ratios

Total assets came in at C$1.74 trillion ($1.36 trillion) as of Jan 31, 2021, up 1% from fourth-quarter fiscal 2020. Net loans fell almost 2% on a sequential basis to C$706 billion ($552.4 billion) but deposits grew slightly to C$1.14 trillion ($0.89 trillion).

As of Jan 31, 2021, common equity Tier I capital ratio was 13.6%, up from 11.7% on Jan 31, 2020. Total capital ratio was 17.4% compared with the prior year’s 15.7%.

Return on common equity (on an adjusted basis) came in at 14.7%, up from 14.6% as of Jan 31, 2020.

Our Viewpoint

Toronto-Dominion’s efforts toward improving revenues — both organically and inorganically — are supported by a diverse geographical presence. However, rising operating expenses and lower demand for loans are near-term concerns.

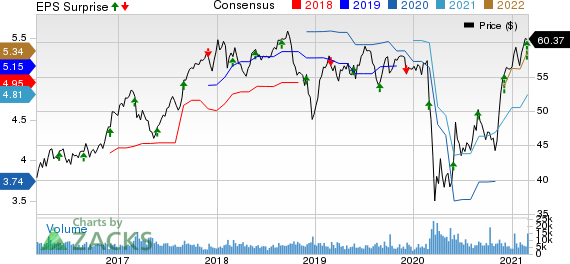

Toronto Dominion Bank The Price, Consensus and EPS Surprise

Toronto Dominion Bank The price-consensus-eps-surprise-chart | Toronto Dominion Bank The Quote

Toronto-Dominion currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Canadian Banks

The Bank of Nova Scotia BNS reported first-quarter fiscal 2021 (ended Jan 31) adjusted net income of C$2.4 billion ($1.9 billion), up 3.2% year over year. Decline in provisions and expenses were positives. However, decline in revenues was discouraging.

Bank of Montreal’s BMO first-quarter fiscal 2021 (ended Jan 31) adjusted net income came in at C$2.04 billion ($1.58 billion), up 26% year over year. The company recorded improvement in revenues, lower provisions and a decline in expenses, which supported results.

Canadian Imperial Bank of Commerce CM reported first-quarter fiscal 2021 (ended Jan 31) adjusted earnings per share came in at C$3.58, up 10% from the prior-year quarter. Results benefited from rise in revenues and lower provisions. However, a slight rise in costs was the headwind.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of Nova Scotia The (BNS) : Free Stock Analysis Report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Toronto Dominion Bank The (TD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance