Topbuild (BLD) Hits a 52-Week High: What's Driving the Stock?

TopBuild Corp. BLD touched a new 52-week high of $229.44 on Jun 7. The stock pulled back to end the trading session at $228.54, up 1.65% from the previous day’s closing price of $224.83.

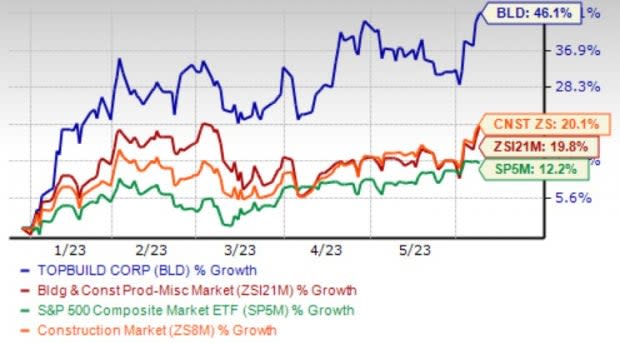

BLD has gained 46.1% in the year-to-date period compared with the Zacks Building Products – Miscellaneous industry’s growth of 19.8%, the Zacks Construction sector’s increase of 20.1% and S&P 500 Index’s growth of 12.2%.

Amid high material and labor costs as well as supply-chain constraints, this Zacks Rank #3 (Hold) company has been witnessing high sales volume and selling prices in its Installation as well as Specialty Distribution segments. The upside was backed by operational efficiencies, accretive acquisitions and successful inflation mitigation initiatives.

Image Source: Zacks Investment Research

What's Driving the Outperformance?

TopBuild has been recording solid earnings and revenue growth over the last few quarters. In first-quarter 2023, the company’s sales increased 8.2%, adjusted earnings per share grew 24.6%, the adjusted gross margin expanded 180 bps and the adjusted EBITDA margin expanded 150 bps from the prior-year period’s levels. The impressive margin expansion led to increased profitability, depicting a flexible operating model and its ability to quickly reduce costs. The impressive performance was backed by higher sales volume and higher selling prices in both segments of the company along with contributions from acquisitions. Also, operational efficiencies, fixed-cost leverage and the ongoing success in managing inflation aided the company.

Acquisitions are an important part of the company’s growth strategy to supplement organic growth and expand access to additional markets and products. On Jan 26, 2023, BLD completed this year’s first acquisition by acquiring SRI Holdings, which is a residential insulation installation company.

In 2022, BLD made five insulation company acquisitions, which are expected to generate $17.3 million in revenues annually, including CV Insulation, LLC., Assured Insulating, which serves markets in North-eastern Texas and North-western Louisiana, Green Energy (located in Orego), Billings (located in Montana), Southwest (located in Florida). The increase in net sales of BLD in first-quarter 2023 was partially driven by these acquisitions, which contributed 1.3% to sales growth. The company is focused on driving top-line growth, the successful integration of DI and improving operational efficiencies. Meanwhile, the company remains committed to its long-term outlook.

BLD maintains a strong liquidity position. Cash and cash equivalents at first-quarter 2023-end were $333.8 million, up from $240.1 million at 2022-end. The company has $432.3 million available in borrowing capacity under the revolving facility. This brings the total liquidity to $766.1 million at first-quarter 2023-end up from $672.4 million reported at 2022-end.

Key Picks

Here are some top-ranked stocks that investors may consider from the same sector.

Dycom Industries, Inc. DY carries a Zacks Rank #1 (Strong Buy). DY has a trailing four-quarter earnings surprise of 153.7%, on average. Shares of DY have gained 12.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DY’s 2023 sales and EPS indicates a rise of 7.7% and 36.1%, respectively, from the year-ago period’s levels.

Vulcan Materials Company VMC carries a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 7.1%, on average. Shares of VMC have increased 27.2% in the past year.

The Zacks Consensus Estimate for VMC’s 2023 sales and EPS indicates a rise of 5.9% and 26.2%, respectively, from the year-ago period’s levels.

Martin Marietta Materials, Inc. MLM carries a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 31%, on average. Shares of MLM have increased 25.7% in the past year.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates a rise of 19% and 32.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance