Top Ranked Income Stocks to Buy for January 26th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, January 26th:

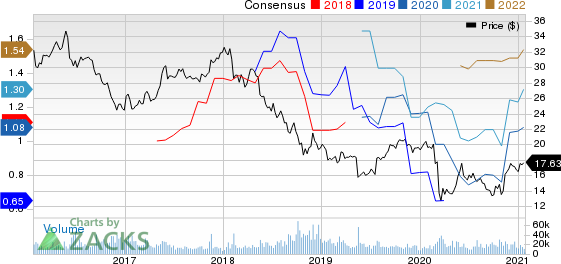

New Residential Investment Corp. (NRZ): This reit that focuses on investing in and managing residential mortgage related assets has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.4% over the last 60 days.

New Residential Investment Corp. Price and Consensus

New Residential Investment Corp. price-consensus-chart | New Residential Investment Corp. Quote

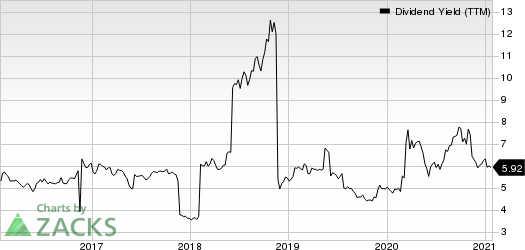

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 8.17%, compared with the industry average of 7.63%. Its five-year average dividend yield is 11.82%.

New Residential Investment Corp. Dividend Yield (TTM)

New Residential Investment Corp. dividend-yield-ttm | New Residential Investment Corp. Quote

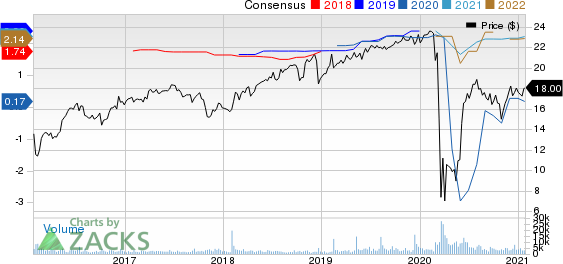

Vodafone Group Plc (VOD): This telecommunication services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.9% over the last 60 days.

Vodafone Group PLC Price and Consensus

Vodafone Group PLC price-consensus-chart | Vodafone Group PLC Quote

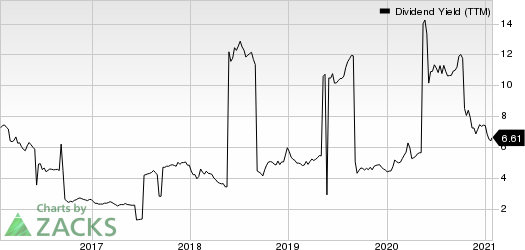

This Zacks Rank #1 company has a dividend yield of 5.92%, compared with the industry average of 2.48%. Its five-year average dividend yield is 6.13%.

Vodafone Group PLC Dividend Yield (TTM)

Vodafone Group PLC dividend-yield-ttm | Vodafone Group PLC Quote

PennyMac Mortgage Investment Trust (PMT): This specialty finance company that invests primarily in mortgage-related assets has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.3% over the last 60 days.

PennyMac Mortgage Investment Trust Price and Consensus

PennyMac Mortgage Investment Trust price-consensus-chart | PennyMac Mortgage Investment Trust Quote

This Zacks Rank #1 company has a dividend yield of 10.46%, compared with the industry average of 0.00%. Its five-year average dividend yield is 10.44%.

PennyMac Mortgage Investment Trust Dividend Yield (TTM)

PennyMac Mortgage Investment Trust dividend-yield-ttm | PennyMac Mortgage Investment Trust Quote

China Petroleum & Chemical Corporation (SNP): This energy and chemical company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 58.9% over the last 60 days.

China Petroleum & Chemical Corporation Price and Consensus

China Petroleum & Chemical Corporation price-consensus-chart | China Petroleum & Chemical Corporation Quote

This Zacks Rank #1 company has a dividend yield of 6.42%, compared with the industry average of 4.71%. Its five-year average dividend yield is 5.99%.

China Petroleum & Chemical Corporation Dividend Yield (TTM)

China Petroleum & Chemical Corporation dividend-yield-ttm | China Petroleum & Chemical Corporation Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vodafone Group PLC (VOD) : Free Stock Analysis Report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

PennyMac Mortgage Investment Trust (PMT) : Free Stock Analysis Report

New Residential Investment Corp. (NRZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance