Top Insider-Bought Stocks This June

Insiders are buying, but should you? When company executives throw more of their wealth in their company, increasing their risk of exposure to one particular entity, sends a bullish signal that they are confident about that company’s future. This is a strong indicator that the company’s future growth outlook may not be adequately captured in the company’s share price, in insiders’ eyes. In this article, I’ve picked out three stocks insiders have been accumulating over the past three months.

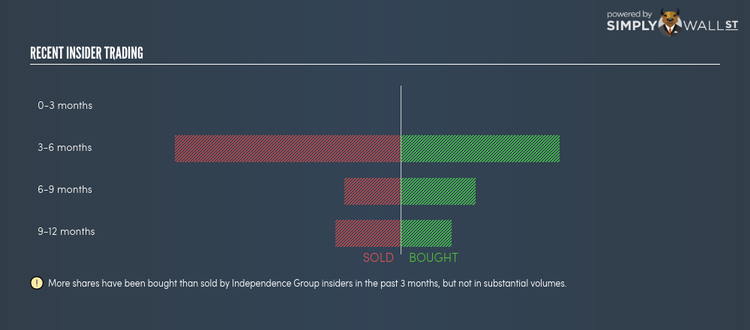

Independence Group NL (ASX:IGO)

Independence Group NL operates as a minerals mining, development, and exploration company in Australia. Independence Group was established in 2000 and with the company’s market capitalisation at AUD A$2.99B, we can put it in the mid-cap stocks category.

Independence Group NL’s (ASX:IGO) insiders have invested 15,500 shares in the large-cap stocks within the past three months. In total, individual insiders own over 1 million shares in the business, which makes up around 0.2% of total shares outstanding.

Insiders that have recently ramped up their holdings are: Debra Bakker (board member) . , Geoffrey Clifford (board member) . and Peter Bilbe (board member) .

With a notable expected earnings growth rate of 29.15% per year for the next five years, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. Dig deeper into Independence Group here.

Perseus Mining Limited (ASX:PRU)

Perseus Mining Limited engages in the exploration, evaluation, development, and mining of gold properties in West Africa. Formed in 2003, and currently lead by Jeffrey Quartermaine, the company size now stands at 464 people and with the market cap of AUD A$444.98M, it falls under the small-cap stocks category.

Perseus Mining Limited (ASX:PRU) is one of Australia’s small-cap stocks that saw some insider buying over the past three months, with insiders investing in 15,379 shares during this period. In total, individual insiders own over 19 million shares in the business, which makes up around 1.88% of total shares outstanding.

The entity that bought on the open market in the last three months was

Van Eck Associates Corporation. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

Analysts anticipate an impressive double-digit top-line growth of 23.16% per year over the next five years, which appears to flow through to a large earnings growth rate of 68.88% per annum. If insiders believe these benefits are defensible, this could be a motivation for the net buying activity. Dig deeper into Perseus Mining here.

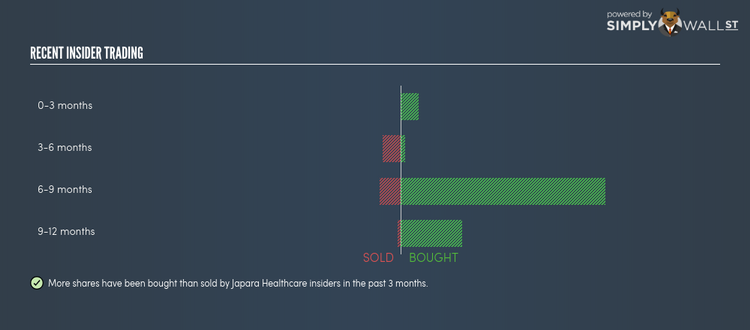

Japara Healthcare Limited (ASX:JHC)

Japara Healthcare Limited, together with its subsidiaries, owns, develops, and operates residential aged care facilities in Australia. Japara Healthcare was founded in 2005 and with the company’s market cap sitting at AUD A$487.90M, it falls under the small-cap stocks category.

Japara Healthcare Limited’s (ASX:JHC) insiders have invested more than 4 million shares in the small-cap stocks within the past three months. In total, individual insiders own over 18 million shares in the business, which makes up around 6.69% of total shares outstanding.

The entity that bought on the open market in the last three months was

Perpetual Limited. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

Japara Healthcare’s share price traded at a high of AU$2.07 and a low of AU$1.76 in the past three months. This indicates reasonable volatility with a change of 17.95%, which insiders may deem as an opportunity to increase their shareholdings. Continue research on Japara Healthcare here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance