Top German Dividend Stocks To Watch In May 2024

As the German market experiences a robust upswing, with the DAX index gaining 4.28% on better-than-expected corporate earnings and optimism around potential interest rate cuts, investors are increasingly looking at dividend stocks as a reliable source of income. In such an environment, a good dividend stock typically combines consistent payout history with solid financial health and growth prospects, making it an attractive option for those seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.38% | ★★★★★★ |

Südzucker (XTRA:SZU) | 4.98% | ★★★★★☆ |

Brenntag (XTRA:BNR) | 3.01% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.03% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.02% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.88% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.82% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.76% | ★★★★★☆ |

Deutsche Post (XTRA:DHL) | 4.59% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

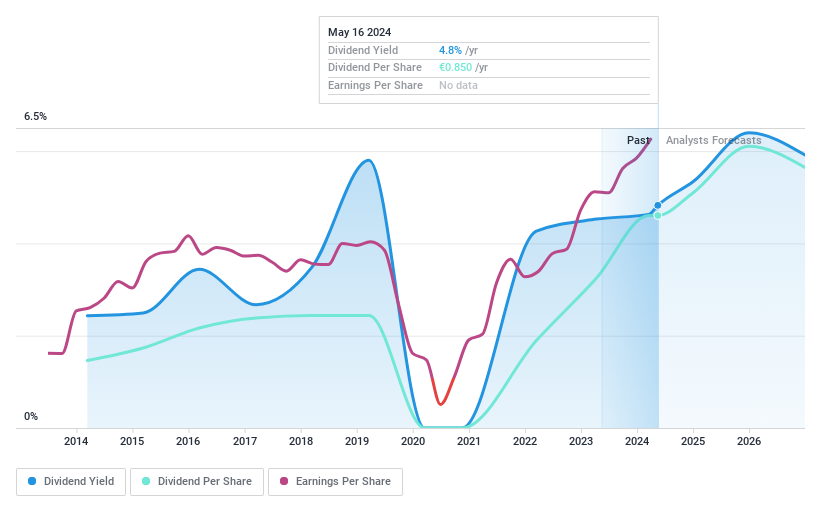

SAF-Holland

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market cap of €799.85 million.

Operations: SAF-Holland SE generates revenue from manufacturing and supplying chassis-related assemblies and components for trailers (€1.12 billion), trucks (€0.63 billion), semi-trailers (€0.45 billion), and buses (€0.18 billion).

Dividend Yield: 4.8%

SAF-Holland's dividend payments have increased over the past decade but have been volatile and unreliable. Despite trading at 38.9% below estimated fair value, the company's dividends are well covered by earnings (44.5% payout ratio) and cash flows (31.6% cash payout ratio). Recent Q1 2024 results showed a rise in net income to €26.23 million from €19.56 million, indicating strong performance, although high debt levels remain a concern for investors seeking stability in dividend stocks.

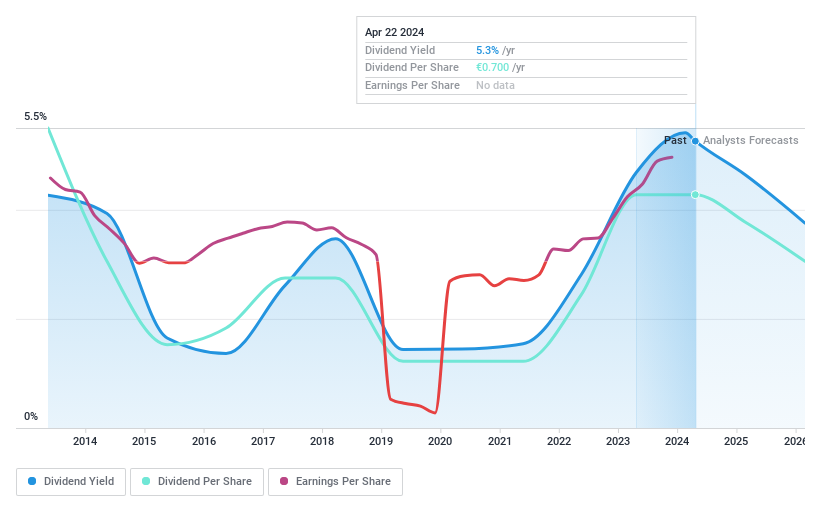

Südzucker

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG, with a market cap of €2.87 billion, produces and sells sugar products in Germany, the European Union, the United Kingdom, and internationally.

Operations: Südzucker AG's revenue segments comprise €1.57 billion from Fruit, €4.18 billion from Sugar, €1.23 billion from Starch, €1.23 billion from CropEnergies, and €2.42 billion from Special Products (excluding Starch).

Dividend Yield: 5%

Südzucker's dividend payments have been unstable and volatile over the past decade, despite a payout ratio of 22.4% and cash payout ratio of 52.4%, indicating coverage by earnings and cash flows. Trading at 44.6% below estimated fair value, it offers a competitive yield in Germany's top quartile for dividend payers. However, forecasted earnings decline by an average of 45.3% per year raises concerns about future sustainability. Recent board meeting proposed a new dividend ahead of fiscal results release on May 16, 2024.

Take a closer look at Südzucker's potential here in our dividend report.

Our valuation report unveils the possibility Südzucker's shares may be trading at a discount.

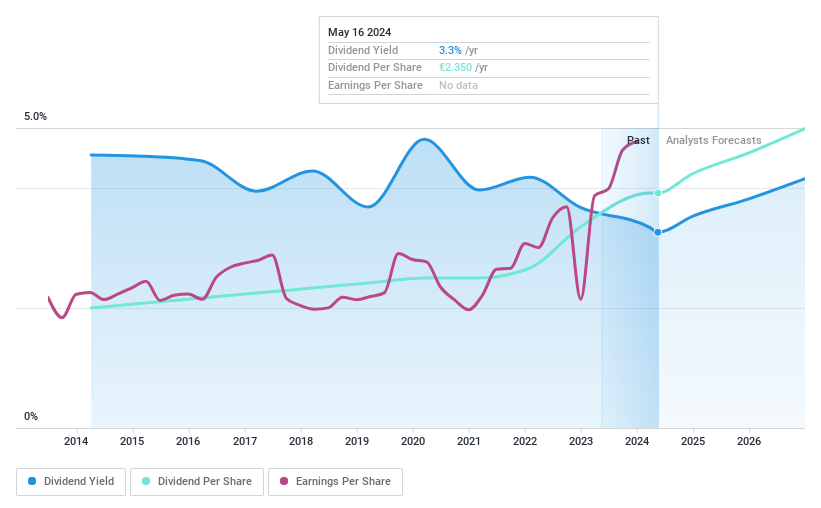

Talanx

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG is a global provider of insurance and reinsurance products and services with a market cap of approximately €18.59 billion.

Operations: Talanx AG generates revenue through several key segments: Reinsurance (€24.46 billion), Industrial Lines (€9.07 billion), Private and Corporate Insurance Germany (€3.56 billion), International Private and Corporate Insurance (€7.10 billion), and Corporate Operations (€965 million).

Dividend Yield: 3.3%

Talanx AG's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 37.9% and a cash payout ratio of 7.5%, indicating strong coverage by both earnings and cash flows. Recent Q1 2024 results showed net income rising to €572 million from €423 million year-over-year, with earnings per share increasing to €2.22 from €1.67, reinforcing its capacity for sustainable dividends despite trading at 62.1% below estimated fair value.

Delve into the full analysis dividend report here for a deeper understanding of Talanx.

Our expertly prepared valuation report Talanx implies its share price may be lower than expected.

Next Steps

Discover the full array of 30 Top Dividend Stocks right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:SFQ XTRA:SZU and XTRA:TLX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance