Top ASX Dividend Paying Companies

Australian Pharmaceutical Industries, Folkestone Education Trust, and InvoCare have one big thing in common. They are on my list of the best dividend stocks which have generously contributed to my portfolio income over the past couple of months. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

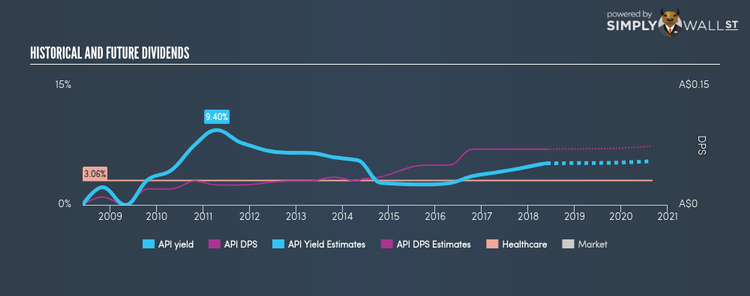

Australian Pharmaceutical Industries Limited (ASX:API)

Australian Pharmaceutical Industries Limited engages in the wholesale distribution of pharmaceutical, medical, health, beauty, and lifestyle products to pharmacies. Australian Pharmaceutical Industries was started in 1910 and with the market cap of AUD A$659.85M, it falls under the small-cap group.

API has a great dividend yield of 5.22% and pays out 71.30% of its profit as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. Interested in Australian Pharmaceutical Industries? Find out more here.

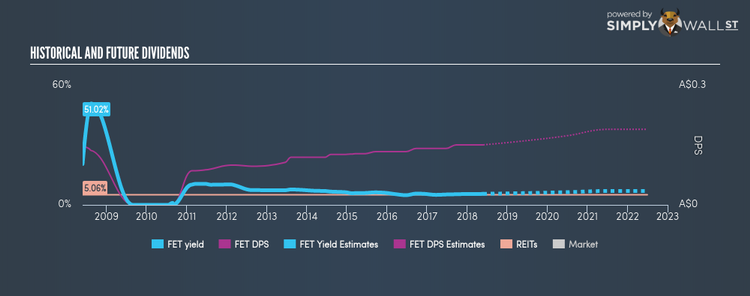

Folkestone Education Trust (ASX:FET)

The Folkestone Education Trust is the largest Australian ASX listed (ASX:FET) real estate investment trust (A-REIT) that invests in early learning properties. Folkestone Education Trust was established in 2002 and with the market cap of AUD A$695.65M, it falls under the small-cap group.

FET has a substantial dividend yield of 5.55% and is currently distributing 34.01% of profits to shareholders , with analysts expecting this ratio in three years to be 96.49%. Although investors would have seen a few years of reduced payments, it has picked up again, with dividends increasing from AU$0.15 to AU$0.15 over the past 10 years. Folkestone Education Trust is also reasonably priced, with a PE ratio of 6.3 that compares favorably with the AU REITs average of 8.9. Interested in Folkestone Education Trust? Find out more here.

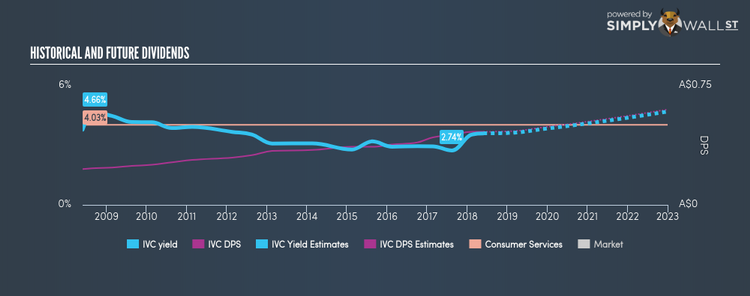

InvoCare Limited (ASX:IVC)

InvoCare Limited provides funeral, cemetery, crematoria, and related services in Australia, New Zealand, and Singapore. The company size now stands at 1644 people and with the market cap of AUD A$1.40B, it falls under the small-cap stocks category.

IVC has a sizeable dividend yield of 3.60% and is currently distributing 51.83% of profits to shareholders , with the expected payout in three years hitting 84.02%. Over the past 10 years, IVC has increased its dividends from AU$0.23 to AU$0.46. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. InvoCare’s earnings per share growth of 37.34% over the past 12 months outpaced the au consumer services industry’s average growth rate of 9.50%. Interested in InvoCare? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance