Top 50 hotspots for home value growth, revealed

Victoria and Tasmania dominate

Sydney and Melbourne could be hit with record property value declines

These two cities could drag the national property market further down

Australia’s homes have collectively lost $70.1 billion in value

Sydney and Melbourne may be the investors’ darlings, but regions in Tasmania and Victoria dominate when it comes to dwelling value growth.

The South East Coast region in Tasmania has seen the largest annual increase in dwelling values in the year to November 2018, with a whopping 16.3 per cent growth.

Brighton and North West Hobart, both in Tasmania, took out silver and bronze with respective growths of 14.8 per cent and 14.3 per cent.

In fact, Lachlan Valley (11.1 per cent) is the only NSW region to make the top 10 list, while South West Gippsland and Baw Baw are the only Victorian regions to make the top 10.

A regional focus

The top 50 list has a strong slant towards regional areas, rather than capital cities, CoreLogic head of research, Cameron Kusher said.

This is a reflection of how capital city markets have led the national slump in value growth, he added, warning the outlook for the housing market is for further weaknesses.

“Although the sharp falls of this year (especially in Sydney) are unlikely to continue at their pace over the next year, it would not be a surprise to see that in 12 months’ time additional regions across the nation have recorded annual value falls,” he said.

“More affordable regional housing markets with healthy or improving economic and demographic conditions are expected to hold up better in terms of growth than the more expensive and weaker capital city housing markets,” he said.

Give me the numbers

These were Australia’s top-performing regions:

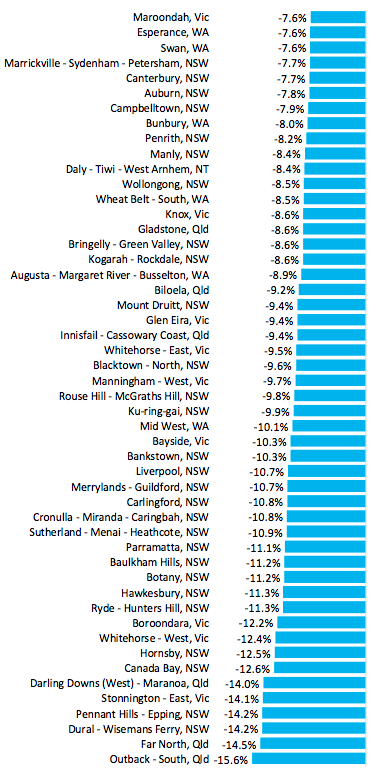

These were Australia’s bottom-performing regions:

Are Sydney and Melbourne set to fall further?

The east-coast cities should brace themselves for a housing downturn that would eclipse any other in modern Australian history, economists from Capital Economics warned this week.

According to the economists’ note, Sydney will suffer 20 per cent declines in house prices while Melbourne should prepare for a fall of 17 per cent.

The economists blamed an oversupply of property and constricted demand, triggered by regulatory action against investor and interest-only lending.

However they also suggested property prices in Sydney and Melbourne are overvalued and rose “too far too fast” during the last boom.

Melbourne and Sydney leading decline as nation’s property value sheds $70 billion

Residential property prices fell 1.5 per cent in the September quarter, according to fresh figures from the Australian Bureau of Statistics (ABS).

Sydney continued its softening streak, with prices down 1.9 per cent and Melbourne saw its third consecutive quarterly fall, down 2.6 per cent.

Previously limited to expensive properties, value declines are now being observed across all market segments in the two major cities, ABS chief economist Bruce Hockman said.

Darwin also saw a quarterly fall of 4.4 per cent, while Perth slipped 0.5 per cent.

Nationally, the total value of Australia’s 10.1 million dwellings fell $70.1 billion to $6.8 trillion.

The mean dwelling price across the country is now $675,000.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: 9 rising markets where you can buy a house for less than $300k

Now read: Why a 35% house price crash is ‘very unlikely’

Now read: Here’s what property investors will be doing in 2019

Yahoo Finance

Yahoo Finance