Top 5 U.S. Giants at Lucrative Valuations Amid April Turmoil

Wall Street’s impressive bull run for the last 15 months has been facing severe hurdles in April. Historically, this month is known as favorable to equity investors. However, this year it is turning out to be different. Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have tumbled 4.6%, 5.5% and 6.7%, respectively.

On Apr 19, both the S&P 500 and Nasdaq Composite recorded sixth-straight days of negative closing, the longest losing streak for both benchmarks since October 2022. Last week, the S&P 500 fell more than 3%, marking its third straight negative week.

The Nasdaq Composite tanked 5.5%, reflecting the tech-heavy index’s fourth straight declining week, its longest negative streak since December 2022. Last week, the tech-laden index posted its worst week since November 2022.

Sticky Inflation Delays Rate Cut Expectations

On Apr 10, the Department of Labor reported that the consumer price index (CPI) for March rose 0.4% sequentially and 3.5% year over year. Core CPI (excluding volatile food and energy items) for March rose 0.4% sequentially and 3.8% year over year.

The U.S. inflation rate remains stubborn despite a restrictive monetary policy and an extremely high interest rate regime in the last 24 months. Fed officials are concerned that even after declining to a great extent from its peak in June 2022, the inflation rate is yet to show any convincing evidence that it is moving gradually to the targeted level of 2%.

The sticky inflation rate pushed investors’ expectations to June. Following the release of the March CPI data, the CME FedWatch shows just a 15% chance of a rate cut in June. The majority of the respondents are now expecting the first reduction of the benchmark lending rate to happen in September. What is more important is that 16% of respondents are expecting no rate cut in 2024.

Recent Meltdown is Temporary

We believe that the recent downtrend has provided a good opportunity to buy good stocks. Bull market corrections are common features. At this stage, buying on the dip will be the best investment strategy to make the most of the ongoing Wall Street rally. Several corporate behemoths are currently available at attractive valuation.

Fundamentals of the U.S. economy remain rock solid. On Apr 16, the Atlanta Fed projected GDP to grow at 2.9% in first-quarter 2024. Notably, the U.S. economy grew 2.5% in 2023. Consumer expenditure — the largest driver of the U.S. GDP — remains strong despite dwindling savings rate. This eliminates the chance of a near-term recession.

Our Top Picks

We have narrowed our search to five U.S. bigwigs (market capital > $70 billion) with attractive valuations. The stocks have strong potential for 2024 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

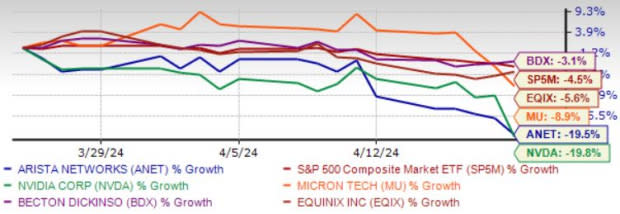

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

NVIDIA Corp.’s NVDA Compute & Networking revenues are gaining from the strong growth of AI, high-performance and accelerated computing. The data center end-market business is likely to benefit from the growing demand for generative AI and large language models using graphic processing units based on NVIDIA Hopper and Ampere architectures.

A surge in hyperscale demand and higher sell-ins to partners across the Gaming and ProViz end markets following the normalization of channel inventory are acting as tailwinds for NVDA. Collaborations with Mercedes-Benz and Audi are likely to advance NVDA’s presence in autonomous vehicles and other automotive electronics spaces.

Zacks Rank #1 NVIDIA has an expected revenue and earnings growth rate of 74.1% and 84.7%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last seven days. The stock price of NVDA is currently trading at a 21.8% discount to its 52-week high.

Micron Technology Inc. MU has enhanced its chip packages with AI, machine learning and deep learning. Using AI and analytics, MU has produced hardware with increased storage capacity, faster memory, and high-quality data filtering.

The expectation of supply normalization by mid-year 2024 is likely to drive pricing, while the boom in AI spending is expected to fuel demand for MU’s chips in the data center end market. Additionally, 5G adoption in the IoT devices and wireless infrastructure is likely to spur demand for MU’s memory and storage.

Zacks Rank #2 Micron Technology has an expected revenue and earnings growth rate of 57.8% and more than 100%, respectively, for the current year (ending August 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days. The stock price of MU is currently trading at a 18.2% discount to its 52-week high.

Arista Networks Inc. ANET is likely to benefit from a software-driven, data-centric approach that helps customers build their cloud architecture and enhance the cloud experience they offer their clients. The versatility of ANET’s unified software stack across various use cases, including WAN routing, campus and data center infrastructure, sets it apart from other competitors in the industry.

Healthy traction in the EMEA region is driving net sales in the international market. Steady improvement in lead times and easing of supply chain woes are tailwinds. ANET expects a healthy improvement in gross margin, owing to the optimization of manufacturing output.

Zacks Rank #1 Arista Networks has an expected revenue and earnings growth rate of 11.8% and 7.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 30 days. The stock price of ANET is currently trading at a 20% discount to its 52-week high.

Becton, Dickinson and Co.’s BDX continued focus on research and development and progress toward meeting its 2025 strategy raises optimism. The divestiture of BDX’s surgical instruments platform to support its BD 2025 financial goals. The BD Interventional arm’s focus on high-growth end markets looks promising. Regulatory approvals and product launches by BDX over the past few months are also encouraging.

Zacks Rank #2 Becton, Dickinson and Co. has an expected revenue and earnings growth rate of 6% and 7.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 60 days. The stock price of BDX is currently trading at a 18.5% discount to its 52-week high.

Equinix Inc.’s EQIX global data center portfolio is well-poised to benefit from the solid demand for interconnected data center infrastructure. Enterprises and service providers’ continued efforts to integrate artificial intelligence into their strategies and offerings and advance their digital transformation agendas are likely to keep demand for EQIX up in the near term.

EQIX’s recurring revenue model assures steady revenues. For 2024, we estimate recurring revenues to increase 7.5% on a year-over-year basis. EQIX’s strategic expansion to capitalize on favorable industry trends, backed by a healthy balance sheet, is encouraging.

Zacks Rank #2 Equinix has an expected revenue and earnings growth rate of 8.2% and 8.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.2% over the last 30 days. The stock price of EQIX is currently trading at a 18.2% discount to its 52-week high.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance