Top 3 German Growth Companies With High Insider Ownership

Germany's DAX index has shown impressive gains recently, reflecting better-than-expected corporate earnings and a positive economic outlook. In this thriving market environment, identifying growth companies with high insider ownership can be particularly rewarding, as these firms often exhibit strong alignment between management and shareholder interests. In the current landscape, a good stock is characterized by robust growth potential and significant insider ownership, which signals confidence from those who know the company best. This article will explore three such German growth companies that stand out in today's market.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 73% |

Deutsche Beteiligungs (XTRA:DBAN) | 35.3% | 31.4% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

init innovation in traffic systems (XTRA:IXX) | 39.7% | 23% |

Ströer SE KGaA (XTRA:SAX) | 20% | 31.8% |

Exasol (XTRA:EXL) | 25.3% | 107.4% |

Beyond Frames Entertainment (DB:8WP) | 10.9% | 81.9% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stemmer Imaging (XTRA:S9I) | 26.4% | 18.2% |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | 29.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

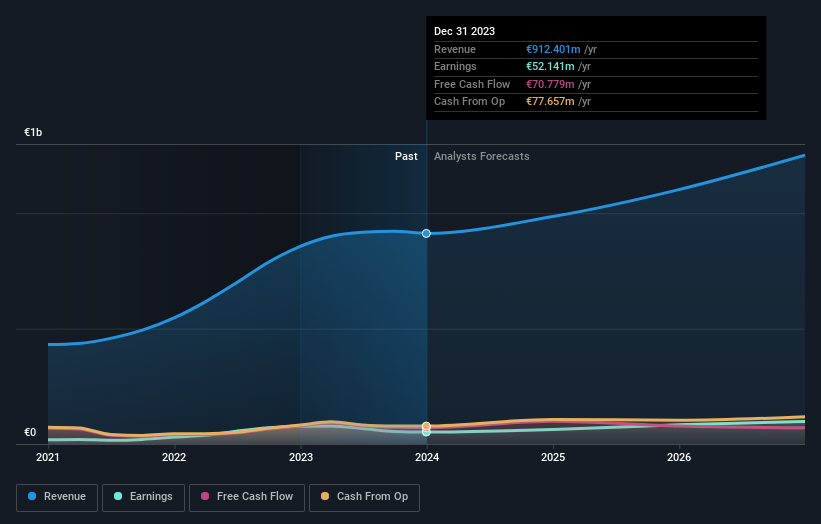

Nagarro

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nagarro SE, with a market cap of €1.20 billion, offers digital product engineering and technology solutions across North America, Central Europe, rest of Europe, and internationally.

Operations: The company's revenue segments include digital product engineering and technology solutions in North America, Central Europe, rest of Europe, and internationally.

Insider Ownership: 12.3%

Earnings Growth Forecast: 17.9% p.a.

Nagarro, a growth company with high insider ownership in Germany, is forecast to grow earnings by 17.89% annually, outpacing the German market. However, profit margins have decreased from 8.7% to 5.8%, and the stock has been highly volatile over the past three months. Despite trading at 36.5% below its estimated fair value and having significant debt levels, Nagarro's revenue is expected to grow faster than the market at 12.3% per year.

Unlock comprehensive insights into our analysis of Nagarro stock in this growth report.

The valuation report we've compiled suggests that Nagarro's current price could be quite moderate.

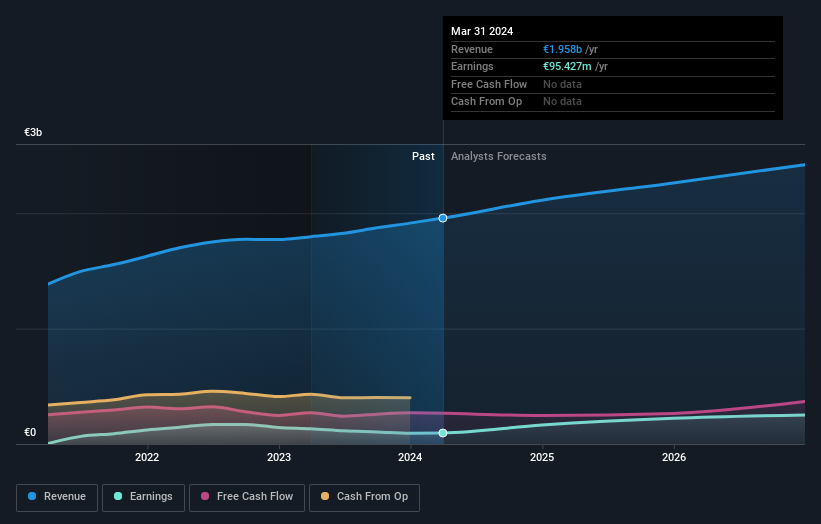

Ströer SE KGaA

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA offers out-of-home media and online advertising solutions in Germany and globally, with a market cap of €3.64 billion.

Operations: The company's revenue segments include Daas & E-Commerce (€355.06 million), Out-Of-Home Media (€881.10 million), and Digital & Dialog Media (€839.39 million).

Insider Ownership: 20%

Earnings Growth Forecast: 31.8% p.a.

Ströer SE KGaA, a growth company with substantial insider ownership in Germany, reported first-quarter sales of €453.4 million, up from €409.9 million the previous year, and net income of €6 million compared to €3.4 million. While its profit margins have declined to 4.9% from 7.4%, earnings are forecast to grow significantly at 31.83% per year, outpacing the German market's growth rate of 17.9%. The company is trading at a significant discount to its estimated fair value despite high debt levels and recent buybacks totaling €50 million for 1.92% of shares.

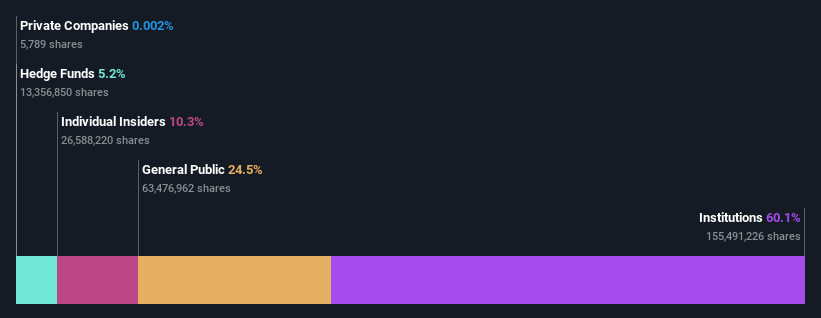

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products with a market cap of approximately €6.52 billion.

Operations: Zalando SE generates revenue primarily from its online platform for fashion and lifestyle products, amounting to €10.40 billion.

Insider Ownership: 10.3%

Earnings Growth Forecast: 27% p.a.

Zalando, a growth company with high insider ownership in Germany, reported Q1 2024 sales of €2.24 billion and a net loss of €8.9 million. Despite recent volatility and trading at 46.9% below estimated fair value, Zalando's earnings are forecast to grow significantly at 27% per year, outpacing the German market’s growth rate of 17.9%. However, its return on equity is expected to remain low at 12.4% over the next three years.

Where To Now?

Dive into all 21 of the Fast Growing German Companies With High Insider Ownership we have identified here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include DB:NA9XTRA:SAX XTRA:ZAL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance