Tile Shop Holdings Inc (TTSH) Reports Decline in Q4 and Full-Year 2023 Sales Amidst ...

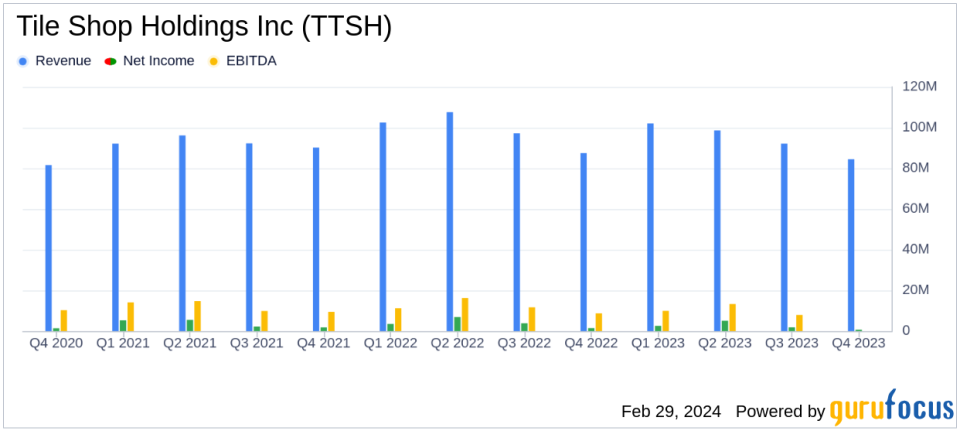

Net Sales: Q4 decreased by 3.4%, full-year decreased by 4.4%.

Comparable Store Sales: Q4 and full-year comparable store sales decreased by 3.2% and 4.1%, respectively.

Gross Margin: Remained robust at 64.7% for Q4 and 64.4% for the full year.

Net Income: Q4 reported at $0.6 million, with full-year net income at $10.1 million.

Diluted Earnings per Share: Q4 at $0.01, full-year at $0.23.

Debt Status: Achieved a debt-free position by year-end 2023.

Adjusted EBITDA: Q4 at $6.6 million, full-year at $38.8 million.

On February 29, 2024, Tile Shop Holdings Inc (NASDAQ:TTSH) released its 8-K filing, detailing the financial outcomes for both the fourth quarter and the full year of 2023. As a specialty retailer of natural stone and man-made tiles, Tile Shop Holdings Inc operates across the United States, offering a range of products for both retail and commercial customers. Despite a challenging macroeconomic environment and a seasonal slowdown, the company managed to maintain a strong gross margin and end the year debt-free.

Financial Performance and Challenges

Tile Shop Holdings Inc faced a decrease in net sales of 3.4% in Q4 and 4.4% for the full year, primarily attributed to a decline in traffic, partially offset by an increase in average ticket value. The company's gross margin remained strong at 64.7% for Q4 and 64.4% for the full year, reflecting effective cost management and lower international freight rates. However, the company did experience a decrease in gross margin rate year-over-year, mainly due to increased supplier costs and higher international freight rates earlier in the year.

While the company's net income for Q4 was $0.6 million, down from $1.45 million in the same quarter of the previous year, the full-year net income stood at $10.1 million, a decrease from $15.7 million in 2022. Diluted earnings per share for Q4 were $0.01, with the full year at $0.23. The company's ability to maintain profitability and a strong gross margin in a retail-cyclical industry, despite declining sales, is a testament to its operational efficiency and cost management strategies.

Operational Highlights and Capital Structure

Tile Shop Holdings Inc's selling, general, and administrative expenses saw a slight decrease, contributing to the company's cost management efforts. The company also highlighted its capital structure, having repaid $45.4 million of borrowings and ending the year with no debt outstanding. Cash and cash equivalents saw an increase from the previous year, indicating a solid liquidity position.

Adjusted EBITDA for Q4 was $6.6 million, down from $8.9 million in the prior year's quarter, while the full-year Adjusted EBITDA was $38.8 million, compared to $49.6 million in 2022. These figures are crucial as they provide insights into the company's operational profitability and ability to generate cash flow from its core business operations.

Management's Perspective

CEO Cabell Lolmaugh commented on the company's performance, expressing satisfaction with the sequential improvement in comparable store sales trends and the company's strategic execution. Despite the macroeconomic headwinds and seasonal challenges, the company's focus on managing expenses and reducing inventory levels contributed to strong operating cash flows, enabling the repayment of debt.

Looking Ahead

Tile Shop Holdings Inc's performance in 2023 reflects resilience in the face of economic pressures. The company's debt-free status and strong gross margin are positive indicators for value investors. As the company navigates the retail landscape in 2024, its ability to adapt to consumer trends and maintain financial discipline will be critical for sustained success.

For a more detailed analysis and to stay updated on Tile Shop Holdings Inc's financial journey, investors and interested parties are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Tile Shop Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance