Three UK Growth Companies With High Insider Ownership And At Least 25% Earnings Growth

As global markets experience fluctuations, with the FTSE 100 poised for a lower opening amidst a cautious trading environment, investors are keenly observing trends and developments. In such a market scenario, growth companies in the United Kingdom with high insider ownership can be particularly compelling, as they often demonstrate aligned interests between management and shareholders, potentially leading to robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 43.9% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 28.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Let's uncover some gems from our specialized screener.

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

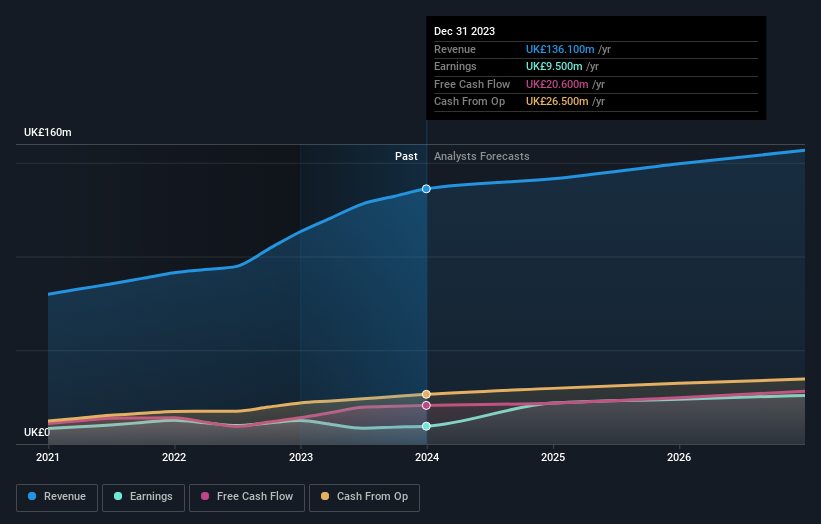

Overview: Judges Scientific plc specializes in designing, manufacturing, and selling scientific instruments and has a market capitalization of approximately £0.80 billion.

Operations: The company generates its revenues primarily from two segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.6%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific plc, a UK-based company with high insider ownership, reported increased sales of £136.1 million for 2023 but saw a decrease in net income to £9.5 million from the previous year's £12.5 million. Despite this dip, the firm is poised for significant growth with expected earnings to rise by 25.32% annually over the next three years, outpacing the UK market's forecast of 12.8%. However, concerns include a high level of debt and recent shareholder dilution which could impact future performance.

Loungers

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market capitalization of approximately £278.05 million.

Operations: The company generates its revenue primarily through the operation of café bars and restaurants, amassing £310.80 million from these activities.

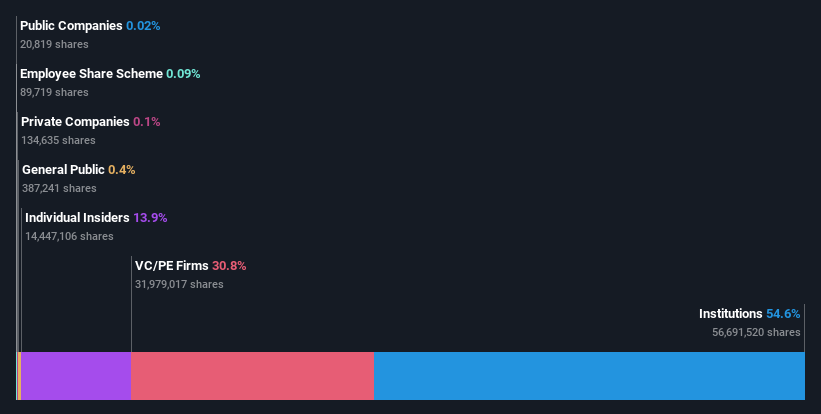

Insider Ownership: 13.9%

Earnings Growth Forecast: 32.8% p.a.

Loungers plc, a UK growth company with significant insider ownership, reported a substantial revenue increase to £353.5 million for FY 2024, marking a 24.7% rise year-over-year. Despite this growth, profit margins dipped to 2.3% from last year's 3.7%. Looking ahead, Loungers is expected to see earnings grow by an impressive 32.82% annually over the next three years, significantly outpacing the broader UK market projection of 12.8%. Recent executive appointments aim to sustain this rapid expansion and operational excellence.

Dive into the specifics of Loungers here with our thorough growth forecast report.

Our expertly prepared valuation report Loungers implies its share price may be lower than expected.

Genel Energy

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market capitalization of approximately £248.91 million.

Operations: The company generates its revenue primarily from oil and gas production, totaling $84.80 million.

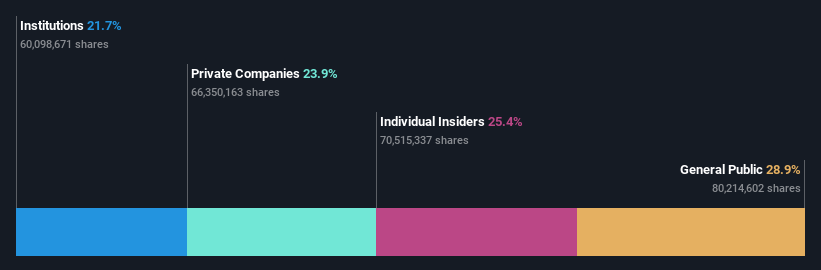

Insider Ownership: 25.4%

Earnings Growth Forecast: 50.5% p.a.

Genel Energy, a UK-based growth company with high insider ownership, is set to become profitable within three years, surpassing average market growth expectations. Despite trading 21.4% below its estimated fair value and expecting revenue growth of 10.7% annually—faster than the UK market's 3.6%—its recent performance has been underwhelming with a significant drop in sales to US$84.8 million from US$401.9 million last year and a net loss of US$61.3 million. The upcoming retirement of Sir Michael Fallon from the board poses additional governance challenges.

Key Takeaways

Access the full spectrum of 59 Fast Growing UK Companies With High Insider Ownership by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:JDGAIM:LGRS and LSE:GENL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance