Three Things You Should Check Before Buying NXP Semiconductors N.V. (NASDAQ:NXPI) For Its Dividend

Today we'll take a closer look at NXP Semiconductors N.V. (NASDAQ:NXPI) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

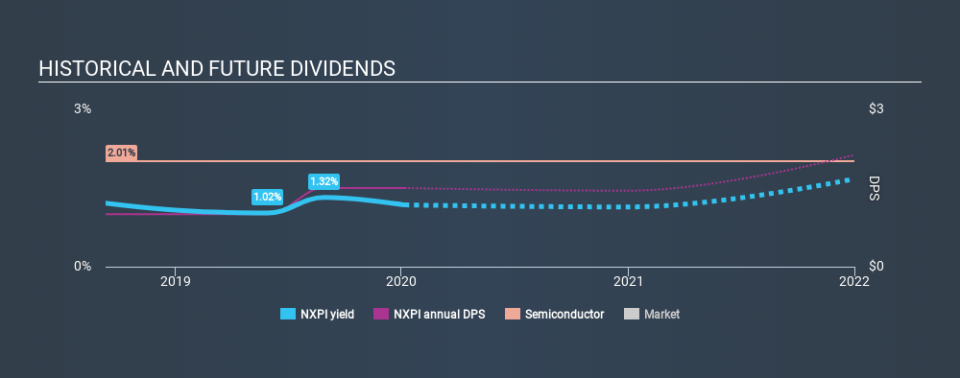

NXP Semiconductors has only been paying a dividend for a year or so, so investors might be curious about its 1.2% yield. The company also bought back stock equivalent to around 5.2% of market capitalisation this year. Some simple analysis can reduce the risk of holding NXP Semiconductors for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. NXP Semiconductors paid out 79% of its profit as dividends, over the trailing twelve month period. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. NXP Semiconductors's cash payout ratio last year was 17%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that NXP Semiconductors's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Is NXP Semiconductors's Balance Sheet Risky?

As NXP Semiconductors has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). NXP Semiconductors has net debt of 1.87 times its EBITDA, which we think is not too troublesome.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 2.14 times its interest expense, NXP Semiconductors's interest cover is starting to look a bit thin.

We update our data on NXP Semiconductors every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. This works out to be a compound annual growth rate (CAGR) of approximately 50% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. While there may be fluctuations in the past , NXP Semiconductors's earnings per share have basically not grown from where they were five years ago. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. NXP Semiconductors's payout ratios are within a normal range for the average corporation, and we like that its cashflow was stronger than reported profits. Second, the company has not been able to generate earnings growth, and its history of dividend payments is shorter than we consider ideal (from a reliability perspective). While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than NXP Semiconductors out there.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 24 analysts we track are forecasting for NXP Semiconductors for free with public analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance