Three Swedish Growth Companies With High Insider Ownership And Up To 53% Earnings Growth

As European markets show signs of resilience with indices like the STOXX Europe 600 ending a losing streak, investors are closely watching corporate performance indicators across the region, including Sweden. In this context, exploring growth companies with high insider ownership could offer valuable insights, particularly in an environment where earnings growth and economic recovery are key focal points.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Growth Rating |

CTT Systems (OM:CTT) | 16.9% | ★★★★★★ |

Sun4Energy Group (NGM:SUN4) | 16% | ★★★★★★ |

BioArctic (OM:BIOA B) | 35.1% | ★★★★★★ |

OX2 (OM:OX2) | 12.5% | ★★★★★★ |

Calliditas Therapeutics (OM:CALTX) | 11.6% | ★★★★★★ |

Spago Nanomedical (OM:SPAGO) | 16.1% | ★★★★★★ |

KebNi (OM:KEBNI B) | 32.5% | ★★★★★★ |

Yubico (OM:YUBICO) | 30.1% | ★★★★★★ |

Egetis Therapeutics (OM:EGTX) | 10.3% | ★★★★★★ |

SaveLend Group (OM:YIELD) | 20.9% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Medicover

Simply Wall St Growth Rating: ★★★★☆☆

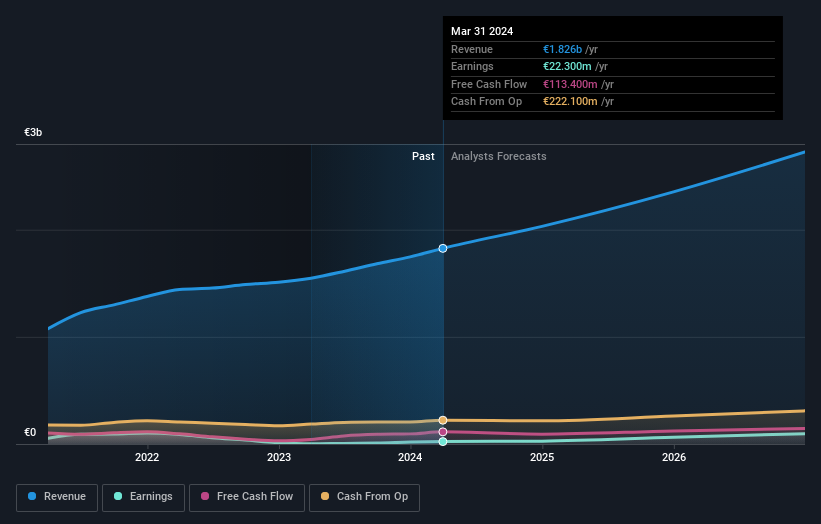

Overview: Medicover AB operates in the healthcare and diagnostic services sector, serving regions including Poland, Sweden, and other international markets, with a market capitalization of approximately SEK 25.98 billion.

Operations: The company generates its revenue through healthcare and diagnostic services across Poland, Sweden, and various international locations.

Insider Ownership: 11%

Earnings Growth Forecast: 38.2% p.a.

Medicover exhibits strong growth potential with earnings forecasted to increase significantly, outpacing the Swedish market. Recent financial results show robust sales and net income growth, reflecting a positive trajectory. Insider activity is bullish, with more shares bought than sold recently, indicating confidence from those closest to the company. However, challenges include low forecasted Return on Equity and poor coverage of interest payments by earnings. Medicover's guidance suggests substantial future revenue exceeding €2.2 billion, supporting its growth narrative amidst operational risks.

Dive into the specifics of Medicover here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Medicover's share price might be too optimistic.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

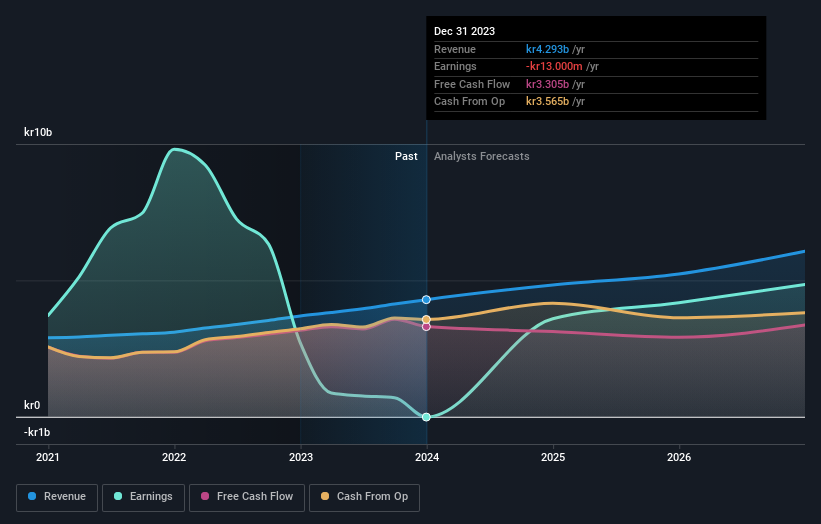

Overview: AB Sagax (publ) is a property company active in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 97.61 billion.

Operations: The company generates its revenue primarily from real estate rentals, amassing SEK 4.29 billion.

Insider Ownership: 28.3%

Earnings Growth Forecast: 49.7% p.a.

AB Sagax is poised for notable growth, with revenue expected to rise by 11% annually, outstripping the broader Swedish market's 1.7%. Despite a challenging year with a net loss reported in Q4 2023 and full-year earnings revealing a shift from profit to a SEK 13 million loss, the company maintains investor confidence through consistent dividends. However, concerns linger due to shareholder dilution over the past year and debt that isn't well covered by operating cash flow.

Click here and access our complete growth analysis report to understand the dynamics of AB Sagax.

The valuation report we've compiled suggests that AB Sagax's current price could be inflated.

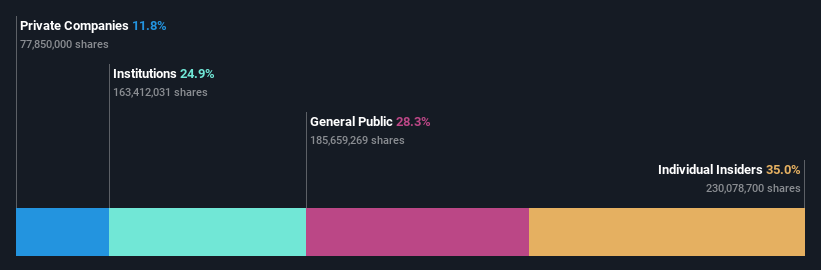

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a property company based in Sweden, with a market capitalization of approximately SEK 32.55 billion.

Operations: The company generates its revenue primarily from two segments: SEK 1.89 billion from Gothenburg and SEK 0.92 billion from Stockholm.

Insider Ownership: 35%

Earnings Growth Forecast: 53.7% p.a.

Wallenstam has demonstrated a significant turnaround with its first quarter 2024 performance, reporting a net income of SEK 333 million, a stark contrast to the previous year's SEK 48 million. This reflects strong operational improvements despite recent dividend cuts to SEK 0.50 per share and ongoing financial challenges indicated by poor coverage of interest payments by earnings. Insider transactions have been neutral, with no substantial buying or selling in the past three months, highlighting steady but cautious insider confidence amidst recovery efforts.

Taking Advantage

Investigate our full lineup of 83 Fast Growing Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include OM:MCOV BOM:SAGA AOM:WALL B and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance