Three Solid Dividend Stocks Offering Up To 7.1% Yield

As global markets navigate through a landscape marked by fluctuating inflation rates and shifting monetary policies, investors are increasingly seeking stable income streams. Dividend stocks, known for their potential to provide regular income and relative stability, could be particularly appealing in the current economic environment where consistent yield is a premium.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.00% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.62% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 6.06% | ★★★★★★ |

Globeride (TSE:7990) | 3.69% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.52% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.97% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.44% | ★★★★★☆ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

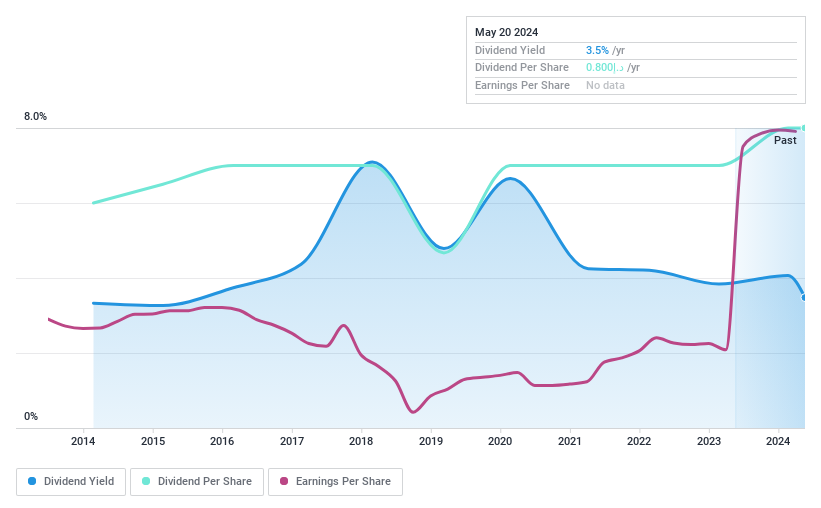

Dubai Refreshment (P.J.S.C.)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) operates as a bottler and seller of Pepsi Cola International products in Dubai, Sharjah, and the other Northern Emirates of the United Arab Emirates, with a market capitalization of AED 1.88 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates AED 802.16 million from its wholesale groceries segment.

Dividend Yield: 3.8%

Dubai Refreshment (P.J.S.C.) has experienced a 279.2% earnings growth over the past year, yet its dividends have shown volatility and unreliability over the last decade, with occasional drops exceeding 20%. Despite this instability, the dividend coverage is strong due to a low payout ratio of 20.2% and a cash payout ratio of 56.6%, suggesting that both earnings and cash flows substantially cover dividend payments. However, its current dividend yield of 3.83% is significantly lower than the top AE market payers at 7.34%. Additionally, recent financials indicate slight declines in sales and net income as compared to the previous year.

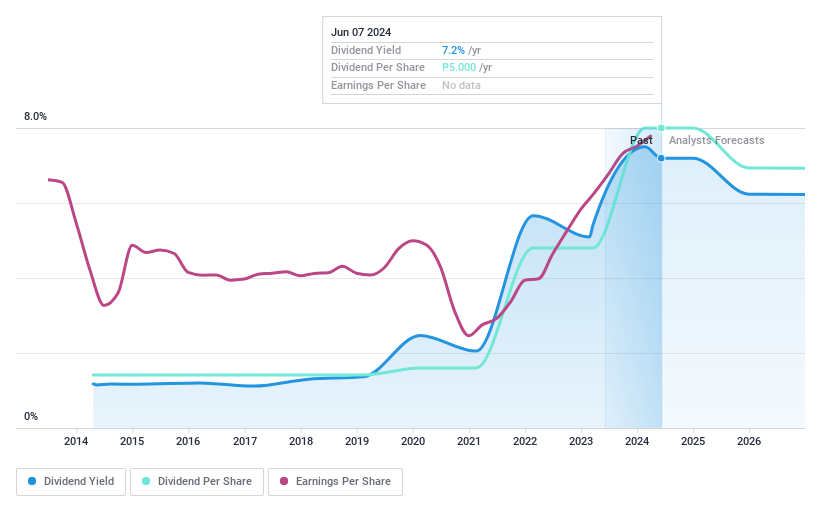

Metropolitan Bank & Trust

Simply Wall St Dividend Rating: ★★★★★★

Overview: Metropolitan Bank & Trust Company operates as a comprehensive banking institution offering a range of financial services across the Philippines, Asia, the United States, and Europe, with a market capitalization of approximately ₱308.44 billion.

Operations: Metropolitan Bank & Trust Company generates revenue primarily through Branch Banking (₱68.29 billion), Consumer Banking (₱21.59 billion), Treasury operations (₱15.72 billion), Corporate Banking (₱12.19 billion), and Investment Banking (₱0.22 billion).

Dividend Yield: 7.2%

Metropolitan Bank & Trust maintains a robust dividend profile with a 7.19% yield, ranking in the top quartile of PH market payers. Its dividends are well-supported by earnings, evidenced by a conservative payout ratio of 30.8%, ensuring sustainability and reliability over the past decade. Earnings growth of 24% last year and projected annual increases suggest continued ability to fund dividends, despite recent executive changes which may influence future strategic directions.

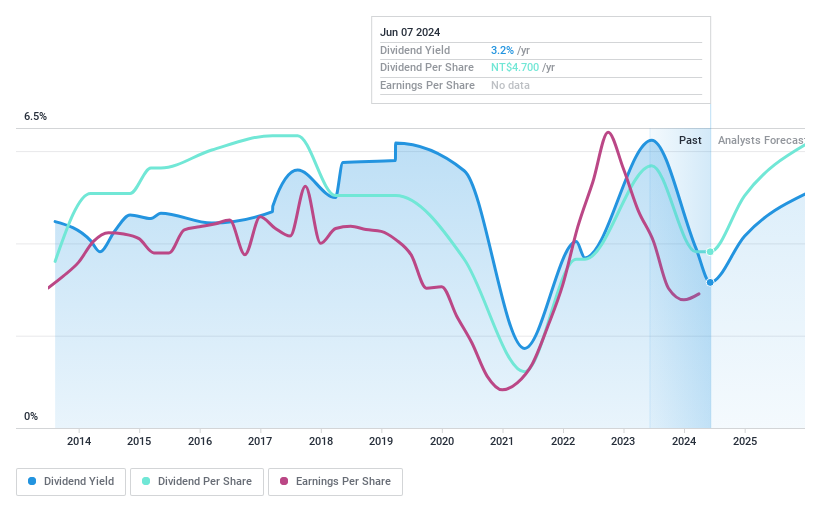

Posiflex Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. specializes in manufacturing and selling industrial computers and peripheral equipment across Taiwan, the United States, and other global markets, with a market capitalization of NT$10.36 billion.

Operations: Posiflex Technology, Inc. generates revenue primarily from the manufacture and sale of industrial computers and peripheral equipment across various global markets.

Dividend Yield: 3.2%

Posiflex Technology has shown a mixed performance in dividends, with a history of volatility and unreliable growth over the past decade. Despite this, recent earnings indicate some recovery, with an increase in net income and EPS in Q1 2024 compared to the previous year. The company's dividend sustainability is supported by a low cash payout ratio of 27.5% and an earnings coverage ratio of 80.9%, though its yield remains below the top quartile for its market at 3.15%. Recent executive changes could signal strategic shifts affecting future payouts.

Seize The Opportunity

Reveal the 1968 hidden gems among our Top Dividend Stocks screener with a single click here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DFM:DRC PSE:MBT and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance